Electric vehicle (EV) makers have been under pressure due to supply chain issues, higher costs, and component shortages. However, the long-term prospects for EV makers look bright as demand remains strong amid high fuel costs and favorable policies being implemented by several countries (including the Inflation Reduction Act in the U.S.) to boost EV adoption. As per research firm Canalys, global EV sales jumped 63% year-over-year to 4.2 million in the first half of 2022. U.S.-based EV companies Tesla (NASDAQ:TSLA) and General Motors (NYSE:GM), and Chinese EV maker Nio (NYSE:NIO) are names that one cannot afford to ignore in this lucrative market. Using TipRanks’ Stock Comparison tool, let us compare these three EV stocks to pick the one that Wall Street is most upbeat about.

Tesla (TSLA) Stock

Despite growing competition in the EV space, Elon Musk’s Tesla continues to be a name to reckon with. COVID-led shutdowns in Shanghai caused a sequential decline in the company’s production volumes, deliveries, and revenue in the second quarter. However, on a year-over-year basis, Q2 revenue increased 42% to $16.9 billion while adjusted EPS surged 57% to $2.27.

Tesla has ramped up its production and is optimistic about hitting its full-year delivery growth target of 50%. Indeed, recent updates indicate that the company is poised to deliver strong numbers in the second half, even though cost pressures due to inflation persist.

As per data provided by the Chinese Passenger Car Association (CPCA), Tesla’s Shanghai facility delivered 76,965 vehicles in August. Notably, August numbers marked a significant rebound from 28,217 deliveries in July, thanks to the upgrades to the Shanghai facility.

Is Tesla Stock a Buy, Sell, or Held?

Last week, Wolfe Research analyst Rod Lache upgraded Tesla stock to a Buy from Hold, with a price target of $360. Lache’s upgrade reflected his optimism for the EV sector following the passing of the Inflation Reduction Act (IRA). The analyst now expects global EV penetration to increase to 22% in 2025 from 5% this year. Lache had earlier expected 2025 global EV penetration to come in at 17.5%.

Lache called the IRA the most “consequential development” for the U.S. auto industry and expects U.S. EV penetration to reach 20% in 2025, up from his earlier estimate of 10%. The analyst estimates that the U.S. government may provide incentives worth $11 billion per year to Tesla.

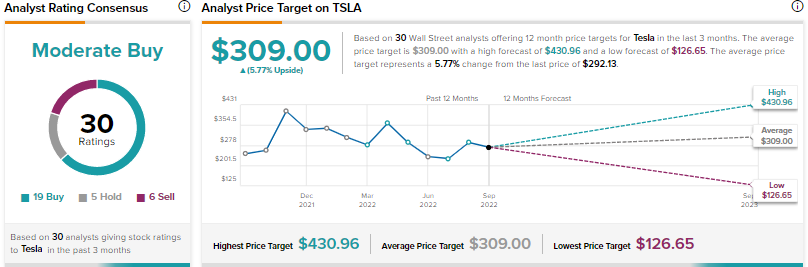

With 19 Buys, five Holds, and six Sells, the Street has a Moderate Buy consensus rating on Tesla. The average Tesla stock price prediction of $309 implies 5.8% upside potential.

General Motors (GM) Stock

Auto giant General Motors is betting big on EVs. The company aims to invest over $35 billion through 2025 in the expansion of its EV portfolio, automated vehicles, and the creation of a battery manufacturing infrastructure in the U.S.

GM has been signing key supply agreements (including recently announced deals with LG Chem and Livent) to ensure that it has the required inputs to meet its goal of producing one million EVs annually in North America by 2025-end. The company aims to generate annual EV revenue of $90 billion by 2030.

Following the launch of the Chevrolet Silverado EV pickup truck and Blazer EV this year, GM recently unveiled the 2024 Equinox EV, an affordable electric SUV. Equinox EV, which has a starting price of around $30,000, is expected to go on sale in the U.S. in fall 2023, beginning with a limited edition 2RS model.

