American air carrier JetBlue (JBLU) is planning to offer budget carrier Spirit Airlines (SAVE) shareholders an all-cash buyout bid for $30 per share to lure them into supporting a takeover.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Spirit rejected its earlier takeover offer of $3.6 billion and instead, the Board of Spirit Airlines has sought to continue its proposed merger with another low-cost carrier Frontier Group Holdings (ULCC) in a cash and stock deal worth $6.6 billion.

Shares of JetBlue rose more than 2% and SAVE stock is surged almost 13% on the news, in the pre-market trading.

JetBlue Lures Spirit Shareholders

JetBlue is attempting a hostile takeover by trying to lure Spirit’s shareholders and make them an active voice in the bargain. JetBlue offered to raise the tender offer to the initial $33 per share deal, should the shareholders vote against the proposed merger deal with Frontier, which is scheduled for June 10.

JetBlue called the Spirit/Frontier deal, “Inferior, high risk, and low value.” It proposed further negotiations, should Spirit’s management agree to share the diligence that JBLU had requested earlier and was denied.

JetBlue’s revised offer of $30 per share reflects a 60% premium to the value of Frontier’s offer as of May 13, 2022. Moreover, it represents a 77% premium to Spirit’s latest closing price.

“Spirit’s conflicted Board rejected JetBlue’s clearly superior offer on baseless grounds and refused to engage constructively – depriving Spirit shareholders of more value and more certainty,” said JetBlue CEO Robin Hayes, in a letter directed to Spirit’s shareholders.

Hayes gave the long-standing relationship between Spirit and Frontier as the reason for Spirit’s refusal to consider JBLU’s proposal in good faith. JetBlue has also agreed to pay a reverse break-up fee of $200 million, should the deal not be consummated. On the other hand, should the acquisition go through, the combined entity would form the fifth largest U.S. domestic carrier.

Spirit’s reluctance to go ahead with JetBlue’s deal stems from the fear of attracting antitrust regulatory scrutiny. It is also concerned about JBLU’s alliance with American Airlines (AAL) in New York and Boston, which itself is facing regulatory objections from the Justice Department.

JetBlue Target Price

Overall, the JBLU stock has a Hold consensus rating, based on five Buys vs. five Holds and two Sells. The average JetBlue price target of $14.60 implies 45.1% upside potential to current levels. Meanwhile, its stock has lost 31.6% year-to-date.

JBLU Stock Investors

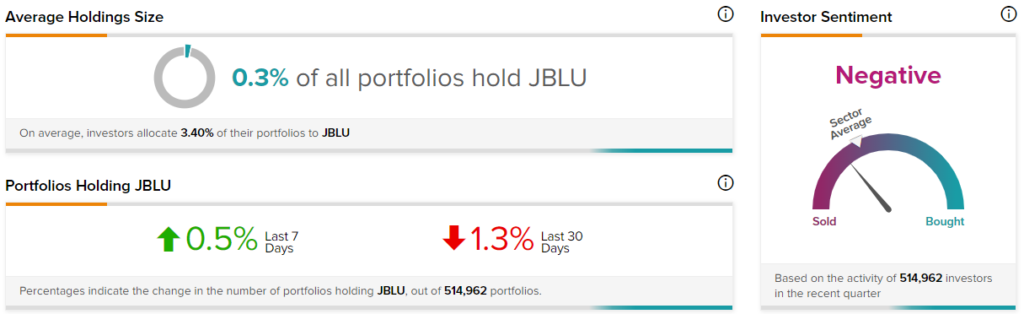

TipRanks’ Stock Investors tool shows that investor sentiment is currently Negative on JetBlue, with 1.3% of portfolios tracked by TipRanks decreasing their exposure to JBLU stock over the past 30 days. Nonetheless, 0.5% of the portfolios have increased their exposure over the last seven days.

Ending Thoughts

JetBlue may win the Spirit shareholder’s vote in the current situation. However, whether the buyout deal ultimately goes through is a long shot. Plus, both Wall Street analysts and investors’ confidence in the JBLU stock seems to be shaky. It’s a wait-and-watch story for the time being.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Wix Delivers Q1 Top-Line Beat; Street Sees 76% Upside!

Musk Tweets About Violating Twitter NDA

Bezos Pokes POTUS for Tweet on Taxing Rich Corporations