Elon Musk is once again at the center of a boardroom storm. Tesla (TSLA) shareholders will vote on November 6 on a pay package that could make him the first trillion-dollar CEO if Tesla hits an $8.5 trillion market value. The proposal, loaded with ambitious production and AI milestones, has already divided analysts and governance experts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Institutional Shareholder Services, a leading proxy advisory firm, recommended against the plan, calling it “excessive” and poorly structured. Moreover, ISS made the same recommendation in 2018 and 2012, both times when investors ultimately sided with Musk. History suggests they will do so again. Tesla’s board argues that Musk’s compensation depends entirely on performance, not guaranteed cash. As the company wrote in a lengthy post on X, “Musk doesn’t earn anything unless the share price rises materially.”

Inside Musk’s Trillion-Dollar Pay Package

The 2025 package would grant Musk roughly 425 million stock options tied to milestones ranging from 20 million cumulative EV deliveries to one million humanoid robots produced. The goals stretch the imagination even by Tesla’s standards. If fully met, the company’s valuation would rise to about $8.5 trillion and Musk’s payout would approach $1 trillion.

Moreover, that target would imply a Tesla stock price around $2,700 a share, nearly four times today’s levels. The structure echoes the 2018 plan that awarded Musk 300 million stock options and triggered fierce legal and governance debates. Despite that, Tesla investors approved it twice, once initially and again after a Delaware court struck it down over disclosure issues.

Proxy Advisors Say No, Investors Say Not So Fast

Critics view Musk’s pay plan as an emblem of overreach in executive compensation. They point to its sheer size and unconventional design, arguing that it encourages risk-taking over stability. Moreover, ISS and other advisory firms warn that such packages distort incentives by linking massive rewards to lofty, uncertain goals.

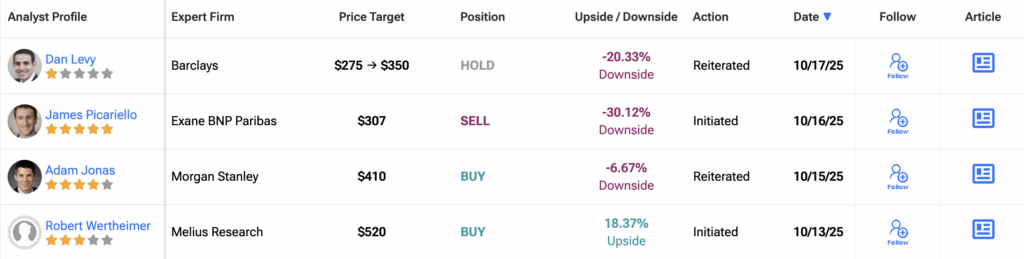

But Tesla investors have long proven that their loyalty outweighs institutional caution. Wedbush analyst Dan Ives, who rates Tesla a Buy with a $600 price target, said shareholders will “overwhelmingly back” Musk. Future Fund co-founder Gary Black agrees, calling the vote “a foregone conclusion.” The consensus among supporters is simple. Musk built Tesla’s identity, and tying his pay to performance keeps him focused on shareholder value.

Markets Watch Earnings, Not the Pay Poll

For Wall Street, the real event comes sooner. Tesla reports third-quarter earnings on October 22, with consensus estimates at $0.55 per share, down from $0.72 a year ago. The company delivered 497,099 vehicles last quarter, a record that could drive a modest earnings beat. Moreover, investors will listen closely for commentary on the fourth quarter, when the loss of the $7,500 federal EV credit could dent demand.

Tesla has already rolled out lower-priced versions of its Model 3 and Model Y to offset that risk. Still, analysts expect margins to tighten as the company leans on discounts and scale to sustain growth. Beyond the numbers, investors want updates on Tesla’s expanding robo-taxi program, launched in Austin in June. The AI-driven platform has become the company’s next big narrative and a key reason the stock is up nearly 100% over the past year.

Elon Musk Defies Gravity, Again

Musk’s latest pay plan may sound outlandish, but so did his earlier ones, until he hit the targets. Each previous package looked impossible at first, only to prove achievable as Tesla scaled production and reshaped the auto industry. Moreover, his supporters argue that betting against him has historically been a mistake.

Critics counter that the trillion-dollar tag stretches both financial logic and corporate precedent. They say a single executive wielding that much potential equity could distort governance for years. Still, Tesla’s culture has always run on ambition and spectacle. Musk’s pay debate is simply the latest chapter in a story where boldness keeps beating the odds.

Key Takeaway

Elon Musk’s trillion-dollar pay drama is loud, but it may not move Tesla’s stock. Investors care more about how earnings, margins, and AI growth shape the next six months. The November 6 vote will grab headlines, but the real judgment comes in cash flow and delivery numbers.

Moreover, whether or not Musk’s award passes, one thing is certain. Tesla’s success and its volatility will remain inseparable from its most unpredictable asset: Elon Musk himself.

Is Tesla Stock a Buy, Hold, or Sell?

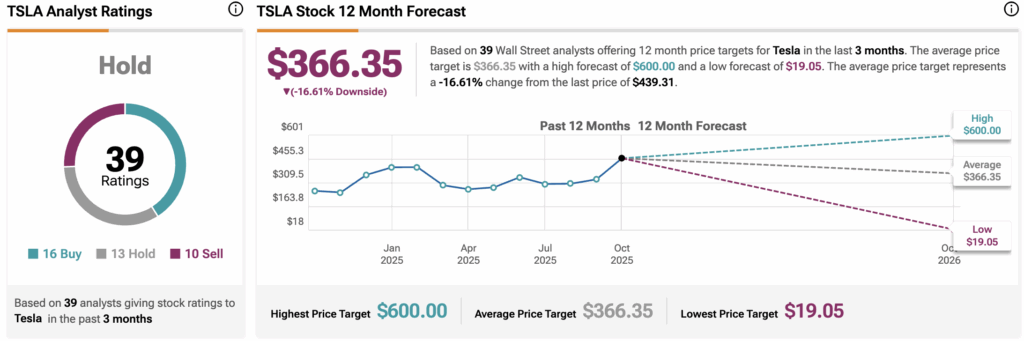

Currently, Wall Street has a Hold consensus rating on Tesla stock based on 16 Buys, 13 Holds, and 10 Sell recommendations. The average 12-month TSLA stock price target of $366.35 implies a 16.6% downside from the current level.