Netflix (NASDAQ:NFLX) recently reported earnings for its third quarter of Fiscal Year 2022. Adjusted earnings per share came in at $3.10, which beat analysts’ consensus estimate of $2.14 per NFLX share. In the past nine quarters, the company has beaten estimates six times.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased 6% year-over-year, with revenue hitting $7.93 billion compared to $7.48 billion. This was also higher than the $7.843 billion that analysts were looking for. Turning to subscriber growth, Netflix’s subscriber base increased by 2.4 million, which was more than double its goal of 1 million. Looking forward, the company expects to add 4.5 million net new subscribers in the fourth quarter.

However, Netflix demonstrated operating deleverage since its operating income margin contracted from 23.5% a year ago to 19.3%, which was attributable to a stronger U.S. dollar.

Is NFLX Stock a Good Buy?

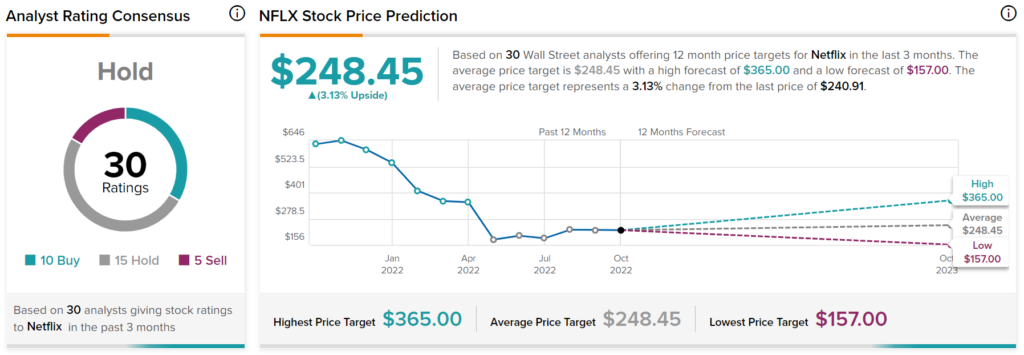

NFLX has a Hold consensus rating based on 10 Buys, 15 Holds, and five Sells assigned in the past three months. The average NFLX stock price target of $248.45 implies 3.1% upside potential.

Investor Sentiment for NFLX Stock is Currently Negative

The sentiment among TipRanks investors is currently Negative. Out of the 573,033 portfolios tracked by TipRanks, 3.6% hold NFLX stock. In addition, the average portfolio weighting allocated towards NFLX among those who do have a position is 5.33%. This suggests that investors in the company are fairly confident about its future.

However, in the last 30 days, 0.6% of those holding the stock decreased their positions. As a result, the stock’s sentiment is slightly below the sector average, as demonstrated in the following image:

Takeaway – NFLX Had a Great Quarter

NFLX saw a blowout quarter. Adjusted EPS beat expectations along with revenue. In addition, the company’s subscriber base increased significantly more than expected. Although investor sentiment is negative, it’s likely to change favorably after today’s report.