Regardless of any individual’s feelings about the transition from fossil fuels to renewable energy sources, there’s no doubt that it is happening. Our society has come to the conclusion that fossil fuels are too dirty for continued long-term, large-scale use, and that something will have to replace them. There are plenty of contenders for the role, and prominent among them are renewable power sources such as solar and wind energy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both of these sources find support from social pressures, which translate into political pressure. The recent high-water mark of political support for renewables came from President Biden’s Inflation Reduction Act, signed in August of last year. Undoubtedly, this legislation offers robust subsidies for projects aimed at transitioning to renewable energy sources.

Offering insight into this ongoing transformation of the energy landscape, Stifel analyst Brian Brophy points out, “We believe utility-scale renewables (solar, batteries, wind) are in the early innings of a significant adoption cycle driven by 1) competitive levelized costs with legacy fossil fuels, including natural gas, 2) accelerating retirements of legacy generation (particularly coal), and 3) the recent passage of the Inflation Reduction Act (IRA) which extends and expands tax credits for green energy projects through at least 2032. Significant ramp in planned clean energy capacity highlights the opportunity.”

Building from this, Brophy has tagged two energy construction companies for investors to considers when ‘riding the clean energy wave.’ These are stocks directly involved in building out the emerging renewable power infrastructure. Here are their details.

Don’t miss

- Billionaire Steve Cohen Goes Big on These 2 ‘Strong Buy’ Stocks — Here’s Why You Should Follow

- ‘Time to Hit Buy,’ Says Bank of America About These 2 Stocks

- Oppenheimer Expects the S&P 500’s Advance to Continue Into 2024 — Here’s Why These 2 Stocks Might Be Worth Buying

MasTec, Inc. (MTZ)

We’ll start with MasTec, a construction and engineering firm that operates as a contractor with a specialty in energy and infrastructure. The company employs over 22,000 people and, in recent decades, has been involved in some of the ‘largest and most complex’ infrastructure projects in the US. MasTec’s work has targeted the communications, oil & gas, and power generation fields – as well as build-outs in energy transition and electric vehicle charging projects.

MasTec’s energy projects totaled over $6.5 billion last year, and its approach to energy transition projects made an important part of that total. The company’s outlook on energy transition is based on a simple insight: that some of the technology may be new (clean hydrogen hubs, for example) but the basic engineering of the infrastructure is not particularly different from existing systems, using many of the same engineering and construction components as traditional power facilities. This insight has powered MasTec’s moves into the clean hydrogen, carbon capture, and wind and solar power segments of the renewable energy sector.

Shares in MasTec are down this year, having fallen some 36% year-to-date. The company has failed to meet the estimates in recent earnings reports, and it has cut back on full-year revenue guidance as well. Economic headwinds – rising prices that increased overhead costs on construction projects – have cut into the company’s business results.

This can be seen in MasTec’s recent 3Q23 financial release. The company’s top line, of $3.26 billion, was a record for the firm – but was also more than $530 million below the forecast. At the bottom line, MasTec reported earnings of 95 cents per diluted share; this missed expectations by 89 cents per share. On a positive note, the company has a strong balance sheet. It recorded a debt reduction of $213 million in the quarter, and as of September 30 had approximately $1.16 billion in liquid assets on hand.

For Stifel’s Brophy, the key points here are a combination of a solid position in a niche with strong growth prospects and a cheap share price. The analyst writes of MasTec, “We are positive on the longer-term growth outlook for MTZ’s businesses. In the communications end market, we see long-term demand tailwinds from ever growing bandwidth demand. In pipelines, we believe longer-term expectations remain low, but see emerging opportunities in carbon capture and clean hydrogen. In renewables and civil infrastructure, we expect significant fiscal stimulus to be a growth tailwind over the coming years. For the T&D end market, we expect continued steady growth in utility investment driven by grid hardening and modernization efforts as well as to support adoption of renewables.”

