Shares of specialty retailer Victoria’s Secret (NYSE:VSCO) are in focus today after the company announced a mixed set of third-quarter numbers. Revenue declined by 4% year-over-year to $1.27 billion, landing in line with estimates. However, EPS of -$0.86 missed the cut by $0.08.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

During the quarter, total comparable sales declined by 7% over the year-ago period. While Direct sales ticked higher by nearly 12%, International sales contracted by 2.4%. Additionally, the company’s North American sales, its biggest vertical, declined by 11% over the year-ago period.

Still, Victoria’s Secret is experiencing improving monthly sales trends in North America. The company is maintaining a focus on enhancing customer experience in its digital business, product improvements and launches to bolster the Victoria’s Secret brand, and also accelerating its beauty business. Martin Waters, the CEO of the company, noted that the sales and margin result in November was the company’s “Best monthly performance in nearly two years.”

For Fiscal year 2023, Victoria’s Secret expects net sales to decline by 2% to 3%. EPS for the year is anticipated to be between $1.85 and $2.25. For the fourth quarter, net sales are anticipated to rise by 2% to 4%, with an expected EPS range of $2.20 to $2.60.

Is VSCO a Good Stock to Buy?

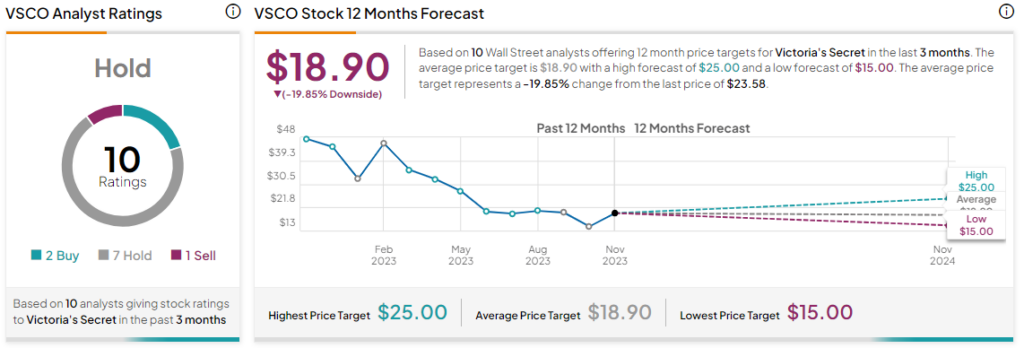

Overall, the Street has a Hold consensus rating on Victoria’s Secret, and the average VSCO price target of $18.90 points to a 19.8% potential downside in the stock. That’s on top of a nearly 48% nosedive in the company’s share price over the past year.

Read full Disclosure