The pound has been on a downward path against the dollar for most of this year – and Chancellor Kwasi Kwarteng’s ‘mini-budget’ has sparked a new plunge, leading the pound to fall to record low levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The falling currency will lead to higher energy costs and higher prices for goods imported in UK – but exporters and internationally diverse companies are likely to benefit from this downfall.

Multinational beverage company Diageo (GB:DGE) and tobacco manufacturer British American Tobacco (GB:BATS) are two companies that are in a position to benefit from the weaker pound.

These companies report their numbers in pounds but generate the majority of their business outside the UK. Therefore, a weak pound helps them post higher revenues and earnings when converted.

Let’s see these stocks in detail.

Diageo

Diageo is a world-leading alcoholic beverage company with more than 200 brands sold in 180 countries. The company owns various popular brands such as Baileys, Johnnie Walker, Smirnoff, and more.

Diageo stock rose on the stock market yesterday. It generates one-third of its sales from North American markets, which is the second largest market for alcohol in the world.

The company’s sales in North America grew by 17% in 2022, mainly driven by a strengthening of the U.S. dollar.

Moving into the fiscal year 2023, the company is expecting some headwinds thanks to reduced consumer spending power. However, Diageo has a well-diversified business model in terms of brands, markets, and price points that give it an edge to successfully deal with such difficulties.

The company expects to deliver its medium-term guidance of net sales growth in the range of 5-7% and profit growth between 6-9% for the next two years.

Diageo share price forecast

According to TipRanks’ analyst consensus, Diageo Group stock has a Moderate Buy rating, based on 15 analyst recommendations.

The DGE target price is 4,730p, which has an upside potential of 22% on the current price level.

British American Tobacco (BAT)

BAT is a global tobacco manufacturing group that owns leading brands such as Dunhill, Kent, Pall Mall, Newport, Camel, Vuse and Velo.

Even though the company is headquartered in the UK, it has operations all around the globe. In 2021, the company generated £11.7 billion in revenues from the U.S. out of its total revenues of £25.7 billion. This represents more than 45% of its revenues coming from the U.S.

BAT stock, like Diageo, is recession-proof and has performed reasonably well in the market. BAT stock has gained around 36% in the last year.

The stock is also among the highest dividend payers, with a yield of 6.4% against the sector average of 1.65%.

The company is also smoothly growing its non-combustible business as smoke categories are witnessing a decline. The new category’s revenues jumped by almost 45% to £1,283 million in the first half of 2022. The company remains on track to achieve its target of £5 billion in revenues from the new category businesses by 2025.

Is BAT a buy or sell?

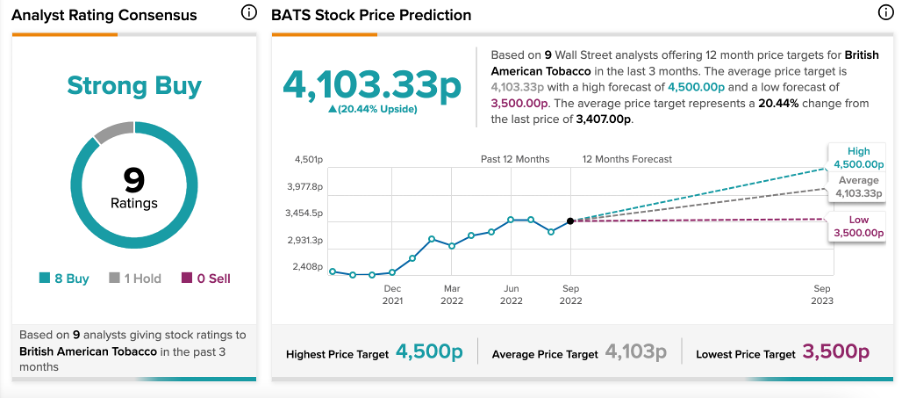

According to TipRanks’ analyst consensus, BAT stock has a Strong Buy rating based on eight Buy and one Hold recommendations.

The BATS target price is 4,103.3p, which is 20.4% higher than the current level. The price has a low forecast of 3,500p and a high forecast of 4,500p.

Conclusion

These companies have always performed well during inflationary times. With their leading position in the market, they are able to pass on higher costs to their customers.

For these two companies at least, the weaker pound acts as a catalyst for higher revenue and earnings growth.