Going to the movies hasn’t been the same in recent years. Just ask theater giant AMC Entertainment (NYSE: AMC), whose stock has been in free-fall for months. AMC stock lost some ground in early trading today, as it was down almost 7% at one point. However, it staged a nice recovery and is now up on the day. What made AMC drop initially, though? Besides the overall bearish market, AMC sank to a new 52-week low earlier today after investors got a look at the company’s overall position. Investors abandoned the stock after considering a debt load CNBC described yesterday as “massive.” AMC is in a bad position right now, and it’s not likely to get better any time soon.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Further, the stock has been diluted in recent months as AMC took advantage of its “meme stock” status. Plus, going into the fall and winter months, there’s a noticeable shortage of blockbuster releases on the horizon now that the summer movie season is over.

A combination of factors is slapping this company in the face right now. While the current share price might make for an attractive gamble, it’s little more than a gamble, which is why I’m bearish on AMC.

The last 12 months for AMC shares have been surprisingly volatile. Last October, shares were worth around $26 each. Soon after, AMC started its slide to the bottom. Brief rallies would kick in along the way on several occasions, but ultimately, nothing stopped AMC’s plunge. Today, shares hover around the $6 mark.

Is AMC Stock a Buy, According to Analysts?

Turning to Wall Street, AMC Entertainment has a Moderate Sell consensus rating. That’s based on two Holds and three Sells assigned in the past three months. The average AMC price target of $4.37 implies 28.7% downside potential. Analyst price targets range from a low of $0.50 per share to a high of $7.50 per share.

Investor Sentiment Has Been Remarkably Quiet

Investor sentiment, what there is of it, has been fairly quiet for AMC lately. Currently, AMC has a Smart Score of 3 out of 10 on TipRanks. That’s the highest level of “underperform.” It also suggests that AMC is fairly likely to underperform the broader market.

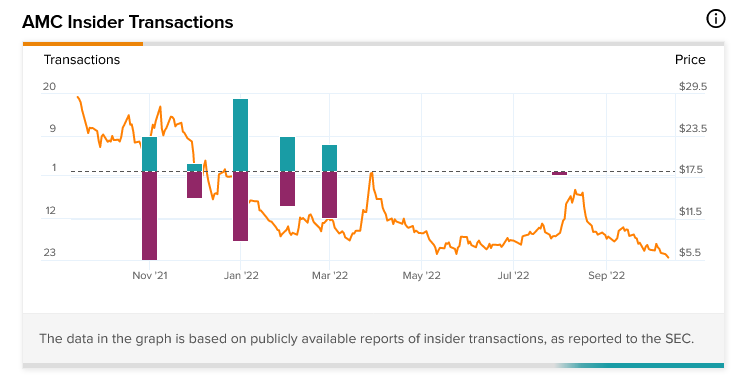

Meanwhile, insider trading at AMC has all but gone dark. The last informative transaction for AMC took place seven months ago when executive vice president John Mcdonald sold $597,500 worth of stock back in March.

The aggregate, meanwhile, isn’t saying much at all lately. Most of what it says over the last 12 months is not good for anyone long AMC. Insiders staged exactly one sale back in July. That’s the last three months of insider trading activity at AMC. That’s the last six months of insider trading activity as well—one sale.

The last 12 months tell a different story. Between October 2021 and February 2022, insiders bought AMC stock on 46 occasions. Insiders sold stock, meanwhile, on 69 occasions.

A Recipe for Disaster

It’s not especially surprising that investors are abandoning ship. Things look downright disastrous at AMC. We’ve already seen several examples of AMC offering new shares of stock in a bid to take advantage of its status as a “meme stock.”

A recent report from Fox Business showed off just to what extent AMC could thank retail traders. Insiders sold a hefty $883.5 million over the last two years, most of which was purchased by retail traders. Stock sales came mainly from hedge funds like Mudrick Capital and private equity firm Silver Lake.

It certainly doesn’t help that AMC is getting negative impressions from analysts lately as well. B.Riley’s Eric Wold recently cut his price target to $7.50, which is currently the high-water mark for price targets. He maintained the Hold rating on the company as well.

Moreover, its debt load is rising to rather substantial levels. Only recently, Odean Finco—a unit of AMC Entertainment Holdings—would issue a private offering of $400 million in senior secured five-year bonds. The bonds are being issued in a bid to repay term loans.

We all know why AMC took on that kind of debt load in the first place. It needed that cash to survive 2020 – when government mandates shuttered theaters for months on end. However, there were signs that AMC was losing ground well before even the pandemic started.

Theaters, in general, have been suffering in the wake of streaming video’s rise to prominence. While clearly, there are still blockbusters making bank for theaters, those are getting somewhat sparse. Remember No Time to Die, the latest installment of the James Bond series? It made just over three times its shooting budget, which makes it a hit by most standards.

Still, with around one in four Americans using Netflix (NASDAQ: NFLX) once a day, that puts a crimp in theaters’ plans to return to glory. Looking at the release schedule for the next few months doesn’t bode all that well, either. Certainly, there will be some noteworthy releases.

October all but ensures a few horror classics in the making, and going into the holidays tends to bring out the Oscar contenders. There’s even hope for a few outlying good ones to emerge in the depths of January.

However, the hope of an easy win is all but gone for now. Major releases from Blade to Untitled Deadpool Movie were pushed back several months.

A look at the release schedule suggests that the next Marvel release won’t hit until November, with Black Panther: Wakanda Forever. Then, Marvel’s schedule goes wholly silent until Ant-Man and the Wasp: Quantumania hits in February.

Conclusion: It’s a $6 Lottery Ticket Right Now

Basically, AMC is a gamble in the short term. The company has a hefty debt load in a declining market that’s not likely to have a whole lot of draw for the next few months. The macroeconomic environment won’t do AMC many favors, either.

Staying at home and streaming video is going to win out for a lot of folks’ Friday night entertainment decisions against paying for babysitters and the like to catch a movie in theaters. There will still be cinephiles out there who crave the “theater experience.” However, huge multiplex theaters trying to cater to a niche market likely won’t fare well.

With the release schedule looking a mite sparse going into the closing of the year, AMC’s chances to turn it around only dwindle with the declining daylight. Granted, AMC may be attractively priced right now to catch virtually any upward trend.

Nonetheless, with price targets potentially going under the $1 level, there may yet be room to fall. That, coupled with a distinct lack of catalysts to produce upward trends right now, is why I’m bearish on AMC.