Over the last several weeks, an increasing number of economic experts sounded the alarm regarding global recession risks. Primarily, the geopolitical flashpoint of Russia’s invasion of Ukraine saw investors scrambling toward resilient stocks to buy. However, an even worse outcome of stagflation could be on the horizon. To mitigate this terrible scenario, investors should prep their portfolio with two stocks that benefit from inelastic demand: Progressive (NYSE:PGR) and Aflac (NYSE:AFL).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Since the wild events of 2022 unfolded, economists expressed concerns about a worldwide recession. Fundamentally, unlike prior crises that materialized, the Federal Reserve lacks monetary policy options. At a time when support is arguably needed, the Fed remains committed to its hawkish stance to address soaring inflation. Therefore, the continued trajectory of interest rate hikes bolstered dollar strength relative to other currencies.

In turn, this dynamic imposed chaos on international markets. For instance, the British pound recently dropped to its lowest level against the greenback since 1985. In mid-September, the World Bank warned about reactionary forces – particularly simultaneous global interest rate hikes – sparking higher probabilities of a worldwide recession. Not surprisingly, then, interest in so-called recession-resistant stocks to buy soared.

If that wasn’t bad enough, top economist Mohamed El-Erian from Allianz shook up the markets with another bearish pronouncement: stagflation, which is a period characterized by slow economic growth coupled with high inflation.

According to TipRanks reporter Michael Marcus, “As El-Erian sees it, inflation is too high, and the Fed’s interest rate hikes to curb it are insufficient; the hikes are more likely to choke off growth while forcing a contraction of the labor force. The result: a near-term of rising prices, rising unemployment, and slow to nonexistent GDP growth, or in a word, stagflation.”

In other words, it’s an ugly situation with few solutions. Fortunately, certain publicly traded companies enjoy inelastic demand, such as the two tickers below.

Progressive

One of the biggest insurance firms in the U.S., Progressive garners the most attraction for its auto insurance programs. Its ongoing quirky commercials featuring the fictional salesperson character named Flo resonates with audiences nationwide. Better yet, Progressive perfectly encapsulates the concept of inelastic demand.

Essentially, this concept refers to demand that stays relatively consistent irrespective of underlying price changes. Of course, pricing dynamics almost always change consumer behaviors. However, when it comes to auto insurance, most states in the Union mandate a minimum threshold of coverage. Only New Hampshire does not, though it requires uninsured drivers to maintain the state’s financial responsibility requirements.

Effectively, then, Progressive cynically benefits from a hostage audience. Drivers must have insurance, or unpleasant consequences await.

Financially, Progressive stands on solid ground. The balance sheet features decent stability metrics, perhaps best characterized by an equity-to-asset ratio of 0.21. This figure ranks better than slightly over half of companies listed in the insurance industry.

However, its standout performances are in the income statement. For instance, Progressive enjoys a three-year book growth rate of 19.7%, ranking better than over 88% of its peers. In addition, the company has 10 years of profitability, adding to its case for stocks to buy in case of stagflation.

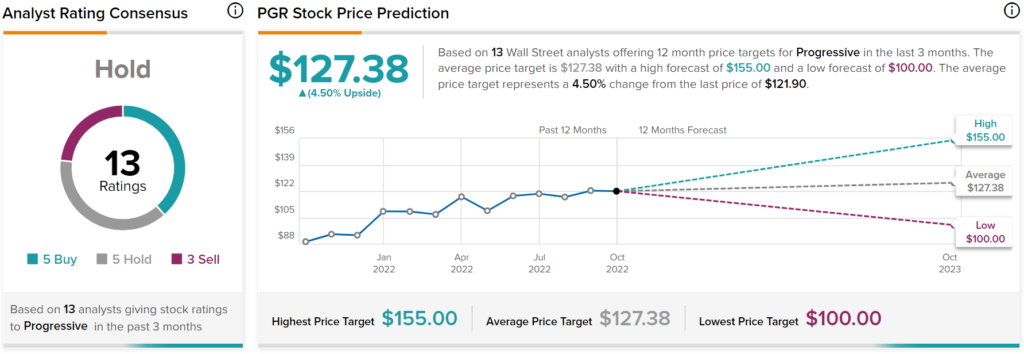

Is Progressive a Good Stock?

Turning to Wall Street, Progressive stock has a Hold consensus rating based on five Buys, five Holds, and three Sells assigned in the past three months. The average PGR price target is $127.38, implying 4.5% upside potential.

Aflac

Another insurance firm with a quirky advertising motif, Aflac is perhaps best known for its talking duck mascot. Business-wise, Aflac specializes in supplemental insurance. While many people believe medical insurance covers everything above the deductible, the reality is that many plans have coverage gaps that can force insurance holders to pay hefty out-of-pocket costs.

Unlike Progressive, Aflac admittedly doesn’t enjoy the hostage audience framework. However, the COVID-19 crisis, along with the resultant wild dynamics of the new normal, likely imposed a wake-up call. In other words, the expression “anything can happen” rang uncomfortably true. Therefore, to prevent financial catastrophe, consumers are likelier to consider supplemental insurance programs like Aflac.

As well, with fears of a recession rising, people are more incentivized to cut back on discretionary spending and focus on the necessities. There may be no better investment than supplemental insurance, especially when resources and opportunities tighten. Therefore, in the present context, Aflac may benefit from inelastic demand.

Financially, the company also provides an encouraging framework. Its key balance sheet attributes like equity-to-asset and debt-to-equity ratios run middle of the road for the industry; not too hot, not too cold. However, Aflac shines in the income statement, particularly with its three-year EBITDA growth rate of 14.8%, ranking better than 60% of its peers. As well, Aflac features a net margin of 20.6%, whereas the industry median stat stands at 5.56%.

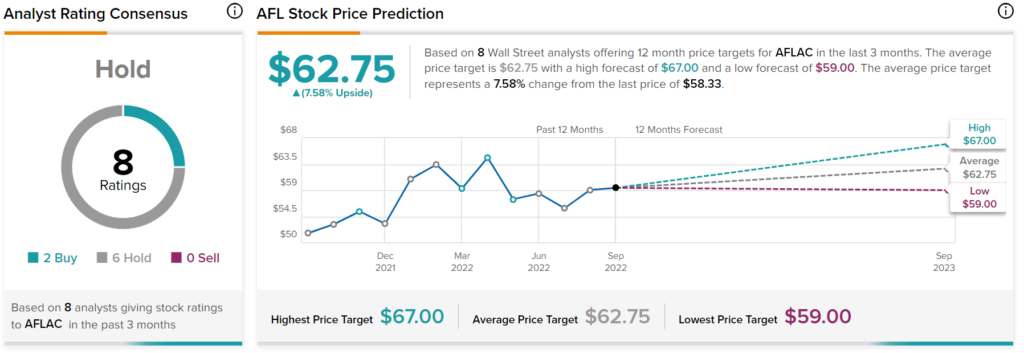

Is AFL Stock a Buy?

Turning to Wall Street, AFL stock has a Hold consensus rating based on two Buys, six Holds, and zero Sells assigned in the past three months. The average AFL price target is $62.75, implying 7.6% upside potential.

Takeaway: Playing It Safe with PGR and AFL Stocks

To be clear, neither of the two stocks to buy feature an exciting business profile. Most likely, investors will not get rich off of PGR or AFL. However, with myriad uncertainties facing the U.S. and global economies, it’s best to think about safety first.