For a while, cosmetics companies like Ulta Beauty (NASDAQ:ULTA) were suffering, as most of its target market found them mostly useless. The government response to COVID-19 made beauty products largely unnecessary, as those who would use them would get all dressed up but with nowhere to go. But with most places open once more, Ulta Beauty’s market came back, and that—plus a killer earnings report—sent shares up over 11% in Friday morning’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The earnings report delivered on every front. Earnings per share came in at $5.07 compared to the consensus estimate of $4.95 per share. Revenue also proved a winner, with $2.49 billion coming in when analysts looked for only $2.47 billion. That was enough for TD Cowen’s Oliver Chen to note that beauty proved “resilient,” and sufficiently so for Chen to hold an Outperform rating and hike the price target from $531 per share to $570.

Beauty Shines Eternal Even in a Macroeconomic Nightmare

The good news for Ulta Beauty, reports noted, was that even with inflation running like the bulls at Pamplona, there was still brisk demand for beauty products, as users wanted to at least feel pretty in an environment that was anything but. That’s not hard to empathize with, even if you’re not a beauty products user, so people’s interest in Ulta Beauty—and the resulting sales spike—makes plenty of sense. In fact, Ulta Beauty revealed that its loyalty program is now 42.2 million members strong, which is actually a record. There were concerns that shoplifting might have cut into its margins, but those turned out to be largely misplaced.

Is Ulta Beauty Stock a Buy or Sell?

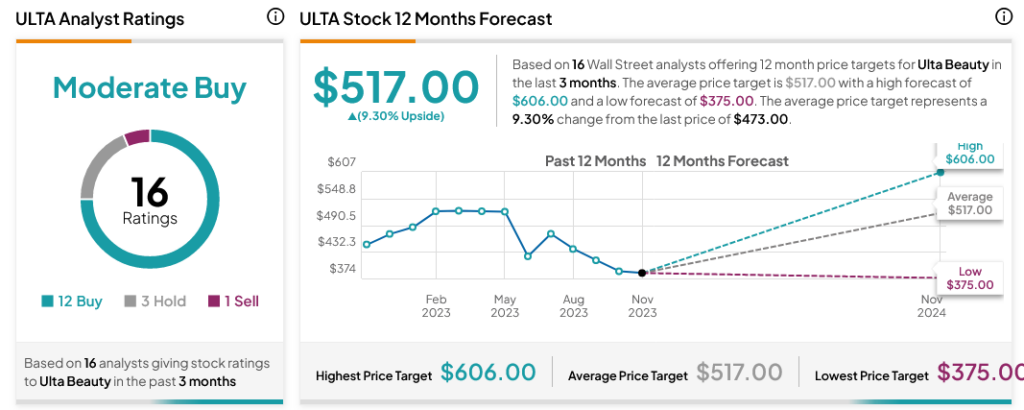

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ULTA stock based on 12 Buys, three Holds, and one Sells assigned in the past three months, as indicated by the graphic below. After a 0.2% decline in its share price over the past year, the average ULTA price target of $517 per share implies 9.3% upside potential.