Ulta Beauty (NASDAQ:ULTA) received Buy ratings from three bullish analysts ahead of the release of its fiscal third-quarter results, scheduled on November 30. The Street expects ULTA’s Q3 adjusted earnings to fall to $4.97 from $5.32 in the prior-year quarter. At the same time, analysts are anticipating the company’s revenue to rise 5.6% year-over-year to $2.47 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ulta Beauty is a leading retailer offering an extensive range of beauty products and salon services.

On Monday, Jefferies analyst Ashley Helgans noted that ULTA stock is trading close to its lower valuation, signaling an opportune entry point. Additionally, the analyst cited the company’s increasing foot traffic and the thriving beauty industry as key factors bolstering ULTA’s prospects. Helgans has a Buy rating on ULTA stock with a price target of $518.

Simultaneously, Oppenheimer analyst Rupesh Parikh maintained a Buy rating on Ulta Beauty stock. However, Parikh lowered the price target on Ulta Beauty to $525 (indicating 28.2% upside potential) from $540.

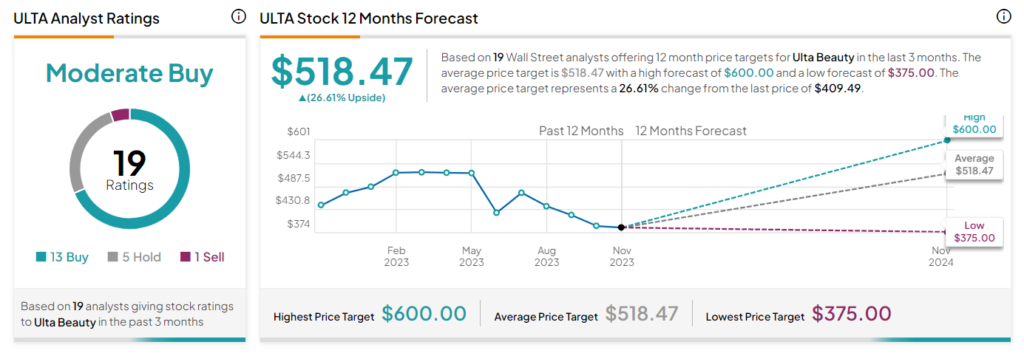

Is ULTA a Buy, Sell, or Hold?

Overall, the Street is cautiously optimistic about Ulta Beauty stock. It has a Moderate Buy consensus rating based on 13 Buys, five Holds, and one Sell. The average ULTA stock price target of $518.47 implies a 26.6% upside potential.