The concept of revenge travel, or people making up for lost time by opening their wallets and booking itineraries for their long-delayed vacations (due to COVID-19), bolstered embattled air carriers. The broader travel sector dodged one bullet. However, now it must contend with another: inflation. As a result, I am slightly bearish on Delta Air Lines (DAL) stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One of the contrarian winners following the onset of the COVID-19 pandemic, U.S.-based international carrier Delta Air Lines flew higher in anticipation that the global health crisis would eventually fade away. While that narrative has played out rather presciently, the current inflationary wave may be too much for air travel to overcome.

When COVID-19 ceased to operate within the exclusive domain of the exotic and became very much a domestic problem in the U.S., investments like DAL stock were downright toxic. According to the U.S. Bureau of Transportation Statistics, air revenue passenger miles fell a staggering 97% between February and April of 2020.

At the same time, audacious contrarian investors saw an opportunity amid the malaise. They reasoned that eventually, the pandemic would fade into the rearview mirror, thus sparking a revival in DAL stock and its ilk.

In hindsight, data from well-respected sources such as UC Davis Health revealed that “COVID fatigue,” or the mental, emotional, and psychological strains associated with pandemic-fueled lockdowns and mitigation efforts, took their toll just months into the crisis. This eventually led to revenge traveling, which may still not be enough to help DAL stock.

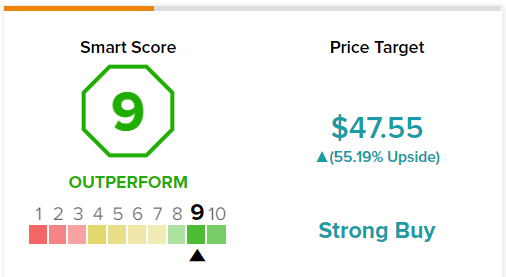

Delta Air Lines’ High Smart Score Rating

On TipRanks, DAL has a 9 out of 10 on the Smart Score rating. This indicates solid potential for the stock to outperform the broader market.

DAL Stock and the Turbulence of Rising Prices

While inflation has been the scourge of both the economy and the political realm, what appealed to many investors about taking a shot with DAL stock and similar names is that revenge travel seemed largely insulated from rising prices.

True, inflation affects everyone since it directly affects the purchasing power of the dollar. Nevertheless, massive traffic surges for Memorial Day and the 4th of July weekend suggested that demand for vacations outweighed inflationary concerns. However, will this narrative continue to hold true for DAL stock? Some doubts are creeping in.

For one thing, the math does not bode well for air carriers. Since the beginning of the COVID-19 crisis in the U.S., the dollar has lost 12.92% of purchasing power – roughly equivalent to 13 cents on the dollar. Therefore, the median household in the U.S. making about $70,000 stands to lose approximately $9,000 by the end of a one-year period.

Considering that a $500 surprise bill would put most Americans into debt, $9,000 is not something that many families can ignore.

Second, despite robust travel demand, evidence is coming to the forefront that inflation is broadly affecting airliners. Under the latest consumer price index read, the segment tracking airfares slipped 1.8% in June from May. This sudden negativity after soaring demand suggests that consumers don’t have the funds to keep floating above inflation.

Poor Financial Predictability

When examining the financial profile undergirding DAL stock, the numbers don’t seem to warrant any kind of pessimism. For instance, in the second quarter of 2022, Delta posted revenue of $13.8 billion, up a whopping 94% from the year-ago quarter. Further, net income came out to $735 million, up nearly 13% year-over-year.

After slipping deeply into negative territory in 2020, free cash flow for Q2 of this year was $1.58 billion, gaining nearly 43% against the year-ago comparison. Should momentum stay true, Delta has a chance to post one of the best annual FCF stats in quite some time. Still, investors should be careful about wading into DAL stock just based on past performances.

Essentially, the financials as they were presented do not provide much value in terms of predictability. As an example, travel demand to Asia is strong, but this market is bifurcated. Tourism in Southeast Asia is strong, largely due to the relaxing of COVID-19 protocols. However, on the Far East side, China requires a minimum 14-day quarantine protocol for all travelers.

Such restrictions will likely not be helpful for Delta, which features many routes to the Far East.

Wall Street’s Take on DAL Stock

Turning to Wall Street, DAL is a Strong Buy based on nine Buys, two Holds, and no Sell ratings. The average Delta Air Lines price target is $47.55, implying 55.2% upside potential.

Conclusion: A Reality Check Beckons

Though the return of air travel represents a significant social turning point for the U.S., whether it remains an economic boon for DAL stock and the airliners is an open question. The biggest concern that investors may have is that Delta is flying up against a massive reality check.

Of course, this reality check is inflation. While the desire to get out of the house following two years of COVID-19 restrictions is an understandable sentiment, at some point, consumers cannot ignore the pain to their bottom line. Therefore, investors should approach DAL stock with extreme caution – if at all.