Recent times have remained tumultuous for global economic stability with a flurry of upward and downward movements caused by a never ending stream of hazard. The world economy is being challenged with an imbalance between supply and demand across nearly every major sector.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Just as the economy was recuperating from COVID-19 disruptions, the Russian invasion of Ukraine threw the global order into disarray. One such impacted industry is that of electric vehicles, has been hard hit with soaring prices of raw materials such as nickel, palladium, and aluminum – key ingredients in catalytic converters, air conditioner condensers, and other requisite parts.

Among all other raw materials, EVs manufacturers rely on nickel to produce long-range batteries. Therefore, Western sanctions on Russia, which is a major exporter of nickel (around 17% of global capacity), have been a blow to manufacturers.

It is known that nickel increases energy storage in a battery’s cathode, which in turn, extends the range of EVs.

Per a BloombergNEF report, demand for battery-grade nickel is likely to be around 1.5 million tons by 2030, up from the existing 400,745 tons this year. It stated, “The nickel price surge and the implications from the Russia-Ukraine invasion are likely to push battery manufacturers, particularly in the U.S., to secure alternate supply chains.”

Tesla Turns Triumphant

Two years ago, at its earnings call and when addressing metal producers, the CEO of Tesla, Inc. (NASDAQ: TSLA) Elon Musk, said, “Please mine more nickel. Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

The dominant player in the EV industry commands a strong position among competitors in terms of acquiring nickel. Sensing the supply issues, Tesla has scanned the globe for the metal and inked several deals with nickel suppliers for uninterrupted supply.

According to a Bloomberg report, recently, Tesla signed a multiyear supply deal with the Brazilian mining group Vale SA (VALE). Though nothing has been officially revealed by either of the companies, the source states that the nickel will be supplied by Canadian mines.

This January, the company inked a deal with Talon Nickel LLC, the U.S. subsidiary of Talon Metals Corp. (TSX: TLO), for the purchase of nickel concentrate to be produced from the Tamarack Nickel Project in Aitkin County, Minnesota.

Commenting on the agreement, Talon CEO Henri van Rooyen said, “This agreement is the start of an innovative partnership between Tesla and Talon for the responsible production of battery materials directly from the mine to the battery cathode.”

Last July, Tesla also entered a nickel-supply deal with mining behemoth BHP Group to get the supply of nickel from BHP’s Western Australian operations, Nickel West. Post-deal, BHP Chief Commercial Officer, Vandita Pant, commented, “Demand for nickel in batteries is estimated to grow by over 500 percent over the next decade, in large part to support the world’s rising demand for electric vehicles.”

Therefore, Tesla currently has a competitive edge based on these deals, as other small firms with less operating leverage have to bear the brunt of rising raw material costs, which will impact the pricing of their vehicles.

In addition to these deals, Tesla operates a huge battery-cell plant outside Reno, Nevada, together with Japan’s Panasonic Corp. Though the company sometimes purchases cells from other suppliers, it manufactures them as well.

Meanwhile, stirring enthusiasm in EV makers, President Joe Biden’s administration is in talks to consider adding EV battery materials to the list of items included in the 1950 Defense Production Act. This, in turn, is likely to accelerate domestic production.

Following the disclosure, Morgan Stanley analyst Adam Jonas commented in a research note to investors, “Recent geopolitical events may have accelerated the nation’s ‘sponsorship’ for on-shoring mission critical battery materials and advanced battery technology to control our own destiny in renewable energy and transportation.”

Expert’s Opinion on Tesla

Recently, Jonas reiterated a Buy rating on Tesla and a price target of $1,300 (18.83% upside potential).

Jonas commented, “The winners in the global EV market will be those firms that can guarantee supply of the key raw materials. The stock market is telling you that Tesla is far ahead in this regard.”

“We are told that one must drive an EV nearly 2 full years just to offset the carbon emissions from the de-forested/strip mined Sumatran coal-fired smelting operations to get the grade 2 nickel to grade 1. Then there’s the cost of over $30k/ton for the metal itself,” he added.

Wall Street’s Take

Turning to the Street, there is cautious optimism surrounding the stock, which has a Moderate Buy consensus rating based on 15 Buys, five Holds, and six Sells. The average Tesla price target of $1,053.50 implies 3.7% downside potential. Shares have gained 63.79% over the past year.

Bloggers Weigh in

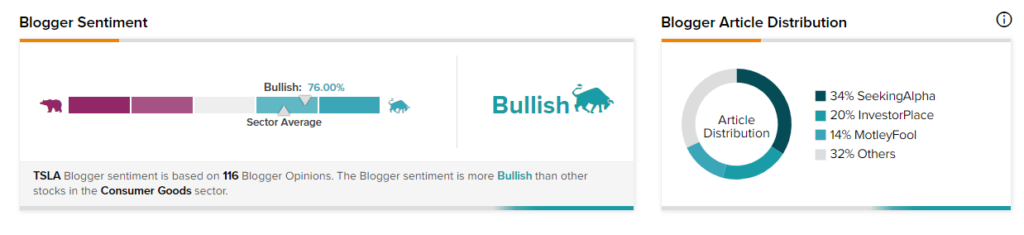

Bloggers seem enthused by the company’s developments. TipRanks data shows that financial blogger opinions are 76% Bullish on TSLA, compared to a sector average of 69%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Robinhood Surges on Extended Trading Announcement

AMC Entertainment Skyrockets on CEO’s Inspiring Comments

Mighty Micron Manages Quarterly Earnings Mastery