Elon Musk-led Tesla (TSLA) is among the major global automakers who are leading the race to automate driving. Tesla’s “Autopilot” technology gives the car the ability to steer, accelerate, and brake automatically when enabled.

However, a National Highway Traffic Safety Administration (NHTSA) report has put the Autopilot in an unfavorable light. Tesla tops the list of vehicle crashes involving advanced driver-assistance systems.

According to the NHTSA data cited by the Wall Street Journal, Tesla reported more than 270 crashes out of a total of about 400 recent crashes linked to its automated driving feature. Honda Motor (HMC) reported 90 crashes, coming second on the list. Meanwhile, a majority of the automakers, including Ford (F), reported fewer than 10 crashes.

Tesla’s Full Self-Driving System Goes Beyond the Autopilot

Automakers believe that driver-assistance systems can improve safety on the roads. Meanwhile, the NHTSA is trying to find out their practical effects. The agency requires automakers to report crash incidents involving automated driving if they result in a fatality or injury.

Tesla cars can be automated at various levels. The Autopilot technology is standard in Tesla car models from 2014. The company offers a more advanced package of driving automation features through its Full Self-Driving system that costs $12,000.

Wall Street’s Take

On June 14, Morgan Stanley analyst Adam Jonas maintained a Buy rating on Tesla with a price target of $1,300, which implies nearly 86% upside potential. The analyst believes that whatever Tesla misses in Q2 because of supply chain challenges, it could make up for it in Q3.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating, based on 16 Buys versus, eight Holds, and six Sells. The average Tesla price target of $917.10 implies 31% upside potential to current levels. Shares have declined more than 40% year-to-date.

Stock Investors

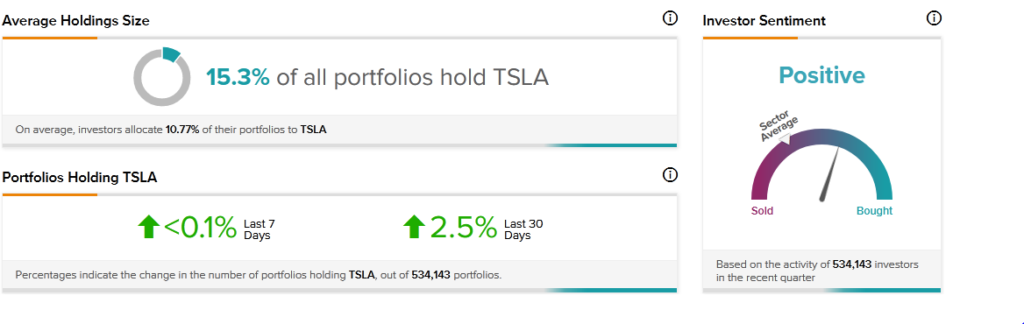

TipRanks’ Stock Investors tool shows that investor sentiment is currently Positive on Tesla, with 2.5% of portfolios tracked by TipRanks increasing their exposure to TSLA stock over the past 30 days.

Key Takeaway for Investors

While the NHTSA report may seem to raise safety concerns about Tesla’s driving automation technology, the agency admits that the report does not tell the whole story yet. At this point, automakers have different reporting methods. For example, factors like miles driven are not captured in the report. Jennifer Homendy, the National Transportation Safety Board chair, has said that Tesla may be overrepresented in the NHTSA report because it tends to capture more details about its cars.

Read full Disclosure