Tesla (TSLA) introduced “Standard” versions of the Model 3 and Model Y this week, with starting prices near $37,000 and $40,000. The trims step down range and features compared with the “Premium” configurations, which is the tradeoff that makes the sticker lower. Moreover, these models arrive into a market where affordability has become the main lever for EV adoption.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, the timing matters for shareholders. Coming into Friday trading, Tesla stock was up about 1.3% and has gained about 82% over the past 12 months, helped more by investor focus on AI opportunities than by unit sales.

Reviewers Weigh Performance and Value

Automotive data provider Edmunds received early access and put both cars on the road. “The new variant of the Model Y is the big surprise,” wrote Alistair Weaver, Edmunds editor in chief . It lacks “sporty reflexes” but is still a comfortable ride. “For only a $5,000 price difference, questions remain about whether the new Standard trim is a good value or just slightly cheaper.”

Edmunds also highlighted the sedan’s strength. “The new Standard Model 3 offers fewer compromises in driving quality than the new Model Y, maintaining strong performance and sporty handling,” added Weaver. “In contrast to the Model Y, the Standard version of the Model 3 retains more value with its price drop from the Premium trim.” This split view gives investors something specific to track in order data.

Investors Gauge Demand and Mix

The central question for the stock is simple. Do the lower prices bring in new buyers, or do they nudge existing shoppers to choose cheaper trims. Furthermore, if mix shifts down, margin pressure could offset volume gains, which is why Wall Street will parse order flow model by model over the next few weeks.

For now the reaction is muted, which suggests expectations were set. Tesla stock was rising about 0.4% in premarket trading near $437.22, while S&P 500 (SPX) and Dow futures edged up roughly 0.1%.

Tesla Prepares to Report Earnings

Tesla reports third-quarter results on Oct. 22. Management will likely detail early demand for the new trims, the delivery cadence into year-end, and any read-through to margins. Moreover, investors remain focused on software and autonomy, including the robo-taxi pilot launched in Austin in June, which many view as the bigger driver of valuation than near-term auto volumes.

Coming into Friday trading, Tesla shares were up about 8% year to date and up about 82% over the past 12 months. This outperformance sets a high bar for the update later this month.

Is Tesla Stock a Buy, Sell, or Hold?

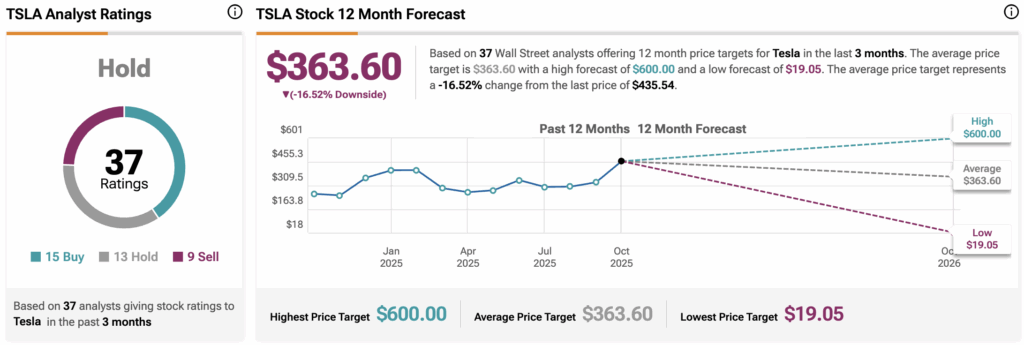

Wall Street remains divided on Tesla’s next move. Based on 37 analyst ratings in the past three months, the consensus sits at Hold. 15 analysts call the stock a Buy, 13 recommend a Hold, and nine say to Sell.

The average 12-month TSLA price target stands at $363.60, implying about a 16.5% downside from the recent price.