Symbolic of the wild narrative of the post-pandemic new normal, embattled cineplex operator AMC Entertainment (NYSE:AMC) initially suffered dramatically because of the sudden disruption of personal mobility. However, the meme-stock phenomenon eventually took over, sending the troubled enterprise skyrocketing to all-time highs. Unfortunately, the ride appears to be over, leaving a bare sliver of hope for contrarian speculators. Everybody else should probably step away from AMC stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Before diving into the discussion, I must explain my ownership disclosure below. While I do carry some shares of AMC stock in my portfolio, I exited during the manic runup in valuations. Therefore, what I do have plays into speculation with house money, so to speak. It’s possible that the meme-stock wave could positively strike the cineplex operator once again. However, arguably most folks do not have the luxury of playing with “free” money.

Fundamentally, conservative investors must stay away from AMC stock. One of the biggest concerns regarding the distressed company centers on its issuance of debt. Over the past three years, management issued $1.3 billion of debt, reflecting substantial concerns with underlying demand. As well, several key financial performance metrics remain mired in red ink.

For example, the company’s three-year cumulative revenue growth rate sits at an alarming -53.7%. Similarly, AMC’s three-year cumulative free cash flow (FCF) growth rate is -1,246%.

Not surprisingly, then, AMC’s Altman Z-Score sank into the distressed zone at -0.9. For reference, a company is considered to be in the distressed zone when its score is less than 1.81. This rating suggests that the company could be a bankruptcy risk within the next two years. At the time of writing, AMC stock has hemorrhaged more than 75% of its equity value on a year-to-date basis.

Expecting these and other painful circumstances to magically improve may represent a fool’s errand (excuse the pejorative statement). Therefore, anyone that’s not a hardened speculator would likely do well to avoid this struggling entity.

AMC Stock Receives a Glimmer of Hope

Although the financial profile undergirding AMC stock likely has most fundamental investors running for the exits, the cineplex operator is not completely devoid of bullish catalysts, surprisingly. Indeed, the latest earnings report for Netflix (NASDAQ:NFLX) may have extended a fragile lifeline.

As TipRanks reporter Vince Condarcuri noted for the company’s third-quarter disclosure, “Adjusted earnings per share came in at $3.10, which beat analysts’ consensus estimate of $2.14 per NFLX share. In the past nine quarters, the company has beaten estimates six times.”

In addition, “Sales increased 6% year-over-year, with revenue hitting $7.93 billion compared to $7.48 billion. This was also higher than the $7.843 billion that analysts were looking for. Turning to subscriber growth, Netflix’s subscriber base increased by 2.4 million, which was more than double its goal of 1 million. Looking forward, the company expects to add 4.5 million net new subscribers in the fourth quarter.”

The point here isn’t so much about rehashing Netflix’s outstanding Q3 beat. Rather, these results strongly indicate that after consumers had fun exercising their revenge travel, they are now ready to seek entertainment and escapism in the living room. Of course, that fundamentally benefits streaming companies the most, representing competitive pressure on AMC stock. However, it’s also beneficial to the box office.

After all, watching a summer blockbuster on the big screen is both entertaining and far cheaper than other forms of in-person entertainment. Examples include watching a ball game or attending a live concert. Therefore, the cineplex industry still brings much relevance to the table.

In addition, bad news might be good news for AMC stock. Currently, consumers remain straddled with fears of inflation, deflation, stagflation, and other economic woes. During these times, escapism may command a premium.

As it turns out, Hollywood might be able to deliver the fantasy that society would crave during an economic downturn. Combined with the human experience of box office attendance, it’s not impossible for AMC stock to perform well.

Is AMC Stock a Buy, Sell, or Hold?

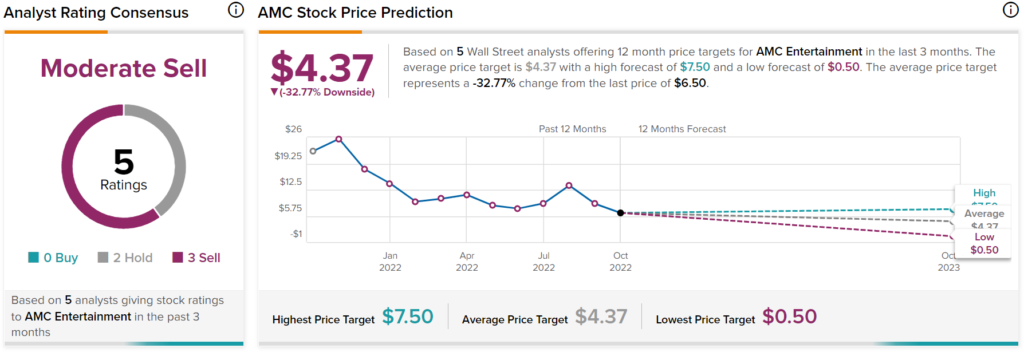

Turning to Wall Street, AMC stock has a Moderate Sell consensus rating based on zero Buys, two Holds, and three Sells assigned in the past three months. The average AMC price target is $4.37, implying 32.77% downside potential.

Don’t Buy Your AMC Lottery Ticket Just Yet

Still, as TipRanks contributor Steve Anderson might say, the narrative could be pretty darn close to impossible. Recently, Anderson mentioned that AMC stock represents a $6 lottery ticket right now. Frankly, it’s hard to come away with any other conclusion.

Irrespective of the impact of the COVID-19 pandemic, cineplex operators continue to face pressure from streaming services. As my colleague stated, “Theaters, in general, have been suffering in the wake of streaming video’s rise to prominence. While clearly, there are still blockbusters making bank for theaters, those are getting somewhat sparse. Remember No Time to Die, the latest installment of the James Bond series? It made just over three times its shooting budget, which makes it a hit by most standards.”

To be fair, certain blockbusters like Top Gun: Maverick benefit from the big-screen experience that a living-room TV can’t replicate. Here’s the problem, though. As I mentioned months earlier, “there’s no guarantee that spending millions of dollars will equate to box office success. When movies bomb, they can render substantial damage to their financial backers, meaning that production studios will be very careful about their exposure.”

Certainly, it’s not the news that supporters of AMC stock want to hear. However, for investors who depend on the fundamentals to make wise decisions, it’s the news they must hear.