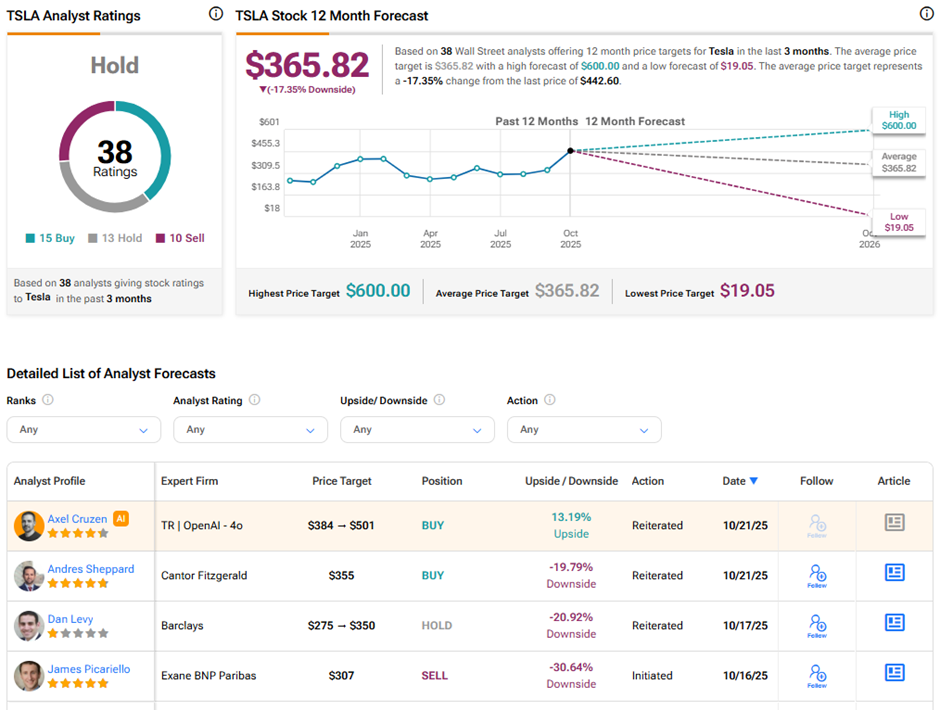

Tesla (TSLA) will release its third-quarter fiscal 2025 earnings today after the market closes. As part of Tesla’s Q3 preview, Cantor Fitzgerald analyst Andres Sheppard reiterated his Buy rating on TSLA with a price target of $355, implying 19.8% downside potential from current levels. He added that the downside estimate and price target are temporary and may be revised after he completes a detailed review of Tesla’s financial model.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With the electric vehicle (EV) maker having surpassed Q3 deliveries, Sheppard urged investors to focus on Tesla’s robotaxi and autonomy businesses. Since its Q2 report on July 23, TSLA stock has surged over 44%. The Elon Musk-led company has made significant progress with its robotaxi service, launched Full Self-Driving (FSD) version 14, and advanced its Optimus robot and Cybercab projects.

Sheppard is a five-star analyst on TipRanks, ranking #822 out of the 10,084 analysts tracked. He has a 53% success rate and an impressive average return per rating of 18.50%.

Focus on Tesla’s Robotaxi and Autonomy

Sheppard highlighted Tesla’s delivery of 497,099 vehicles, well above the sell-side consensus of 443,079, and above 462,890 in 3QFY24. However, he cautioned that U.S. tariffs, the end of the $7,500 EV tax credit, and rising competition from Chinese original equipment manufacturers (OEMs) have dampened EV demand.

He noted that investors will pay close attention to Musk’s comments regarding the timing of multiple key catalysts expected in the near term. These catalysts include the robotaxi rollout and the Cybercab launch next year, FSD adoption in China and Europe, the development timeline for the Optimus, and the production boosts of the new Standard trims of Model Y and Model 3. Sheppard believes the introduction of these affordable versions has affected timing.

He also noted Tesla has produced and delivered about 1.2 million vehicles globally year-to-date but faces a “weaker” fourth quarter. He lowered delivery estimates to around 1.61 million for 2025 and 1.86 million for 2026 and trimmed revenue forecasts to $94.4 billion for 2025 and $107.8 billion for 2026.

Finally, Sheppard highlighted Tesla’s November 6 Annual Shareholder Meeting, where shareholders will vote on the CEO’s trillion-dollar pay package. Musk recently bought roughly 2.5 million TSLA shares, signaling his long-term commitment as CEO.

Is Tesla a Good Stock to Buy Right Now?

Analysts prefer remaining on the sidelines on Tesla stock currently. On TipRanks, TSLA has a Hold consensus rating based on 16 Buys, 13 Holds, and 10 Sell ratings. The average Tesla price target of $369.80 implies 16.5% downside potential from current levels. Year-to-date, TSLA shares have gained 9.6%.