Investment firm Berkshire Hathaway (BRK.B) updated its holdings in a Securities and Exchange Commission (SEC) filing. This filing provides traders with updated data on its investments as of March 31, 2025. Beverage company Coca-Cola (KO) continues to be one of the firm’s favorite stocks, representing 11.07% of its portfolio with 400 million shares held. KO is only surpassed by American Express (AXP) at 15.77% and Apple (AAPL) at 25.76%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While Berkshire Hathaway still loves KO stock, the Warren Buffett-managed firm exited positions in other companies. It dropped Citigroup (C) and Nubank (NU), and decreased its positions in Bank of America (BAC), Capital One (COF), and DaVita (DVA). The firm also increased its positions in Constellation Brands (STZ), VeriSign (VRSN), Pool Corp (POOL), Domino’s Pizza (DPZ), and Heico (HEI).

What Does This Mean for Coca-Cola Stock?

Berkshire Hathaway’s continued $28.65 billion KO stock holdings, which have returned 77.8% in profits, represent a strong vote of confidence in the beverage company. That’s likely to boost investor sentiment as traders and analysts have high hopes for KO stock. It also helps that Coca-Cola is a top performer on the Dow Jones Industrial Average (DJIA).

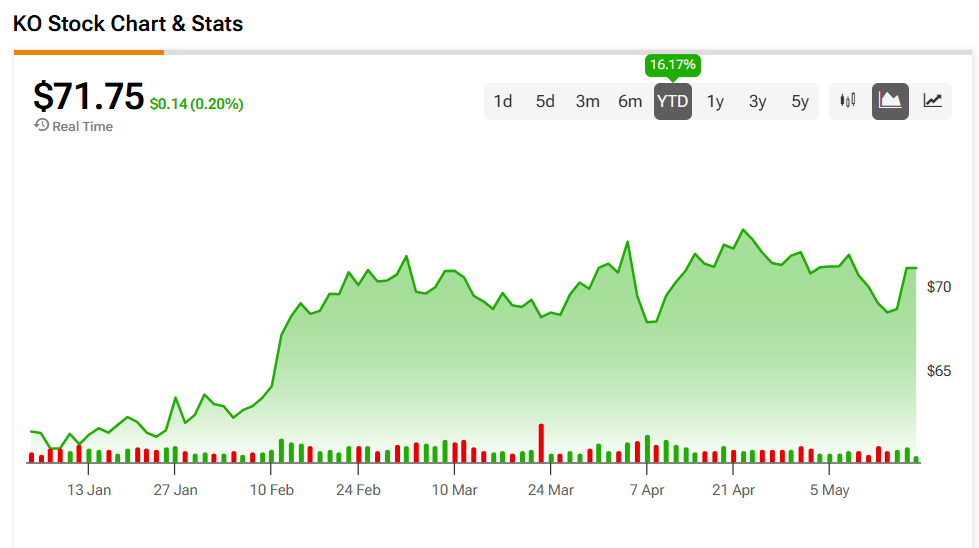

Coca-Cola stock was up 0.2% as of Friday afternoon, building on its 16.17% rally year-to-date. The soda company has performed well in 2025 despite economic uncertainty. Its categorization as a consumer defensive stock helps it weather periods of economic weakness. The shares also perform well when times aren’t tough, making KO a resilient long-term investment.

Is KO Stock a Buy, Hold, or Sell?

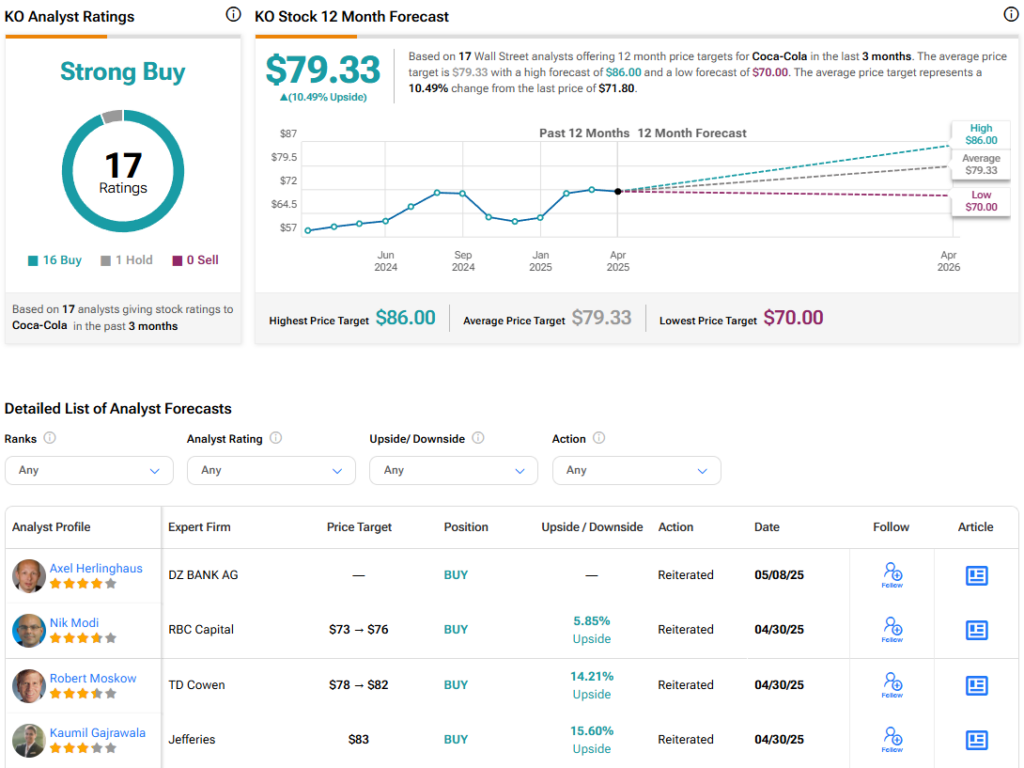

Turning to Wall Street, the analysts’ consensus rating for Coca-Cola is Strong Buy, based on 16 Buy and one Hold ratings over the last three months. With that comes an average KO stock price of $79.33, representing a potential 10.49% upside for the shares.