A rising tide lifts all boats. Cooling treasury yields and last month’s soft inflation print have breathed new life into the markets with the S&P 500 (SPX) and the Dow Jones Industrial Average (DJIA) gaining over 9% over the past month. Moreover, expectations that the U.S. Fed may not push the economy into a recession after all, are adding to investors’ optimism. While homebuilders and real estate service providers have been on a tear lately, multiple retail names are at the center of investors’ attention after promising performances over the Black Friday Cyber Monday weekend.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While spending in the U.S. slowed in October, shoppers did end up loosening their purse strings for the holiday shopping season. Last week, specialty retailer Victoria’s Secret (NYSE:VSCO) reported a 7% drop in comparable sales for the third quarter. Still, sales trends in November remained strong with its CEO, Martin Waters, noting that, the sales and margin result during the month was the company’s “Best Monthly performance in nearly two years.”

On Friday, cosmetic products provider Ulta Beauty’s (NASDAQ:ULTA) shares clocked their best one-day gain in years after the company’s earnings report outperformed estimates on all fronts. Additionally, robust demand has pushed Ulta’s loyalty program membership to a record 42.2 million.

Dollar Tree (NASDAQ:DLTR) saw its enterprise same-store net sales increase by 3.9% during the third quarter. The company expects a mid-single-digit increase in comparable store sales for Fiscal year 2023. In comparison, Foot Locker (NYSE:FL) clocked one of its best one-day gains last week after the company delivered a better-than-expected third-quarter performance. FL had a strong Thanksgiving weekend and is seeing positive momentum from its strategic initiatives. The company plans to enter the Indian market in 2024.

What Are the Best Retail Stocks to Buy?

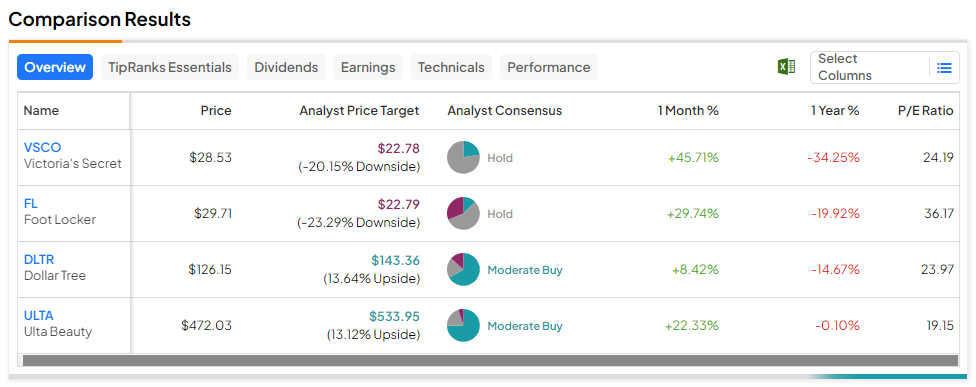

While shares of all these retail stocks have been soaring over the past month, VSCO stands out with a gain of nearly 46%. Following this rise, analysts see a double-digit potential downside in VSCO and FL stocks. Dollar Tree, the laggard of the pack with a modest 8.4% gain over the past month, offers the highest potential upside of 13.6% based on a Moderate Buy consensus rating and a $143.36 price target.

Still, markets are known to enter irrational exuberance territory fairly quickly and our TipRanks Comparison Tool indicates valuation levels for these names may be entering the expensive side based on their price-to-earnings multiple.

Read full Disclosure