TransUnion (TRU), Equifax (EFX), and Experian (EXPGY), the three major credit reporting companies in the U.S., all saw their stocks fall on Thursday alongside an announcement from Fair Isaac (FICO). Fair Isaac announced a new credit score reporting program that allows mortgage lenders to bypass the three credit reporting companies for direct credit scores.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fair Isaac’s new offer is a shakeup for the credit score reporting industry and could have a negative impact on TransUnion’s, Equifax’s, and Experian’s operations—especially as the company is offering the FICO Mortgage Direct License Program for just $4.95 per score, which is a 50% discount compared to the industry average.

Fair Isaac CEO Will Lansing called out the credit score reporting industry with the announcement of this new program. He noted that it “eliminates unnecessary mark-ups on the FICO Score,” and “brings transparency, competition, and cost-efficiency to the mortgage lending process.”

TransUnion, Equifax, & Experian Stock Movements Today

The three major credit reporting companies saw their shares drop alongside Fair Isaac’s announcement.

- TransUnion stock dove 9.03% this morning.

- Equifax stock tumbled 8.01% before the opening bell.

- Experian stock was down 1.31% when markets closed yesterday.

In addition to this, Fair Isaac stock underwent a strong rally on Thursday. This had shares up 16.35% as of this writing.

Credit Score Stock Comparisons

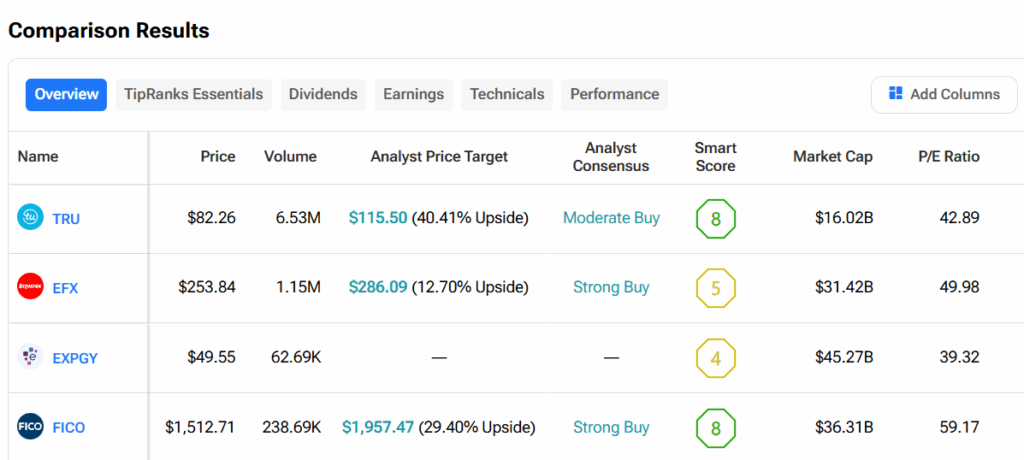

Turning to the TipRanks stock comparison tool, traders can see which of these stocks analysts prefer. Equifax and Fair Isaac both have consensus Strong Buy ratings, while TransUnion has a Moderate Buy consensus rating, and Experian lacks significant coverage.

TRU stock has the most upside potential at 40.41%, followed by FICO stock at 29.4%. EFX stock brings up the rear with a potential 12.7% upside, despite its Strong Buy rating. Again, EXPGY stock lacks the analyst coverage needed for a consensus price target.