Tesla (TSLA) CEO Elon Musk wrote on X that “Version 14.0 goes into early wide release next week, then 14.1 about 2 weeks later and finally 14.2. The car will feel almost like it is sentient being by 14.2.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This comment laid out a clear schedule for the next stages of Tesla’s Full Self-Driving software. The company intends to move from version 14.0 to 14.2 within roughly a month. Musk added that the later update will change how drivers experience the car. He suggested it will behave in a way that feels human, reacting smoothly to the road instead of responding mechanically.

What Sentience Means for Driving

When Musk used the word “sentient” he was not suggesting true human consciousness. What he meant is that Tesla cars should feel as though they are thinking ahead rather than waiting for commands. A sentient feel in this context means the car can anticipate traffic, adapt to unpredictable conditions, and make decisions that are closer to how people drive.

FSD already handles lane changes, traffic signals, and highway driving, but Musk’s remarks point to a step forward. Version 14.2 could reduce the number of driver interventions and raise confidence in the system’s safety. This is key for both regulators and customers.

How Autonomy Could Transform Tesla’s Future

Autonomy has long been Musk’s pitch for Tesla’s future. Selling cars is one thing, but selling software that can turn cars into self-driving taxis would be an entirely new revenue model. It would mean Tesla could make money from every mile driven, not just every car sold.

That is why investors are watching FSD so closely. A functional and trusted FSD subscription service could command high profit margins. It could also push Tesla’s valuation closer to a technology company than a traditional automaker.

Tesla Faces Risks of Overpromising

The promise of “almost sentient” cars creates excitement, but it also raises expectations to dangerous levels. If the update feels underwhelming, investors could punish the stock. Regulators are also paying attention. A system that claims near-human awareness will need to meet strict safety standards before it is fully accepted on public roads.

Tesla has faced criticism in the past for aggressive timelines on autonomy that were later delayed. This time, Musk is committing to quick releases within weeks. The company will be under pressure to deliver improvements that match his words.

Tesla Spends Heavily to Push FSD Forward

Behind the scenes, autonomy is expensive. Training the neural networks that power FSD requires billions of miles of driving data and vast compute clusters. Tesla has invested in its own Dojo supercomputer to train these models faster. Rolling out version 14 also means more testing, more safety drivers, and more regulatory filings in different markets.

Competitors like Waymo and Cruise are also racing to commercialize self-driving technology, but they have taken slower, more cautious paths. Tesla is unique in pushing large-scale beta testing through its customer fleet. This strategy speeds up data collection but also attracts scrutiny whenever the software fails.

This Autonomy Story Is about Future Cash Flows

For shareholders, the autonomy story is about future cash flows. If Tesla can make good on Musk’s vision, the company’s earnings profile changes dramatically. Revenue would come not only from vehicles but also from software subscriptions, licensing, and ride-hailing services.

However, the investment case depends on trust. Investors must decide whether Musk’s promise of “almost sentient” driving is realistic. If it is, Tesla could redefine the auto industry. If it is not, the risk of disappointment remains high.

Is Tesla a Buy, Sell, or Hold?

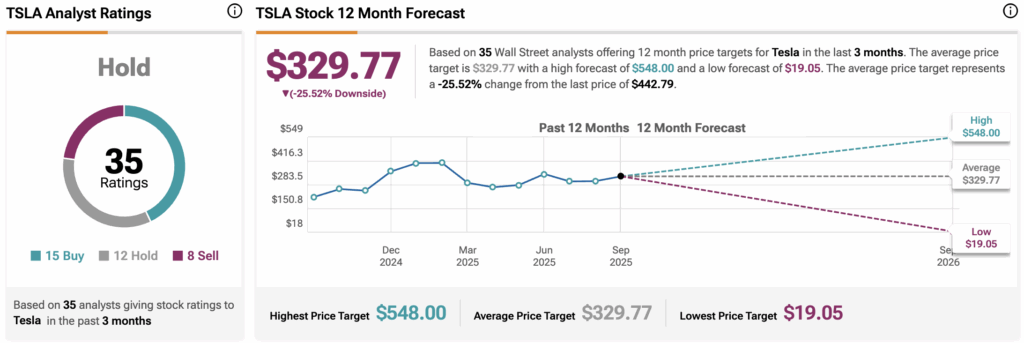

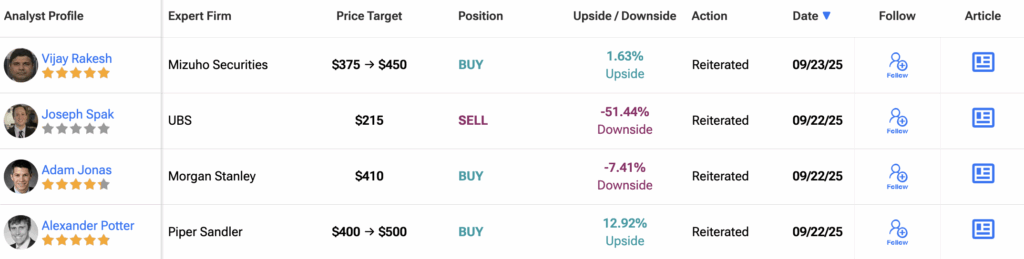

Turning to TipRanks, Tesla is still considered a Hold based on 35 ratings assigned by analysts in the last three months. The average price target for TSLA stock is $329.77, implying a 25.5% downside from the current price.