What is the Prediction for GM Stock?

Aside from Tesla, Wolfe’s analyst Rod Loche is also optimistic about General Motors and reaffirmed a Buy rating to reflect the favorable impact of the Inflation Reduction Act. He raised his price target for GM stock to $50 from $42. Loche expects GM to benefit from incentives worth $12 billion per year.

Loche added, “We would expect this to almost certainly influence OEM [Original Equipment Manufacturers] profitability (We now believe that select OEMs will become more profitable in EVs vs. ICE [Internal Combustion Engine] Vehicles, a very different view than we had just one month ago).”

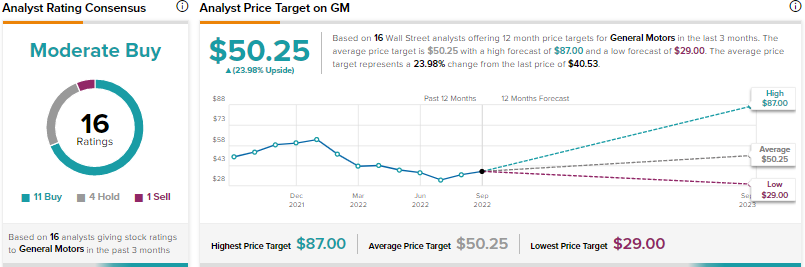

Overall, GM scores a Moderate Buy consensus rating based on 11 Buys, four Holds, and one Sell. At $50.25, the average GM target price suggests 24% upside potential.

Nio (NIO) Stock

COVID-induced lockdowns in China triggered production as well as supply chain disruptions and cost pressures for Nio. The leading Chinese EV maker’s net loss widened in the second quarter even as revenue increased 22% to RMB 10.3 billion ($1.54 billion).

That said, Nio’s August update reflected improved trends as the company delivered 10,677 vehicles, up nearly 82% year-over-year and 6% compared to July. Despite COVID-related uncertainty in China and other macro challenges, Wall Street analysts remain bullish about Nio’s potential to grow rapidly in the EV market. Their optimism is based on strong demand trends for the company’s newly launched vehicles, like the ES7 and ET5 SUVs, and expansion into countries beyond China.

What is the Target Price for Nio Stock?

Nio shares surged nearly 14% on September 12 in reaction to favorable commentary by a Nio bull. Deutsche Bank’s Edison Yu reiterated a Buy rating on NIO stock with a price target of $39, calling the company a top pick among Chinese EV makers.

Furthermore, Bank of America Securities analyst Ming Hsun Lee is bullish on Nio due to its “good product cycle and comprehensive EV portfolio.”

Lee stated that checks by his firm revealed that the total orders for the company’s ES8, ES6, and EC6 models were not significantly impacted by the launch of the ES7 SUV. The analyst believes that the newly launched ET7 and ET5 vehicles also have “different addressable markets given differentiated car size and price.”

Lee believes that Nio’s volume growth will beat rivals Xpeng (XPEV) and Li Auto (LI) over the next few quarters as most of the company’s EVs are new. Moreover, he expects the upgraded versions of ES8, ES6, and EC6, which are scheduled to be launched in 2023, to “sustain demand.” Based on his optimism, Lee reaffirmed a Buy rating and slightly increased the price target for Nio stock to $30 from $29.

All in all, Nio earns the Street’s Strong Buy consensus rating based on nine unanimous Buys. The average Nio Stock price prediction of $31.84 implies 45% upside potential.

Conclusion

EV makers might continue to be under pressure over the short term due to a challenging macro backdrop. However, the long-term prospects for EV makers continue to be attractive, with several countries encouraging accelerated adoption of EVs. Currently, Wall Street is highly bullish on Nio compared to Tesla and General Motors. Moreover, analysts see higher upside potential in Nio stock than in the other two EV stocks.

Disclaimer