For investors seeking a solid return, few stock segments offer a better mix of risk, reward, and opportunity than healthcare stocks. While these stocks are known for their notoriously long product lead times and high overhead costs, they are also known for their ability to turn sharply on a new catalyst and generate strong returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That dynamic is part and parcel of the biopharmaceutical research field. The biotech companies spend their capital and efforts – huge amounts of each – on the discovery, development, and clinical testing of new drugs. Most of these research tracks will fail – but those that succeed, and enter the market, can bring a huge potential for long-term profits.

Before that happens, investors will follow these biotechs, watching for catalysts: the starts of clinical trials, releases of positive clinical data, achievement of regulatory milestones, and the launch of commercialization efforts are all factors that will boost biopharma healthcare stocks, sometimes into the stratosphere.

Covering the healthcare sector from Goldman Sachs, analyst Andrea Tan has pinpointed two biopharmas that are getting ready to reap strong gains, up to 130%, as their own catalyst data comes in. In Tan’s view, these are the stocks that can jump, and investors should get in now. So let’s follow her lead, using data from the TipRanks database and Tan’s latest comments to find out just what makes these two stocks tick.

Don’t miss

- Tech Stocks Have More Room to Run, According to Bank of America — Here Are 2 Names to Watch

- ‘Riding the Clean Energy Wave’: This Analyst Suggests 2 Stocks to Play the Renewable Energy Transition

- Billionaire Steve Cohen Goes Big on These 2 ‘Strong Buy’ Stocks — Here’s Why You Should Follow

Krystal Biotech (KRYS)

Krystal Biotech, the first Goldman Sachs pick, has recently moved from the research-oriented development and clinical stage to the commercial phase of its operations. In May of this year, the company received FDA approval for Vyjuvek, the first of its products to reach the market. Vyjuvek is a gene therapy product for the treatment of dystrophic epidermolysis bullosa (DEB), a serious, genetically linked skin disease.

Behind Vyjuvek, Krystal has an up-and-coming pipeline of drug candidates, at the preclinical and early clinical stages of development. The company is focused on the creation of redosable gene therapy agents, as a method of providing best-in-class treatment options for serious genetic diseases that currently do not have effective medications on the market. In addition to Vyjuvek, Krystal’s active research pipeline has drug programs working on treatments for TGM1-deficient Autosomal Recessive Congenital Ichthyosis (TGM1-deficient ARCI), and cystic fibrosis (CF).

The key story here, however, definitely revolves around the company’s first commercial product. Vyjuvek was approved during Q2 of this year, and amassed 121 patient start forms within six weeks of the product launch. By the end of Q3, on September 30, the company had 284 patient start forms on file, and had brought in a total of $8.6 million in product revenue from the new drug, beating expectations by just over $2.3 million. The successful start to commercialization also brought Krystal its first quarter of positive earnings; the company’s GAAP EPS in 3Q23 came to $2.79 per share, $3.46 better than had been forecast.

The company is now working with regulatory agencies in both Europe and Japan to gain approval in those markets, with regulatory milestones expected in the course of 2024.

Goldman Sachs’ Andrea Tan, in her write-up on Krystal, follows the Vyjuvek lead. She points out the strong launch and the large sales potential, and goes on to explain additional factors that will support the drug, and the company, in the coming months.

“With a first-in-class and best-in-class profile, we are positive on Vyjuvek’s near- and long-term potential (GSe peak global sales of $1.6bn), noting encouraging early launch metrics and KOL diligence supportive of extensive utilization (potentially beyond the 1 vial/week labeled use) across all eligible patients,” Tan noted. “Separately, we see the Skin TARgeted Delivery platform (STAR-D) as leverageable to other indications including in dermatology (ARCI and Netherton syndrome), respiratory (CF and AAT), aesthetics (lateral canthal lines) and oncology, none of which are in our model and thus represent potential upside.”

For Tan, these comments back up a Buy rating on the stock – and her price target, of $160, implies a solid upside of 58% for the coming year. (To watch Tan’s track record, click here)

Overall, Krystal’s Strong Buy consensus rating is unanimous, based on 8 positive reviews, showing a solid agreement among the Street’s analysts that this company has a sound future. The shares are priced at $101.25, and their $153.25 average target price points toward a 51% gain on the one-year horizon. (See KRYS stock forecast)

Iovance Biotherapeutics (IOVA)

Next up is Iovance, a California-based biotech company working on new cancer treatments. The company’s research approach is focused on tumor-infiltrating lymphocytes (TIL), a method that uses the patient’s own immune system to attack tumor cells. TILs are naturally occurring immune cells with a built-in anti-cancer function. They can be collected from a patient and cultivated outside the patient’s body to develop a personalized cache of anti-cancer cells available for administration back to the patient in a one-dose treatment regimen.