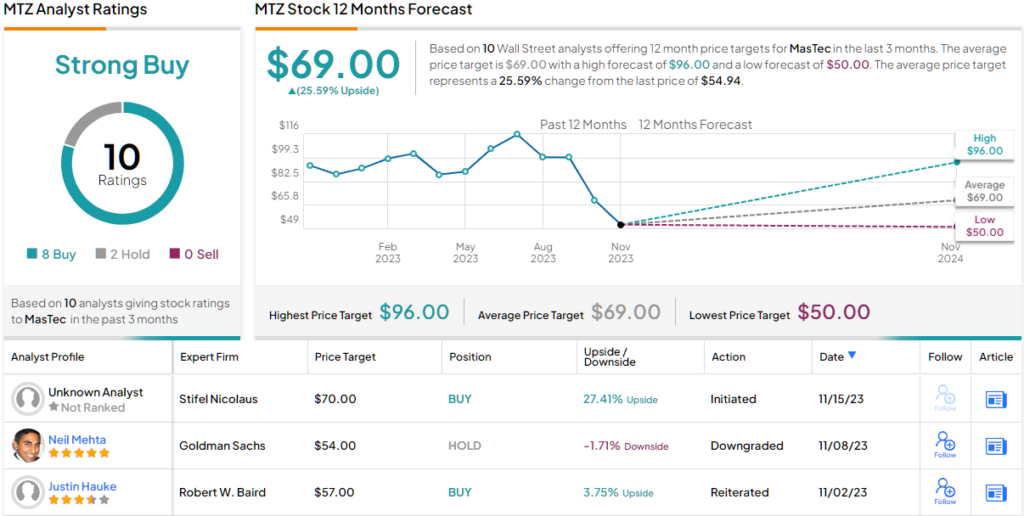

Brophy quantifies his stance with a Buy rating on the stock and $70 price target that points toward a one-year upside potential of 27%.

Overall, the Street’s analysts have given MasTec a Strong Buy consensus rating, basing it on 8 recent Buys against just 2 Holds. These shares are trading for $54.94, and their $69 average price target is almost as the Stifel view, implying ~25% gain in the year ahead. (See MasTec stock forecast)

MYR Group (MYRG)

The second stock we’ll look at is MYR Group, another construction company with close ties to the power industry and a deep interest in renewable power projects. Operating through its subsidiaries, MYR Group works on a wide range of energy-related construction and engineering projects, including substation construction and emergency power restoration, but has particular expertise in transmission and distribution build-out projects, the work that expands and maintains the nation’s electric grid.

On renewables, MYR Group has developed a reputation as a can-do company for clean power builds. The firm provides electrical construction and engineering-procurement services for a multitude of renewable energy projects, including wind and solar farms, hydroelectric installations, and green energy battery and fuel cell storage. The company delivers turnkey projects, with a focus on innovative engineering and quality construction.

In its last earnings release, covering 3Q23, MYR Group reported some important highlights for investors to note. The top line, showing revenue of $939.5 million, was a quarterly record for MYR – up more than 17% y/y and some $62 million ahead of the estimates. The bottom line, a non-GAAP EPS figure of $1.28, was up 19 cents from the prior year quarter, although it was also 2 cents below the forecast. In a metric that bodes well for MYR going forward, the company reported a solid work backlog of $2.62 billion. The backlog was up 5.7% y/y and included $1.14 billion in transmission and distribution (T&D) projects.

Covering this stock for Stifel, analyst Brian Brophy sees plenty of potential for investors to grab onto. He writes, “We are positive on the longer-term outlooks for T&D and renewables installations, key end markets for MYRG. We expect a healthy backdrop of growth for cost-competitive renewables driven by significant fiscal stimulus from the IRA. For T&D, we expect continued steady growth in utility investment driven by grid hardening and modernization efforts as well as to support adoption of renewables. We expect C&I to be more cyclical but expect tailwinds from recent fiscal stimulus funding and outgrowth in MYRG’s core geographic markets (Colorado and Arizona). We believe recently improved FCF conversion and strong ROIC help support the valuation multiple.”

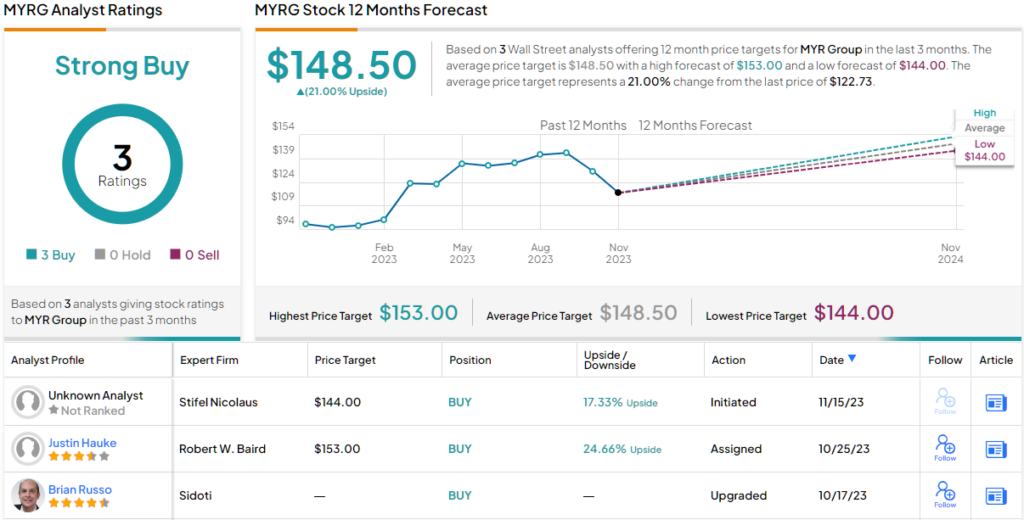

Brophy goes on to put a Buy rating on MYRG shares, and his price target, now set a $144, suggests the stock will gain ~17% on the one-year horizon.

Do other analysts agree? They do. Only Buy ratings, 3, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. Given the $148.50 average price target, shares could climb 21% in the next year. (See MYRG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.