Electric vehicle maker Tesla (TSLA) is set to announce its third-quarter earnings results after the market closes on October 22. Over the past six months, Tesla stock has surged about 96%, helped by growing optimism around its AI ambitions and solid Q3 vehicle delivery numbers. However, rising competition in the EV market and the lack of significant revenue from AI and automation are adding to investor skepticism.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

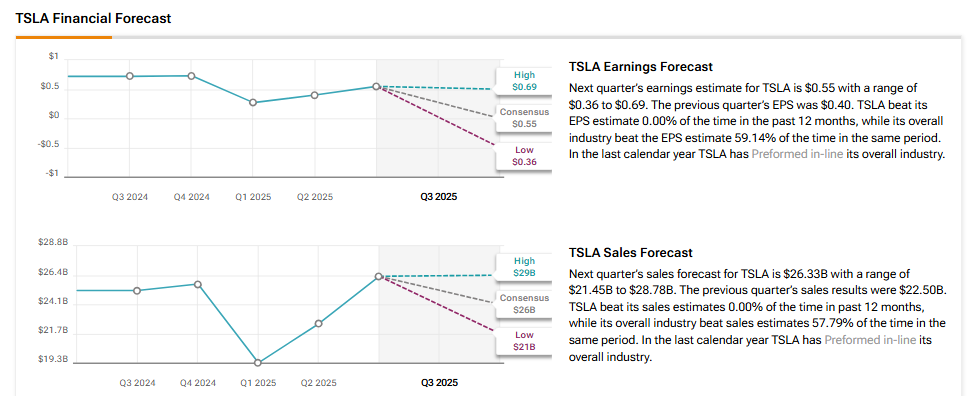

Importantly, Wall Street expects Tesla to report earnings of $0.55 per share for Q3, down 24% from the year-ago quarter. At the same time, analysts project Q3 revenues at $26.33 billion, up 5% year-over-year.

Analysts’ Views Ahead of Tesla’s Q3 Earnings

Heading into Q3 results, Top Wedbush analyst Daniel Ives maintained a Buy rating with a $600 price target. He noted stronger deliveries, helped by steady China sales and early U.S. orders before the EV tax credit ends. For the quarter, Ives expects total revenue of about $26 billion, including roughly $19 billion from automotive sales. He added that Tesla’s next phase will be led by AI and self-driving, which he believes could add $1 trillion in value over time.

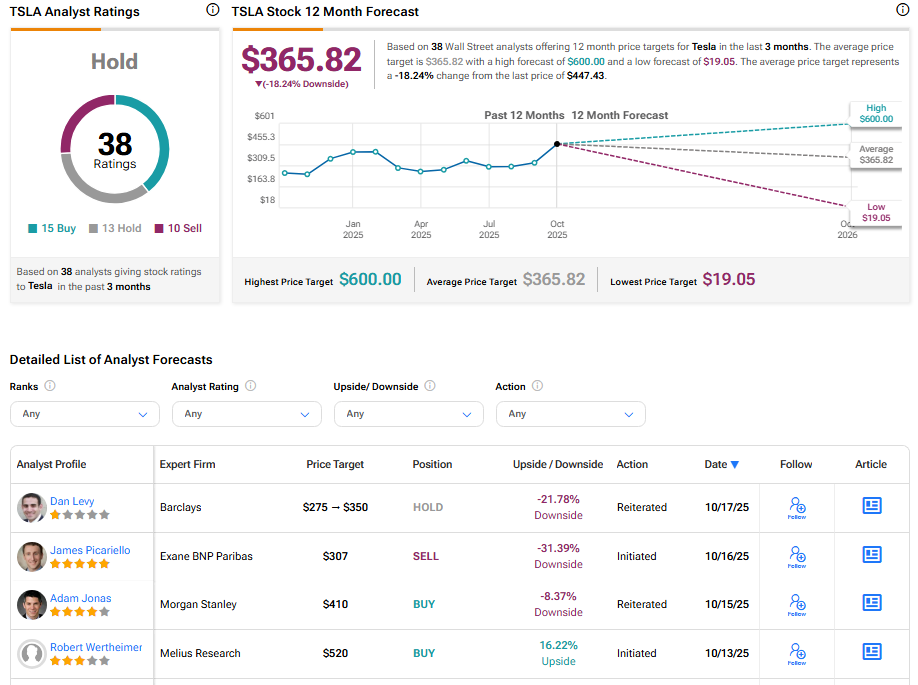

However, BNP Paribas analyst James Picariello initiated coverage on Tesla with a Sell rating and a price target of $307, suggesting a potential 30% downside from current levels. Picariello argued that Tesla’s trillion-dollar valuation is driven largely by optimism surrounding its artificial intelligence ventures—such as robo-taxis and humanoid robots—which so far contribute no revenue. “We see potential for AI-related upside over time, but much of that appears already priced in,” he noted.

Options Traders See Major Movement in TSLA Stock on Q3 Earnings

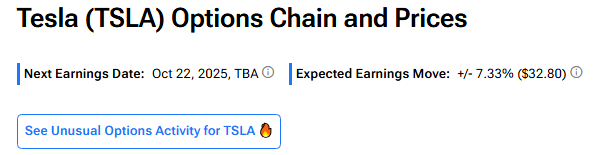

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 7.33% move in either direction in Tesla stock in reaction to Q3 results.

Is Tesla Stock a Buy Now?

On Wall Street, analysts have maintained a Hold stance on Tesla stock. According to TipRanks, TSLA stock has received a Hold consensus rating, with 15 Buys, 13 Holds, and 10 Sells assigned in the last three months. The average Tesla stock price target is $365.82, suggesting a potential downside of 18.24% from the current level.