Stocks have been surging through this month of November. Both the S&P 500 and the NASDAQ indexes are back within close reach of the peak yearly values hit at the end of July, after their single best month since Oct 2022 – and the month isn’t over yet. The gains have paralleled a drop in bond yields; the 10-year Treasury note touched 5% a few weeks ago, but is now down to nearly 4.4%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Clearly, market sentiment is running positive, and investors are not shy about buying into stocks right now. Support for this bullish surge came from the October inflation data, which was reported at a 3.2% annualized rate. That came in lower than expected, and shows the pace of inflation decelerating – good news, and news that buttresses expectations for a Fed rate cut sooner rather than later. Right now, market watchers are pricing in a 29% chance of a 25-basis point cut by March of next year.

This all brings up a question – how to find the right place to put those stock purchasing dollars to work, given a hotter market? We could use a tried and true screen, and look for stocks endorsed by the big-name investment banks – international firms like Deutsche Bank, that have reputations to uphold and customers looking for solid portfolios. Their incentive is clear – do the homework, find the best stocks.

So let’s follow some of Deutsche Bank’s recent suggestions. The bank’s analysts have, in recent weeks, picked out 3 stocks for particularly bullish praise; here they are, with the latest details drawn from the TipRanks platform to go along with the DB commentaries.

Don’t miss

- Goldman Sachs Says These 2 Healthcare Stocks Have up to 130% Upside Potential

- Tech Stocks Have More Room to Run, According to Bank of America — Here Are 2 Names to Watch

- ‘Riding the Clean Energy Wave’: This Analyst Suggests 2 Stocks to Play the Renewable Energy Transition

Griffon Corporation (GFF)

We’ll start with a holding company, whose various wholly-owned subsidiaries operate in two large segments: home and building products, and consumer and professional products. From its NYC headquarters, Griffon Corporation oversees Clopay, North America’s largest manufacturer and distributor of garage doors and rolling steel doors, and AMES Companies, which focuses on branded consumer and professional-grade tools aimed at the home improvement and landscaping sectors.

While not a household name, Griffon can still trace its history back to the beginning of the US. AMES Companies was originally established in 1774, making it one of the oldest US companies still in continuous operation. Clopay isn’t that venerable, but is still well over a half-century in the business; it was established in 1964. Together, Griffon’s subsidiaries employ approximately 6,000 people.

Griffon Corporation has worked hard in recent years to both support its share price and to return capital to shareholders. In an announcement earlier this month, the company publicized a $200 million increase to its share buyback authorization. Including that increase, the company now has an authorized buyback program worth $262 million. The company repurchased $150.8 million worth of stock during its fiscal year 2023, which ended on September 30.

The buyback is complemented by a modest dividend, which Griffon pays out quarterly. In its last declaration, on Nov 15, the company scheduled a 15-cent payment for December 14. This marked a 20% increase in the payment. The dividend annualizes to 60 cents per common share and yields 1.3%.

Griffon maintained its capital returns even though it missed revenue expectations in the recently reported fiscal 4Q23. The company showed a top-line of $641.4 million, $10.95 million below the forecast and down 9.6% year-over-year. The bottom line figure was $1.19 per share by non-GAAP measures. This was up 10 cents y/y, and came in 23 cents better than had been anticipated. Griffon’s free cash flow in the fiscal year came to $389.1 million.

For Deutsche Bank analyst Joe Ahlersmeyer, there’s plenty to like here, and he particularly shines a light on the firm’s work ethic: “Griffon investors can anticipate a dual track of positive momentum over the coming years, with a high-quality, high-margin garage door business in HBP, and a compelling improvement story in CPP, where hard work on streamlining the business model will likely start to show results in FY24 and into FY25.”

Looking ahead to future performance, the analyst also saw plenty of reasons to take a bullish view, writing of Griffon’s potential, “After years of rationalization and readjustment, what remains at Griffon is a focused Building Products business with strong FCF generation potential, which we anticipate will surpass $400mm in annual cash from operations by FY25, providing more than $1bn of deployable capital from FY25-FY27. We see the company increasing share repurchases and growing its dividend, and to a lesser extent deleveraging and exploring bolt-on M&A.”