With this approach, Iovance has assembled a research pipeline to test the viability and efficacy of TIL treatments, both as monotherapy and combination therapy options for various solid tumor cancers. The company’s research and clinical tracks are investigating TILs against advanced solid tumors, including melanoma, non-small cell lung cancer, cervical cancer, and head and neck cancer. Currently, the company has 20 research tracks in progress, ranging from pre-clinical IND-enabling to Phase 1 and 2 clinical studies to pivotal trials.

The most advanced drug candidate in the company’s portfolio is lifileucel, formerly known as LN-144, a TIL being tested against both melanoma and cervical cancer – two malignancies lacking strong therapeutic drug options. Lifileucel is under study for both of these as a monotherapy and in combination with pembro.

In the melanoma track, lifileucel has reached the regulatory application stage. The company has submitted the Biologics License Application to the FDA, and the agency has set a PDUFA date of February 24, 2024. While this date is extended, the agency has indicated its willingness to expedite the remaining review process. Additionally, the company is actively working with regulatory agencies in the UK and Canada to secure approval for lifileucel in the second half of 2024. These regulatory submissions pertain to the use of the drug as a monotherapy against advanced melanoma.

In her assessment of Iovance and the prospects for lifileucel, Goldman Sachs analyst Andrea Tan outlines the path to approval and the substantial potential market within 15 years. Tan notes, “The upcoming approval of the first TIL therapy (and first cell therapy for solid tumors) will transition IOVA to a commercial company where we are constructive on the near- and long-term launch potential given lifileucel’s best-in-class profile, early signs of KOL enthusiasm (per 30 ATCs onboarded and ready for infusion), expected favorable pricing and coverage, and manufacturing readiness and capacity, all of which should support a blockbuster opportunity (GSe peak global sales of $1.5bn in 2038).”

For Tan, this all adds up to a Buy rating, and her price target, at $12, shows the high potential of the stock – she foresees ~130% gain in the shares by the end of next year.

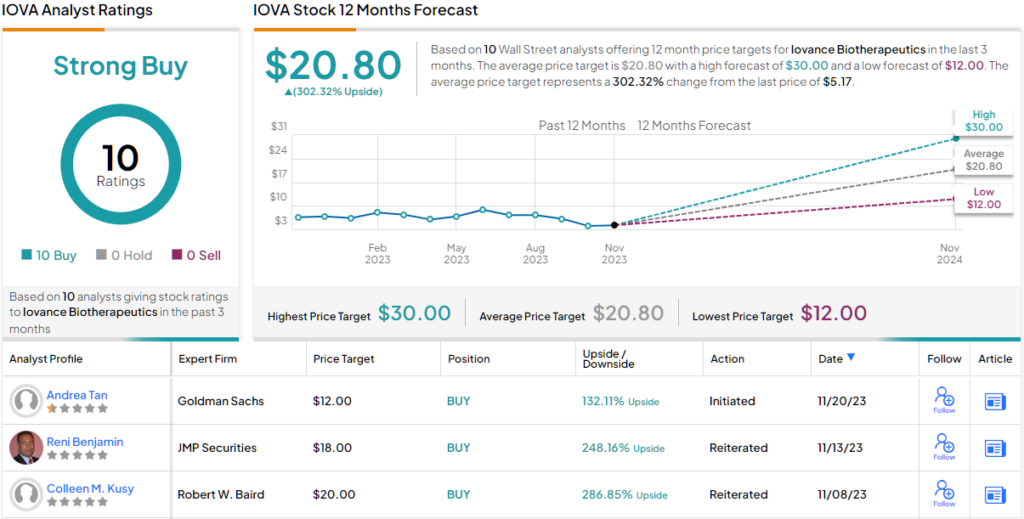

Overall, Iovance gets a Strong Buy consensus rating from 10 unanimously positive analyst reviews – and such agreement from the Street should always pique investor interest. The stock is selling for $5.17, and its $20.80 average price target suggests a one-year upside potential of 302%. (See IOVA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.