Fair Isaac (FICO) stock soared on Thursday after the data analytics company announced a new program that allows mortgage lenders to provide credit scores directly to customers. This program, titled the FICO Mortgage Direct License Program, lets mortgage lenders offer credit scores to customers without the need to go through the three nationwide credit bureaus.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fair Isaac also noted that it will offer more competitive prices through two payment plans. The first option includes a royalty fee of $4.95 per score, a 50% drop from the average per-score fees paid to tri-merge resellers, due to the elimination of credit bureau mark-ups. A funded-loan fee of $33 per borrower per score is included when a FICO-scored loan is closed. Additionally, the current $10 per score fee is still available to mortgage lenders.

Will Lansing, CEO of Fair Isaac, said, “Direct licensing of the FICO Score brings transparency, competition, and cost-efficiency to the mortgage lending process. This change eliminates unnecessary mark-ups on the FICO Score and puts pricing model choice in the hands of those who use FICO Scores to drive mortgage decisions.”

Fair Isaac Stock Movement Today

Fair Isaac stock was up 14.63% in pre-market trading on Thursday, following a 1.08% rally yesterday. The shares have fallen 24.02% year-to-date and declined 21.86% over the past 12 months. Despite today’s rally, trading volume is limited at roughly 69,000 shares, compared to a three-month daily average of about 295,000 units.

Is Fair Isaac Stock a Buy, Sell, or Hold?

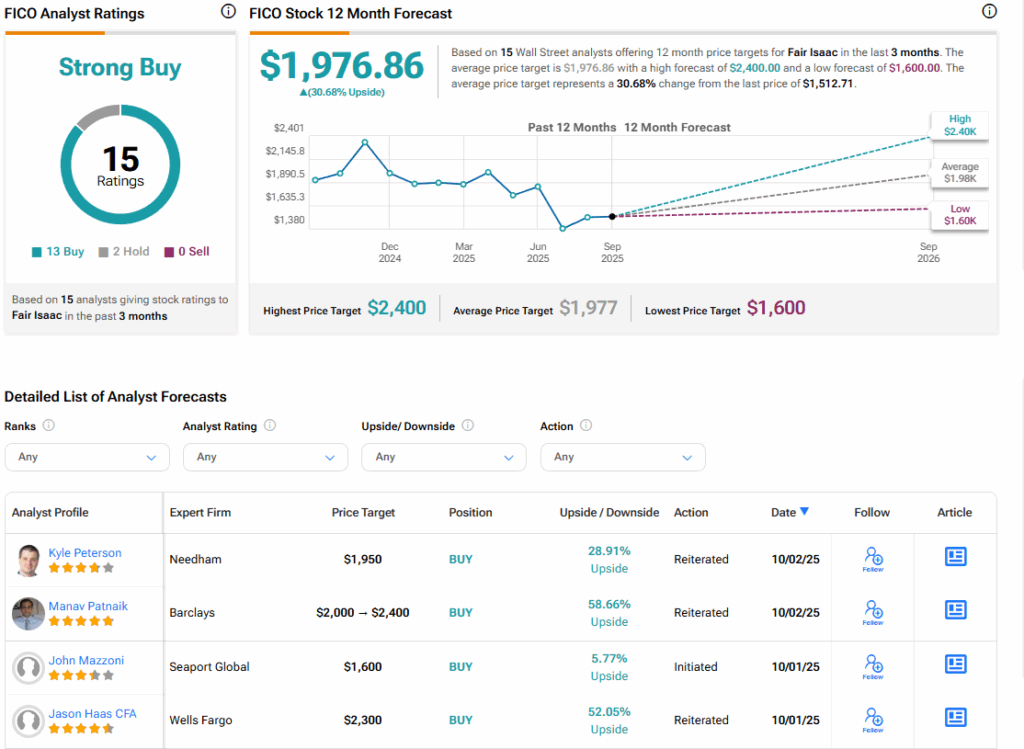

Turning to Wall Street, the analysts’ consensus rating for Fair Isaac is Strong Buy, based on 13 Buy and two Hold ratings over the past three months. With that comes an average FICO stock price target of $1,976.86, representing a potential 30.68% upside for the shares.