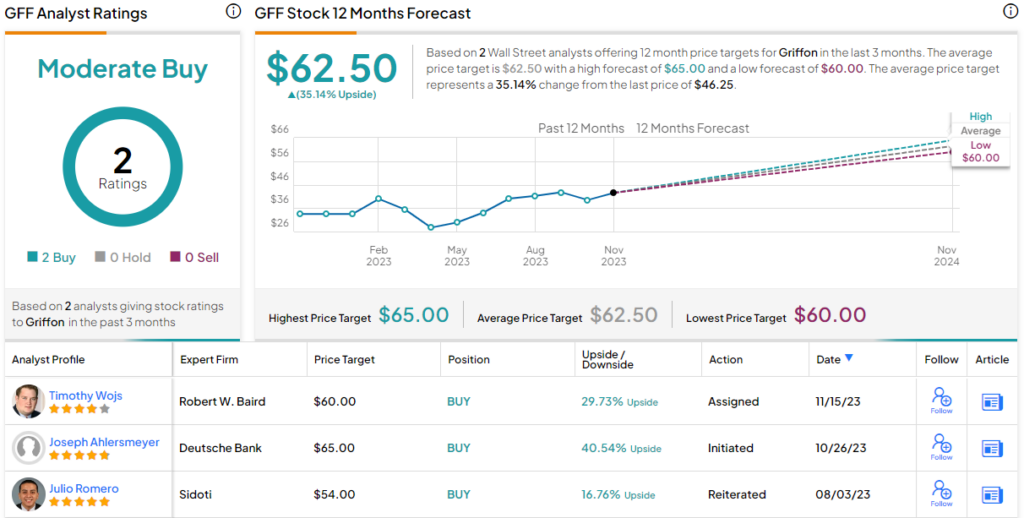

Ahlersmeyer goes on to give these shares a Buy rating, with a $65 price target to point toward a 40.5% appreciation for the coming year. (To watch Ahlersmeyer’s track record, click here.)

This stock has slipped under the radar a bit, and holds a Moderate Buy consensus rating based on just 2 analyst reviews – but they are both positive. The shares are trading for $46.25 and their $62.50 average price target suggests a 35% one-year upside potential. (See Griffon’s stock forecast.)

DoorDash, Inc. (DASH)

Next on our list, DoorDash, is a name you probably know – and have very possibly ordered from. DoorDash is a Silicon Valley tech name, founded in 2013, and in the last 10 years has become a well-known provider of online food ordering and delivery services. The company operates in more than 25 countries around the world, bringing convenience to private and small-merchant consumers.

While the company’s business may focus on small customers, individuals and small businesses, DoorDash itself is decidedly large-cap. The company has a market cap near $38 billion, and has expanded beyond its original food delivery niche. Today, DoorDash can connect consumers with a wide range of products, including food of course, but also flowers, pet supplies, groceries, household goods, and even alcohol. Customers can even call DoorDash to pick up package deliveries, and take them to UPS, FedEx, or the post office.

We all want convenience, and more and more are willing to pay for it. That opens up a huge vista of opportunity for DoorDash, which saw its total orders increase 24% y/y in 3Q23, reaching $543 million. The firm’s gross order volume for the same period also grew 24% y/y, and was reported at $16.8 billion. That’s a solid foundation for any business.

At the top-line, DoorDash reported $2.16 billion in revenue for Q3, beating the forecast by $70 million while growing 29% y/y. At the same time, like many Silicon Valley tech firms, DoorDash is operating at a loss. Its EPS for Q3 was reported as ($0.19); on the positive side, the year-ago quarterly loss was 77 cents per share, and the current figure was 22 cents better than the forecast. We should note here that DoorDash’s quarterly revenues have been showing consistent sequential growth for the past several years, and that the stock is up more than 95% for the year-to-date.

Deutche Bank analyst Lee Horowitz puts this into context when he notes the sheer size of DoorDash’s potential market – and just how much room the company has to keep dashing. In his words, “DoorDash’s core markets in restaurant, grocery, convenience, and retail delivery are massive and measure at around $6.7trn. With DoorDash capturing only 1% of its overall market via users that represent only 7% of available homes, there is ample runway for user growth from here. With this in mind, DoorDash’s ability to take share of these opportunities while also growing profitability despite a more strained global consumer has been on full display in 2023. Thus, we’d argue this should give investors confidence in underwriting the idea that DoorDash will be one of the prime beneficiaries of digital transformation trends within these multi-trillion markets over the coming years. With this in mind, we look for user growth to compound at a CAGR of ~13% between 2022 and 2026.”

Horowitz, a 5-star analyst, initiates his coverage of DASH with a Buy rating, encouraging investors to jump in now while there is plenty of space for the company to expand. His price target here is $125, implying a one-year gain of 32%. (To watch Horowitz’s track record, click here.)

While DB is bullish, the Street generally is somewhat more cautious. All in all, DoorDash receives a Moderate Buy consensus rating, based on 21 recent reviews that break down to 8 Buys, 12 Holds, and 1 Sell. The stock is trading for $94.60 and its $100.39 average target price suggests an upside of a modest 6% in the next 12 months. (See DoorDash’s stock forecast.)

Goodyear Tire (GT)

Let’s finish in the automotive world, with Goodyear Tire. This name is instantly recognizable, as it is one of the world’s top automotive tire companies – and because its eponymous Goodyear Blimp has long been an icon of outdoor advertising. Goodyear was founded in 1898 and today employs 72,000 people and boasts 57 facilities in 23 countries. The company has a $4 billion market cap and is consistently one of the world’s top-five largest tire companies. It is the largest tire company in the US market.

Most of us don’t really think about automotive tires until ours run bald and the car starts to drift – but in today’s world, tires are an essential product, and the market for them is expected to continue growing. Last year, the market for automotive tires clocked in at approximately $126 billion; it is expected to reach $176 billion by 2027. The push toward EV adoption is providing an unexpected boost for tires, too. EVs are typically heavier than comparable-class combustion vehicles, and so wear out their tires faster – necessitating a shorter lifespan and more rapid tire replacement cycle.

For the past several years, the top line has been remarkably stable, staying between $4.73 billion and $5.36 billion, with most values closer to $5 billion. That said, in the most recent quarter, Goodyear posted $5.14 billion in revenues, slipping some 3% year-over-year and missing the forecast by nearly $140 million. At the bottom line, the company realized a non-GAAP EPS of 36 cents; this was 17 cents per share better than expected.

Having a solid base will be important for Goodyear in the near future. The company’s long-time CEO Richard Kramer will be retiring next year, and Goodyear has begun an executive search for a new head. The leadership search was a key point for Deutsche Bank’s analyst Emmanuel Rosner, who notes it among several other factors that should attract investors to GT stock.

Getting into details, Rosner writes, “With a credible operational turnaround path, strategic portfolio optimization through large noncore divestitures, and new leadership coming in to execute, we think Goodyear is about to start a new chapter. We see strong potential for the company to improve its profitability and narrow the gap with its peers through self-help, de-leverage its balance sheet, and unlock large shareholder value.”

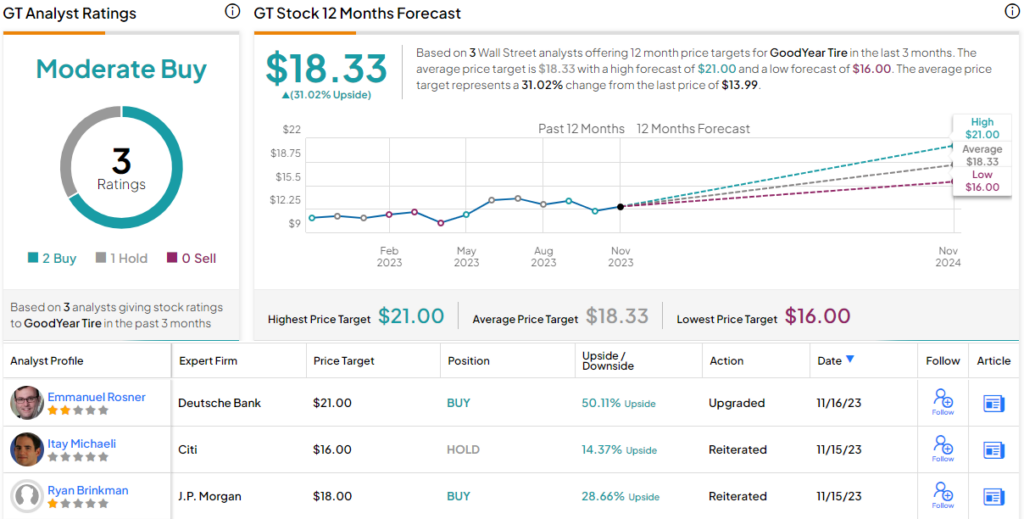

These comments back up Rosner’s Buy rating here, while his $21 price target shows his confidence in a 50% upside for the stock. (To watch Rosner’s track record, click here.)

Even though Goodyear is a venerable name in the US auto industry, the stock only has 3 recent analyst reviews. These include 2 Buys and 1 Hold, for a Moderate Buy consensus rating; the stock’s $18.33 average price target suggests a 31% one-year gain from the current trading price of $13.99. (See Goodyear’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.