The world’s largest electric vehicle (EV) maker, Tesla (NASDAQ: TSLA), is witnessing dimming auto sales in the world’s largest auto market. The resurgence of the Omicron variant in China has led to nationwide restrictions and shutdowns, which are shrinking auto sales.

The news sent TSLA stock down 4.8% to close at $975.93 on April 11. Tesla’s Shanghai Gigafactory has been shut since March 28, 2022, due to the lockdowns, which have impacted the EV maker’s sales in the quarter.

Sales in China

According to the China Association of Automobile Manufacturers (CAAM), auto sales for March marked their first decline in the year, falling 11.7% year-over-year to 2.23 million autos. In February, China’s overall sales increased by 18.7% compared to the year-ago period.

Chen Shihua, deputy secretary-general of CAAM, said, “The recent pandemic situation has been quite severe, and so the figures in March were not too good, and we currently do not see much improvement in April.”

As per stats, the Tesla China factory produced 55,462 autos in March, about 154 more than those produced in February. However, the number was 18.6% lower than the January production of 68,117 autos.

Notably, Tesla China sold 65,814 autos in March, out of which only 60 autos were exported. The Shanghai Gigafactory is a major export hub for Tesla’s EVs to Europe and Asia. Although the impact of the factory closure was not felt in March, it could hurt Tesla’s April production and sales numbers to a greater extent as there is no near-term visibility of when they could resume production.

In early April, Tesla posted upbeat Q1 deliveries and said that the company was on track to achieve a record one million EV deliveries in 2022. TSLA stock has lost 18.47% year-to-date and gained a little more than 39% over the past year.

Bowing to the supply chain pressures amid the lockdowns, other auto manufacturers in China, like Nio (NIO) shut down operations recently.

Analysts’ Take

Recently, Tesla and Elon Musk inaugurated the much awaited Austin Gigafactory, which is set to take over Fremont as the primary location for Tesla’s operations. Wedbush analyst Daniel Ives believes the production at both Austin and Berlin Gigafactory will shake up the dust off the production issues at Tesla.

Commenting on his stance, Ives said, “We believe by the end of 2022 Tesla will have the run rate capacity for overall ~2 million units annually from roughly 1 million today. While the China zero Covid policy is causing shutdowns in Shanghai for Tesla (and others) and remains a worrying trend if it continues, seeing the forest through the trees with Austin and Berlin now live and ramping, Musk & Co will continue to flex its distribution muscles in the EV landscape while many other automakers struggle to get things off the ground.”

Ives maintained a Buy rating on the TSLA stock with a price target of $1,400, which implies 43.5% upside potential to current levels.

The other analysts on the Street are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 15 Buys, five Holds, and six Sells. The average Tesla price target of $1,005.64 implies 3% upside potential to current levels.

Website Traffic

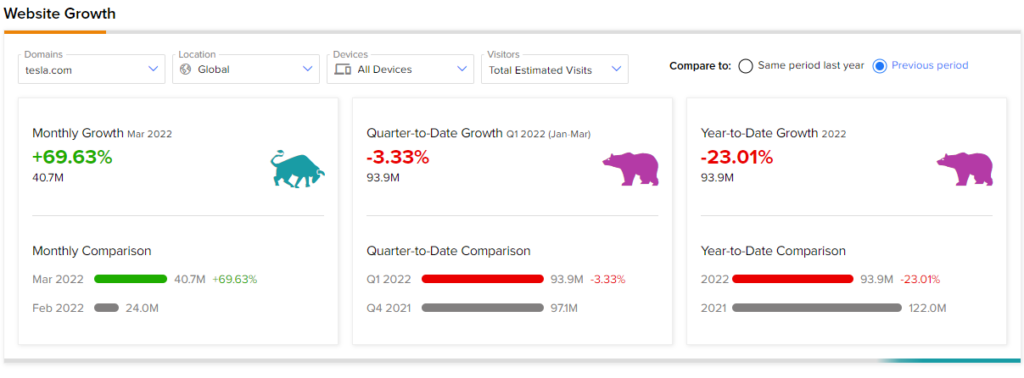

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into TSLA’s performance.

Notably, in March, Tesla website traffic recorded a 69.63% year-over-year increase in monthly visits. However, year-to-date website traffic growth decreased by 23.01% compared to the same period last year.

Ending Thoughts

Although the current pandemic-related production halts in China are affecting production and sales for Tesla, the company’s opening of the Austin and Berlin factories is a highly encouraging event for its future performance. Moreover, the rising fuel prices and enhanced carbon footprint awareness coupled with inflation are driving customers towards the EV shift, with Tesla being the major benefactor. All in all, it seems like a good time to buy and hold Tesla shares for a long time on the horizon.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Shopify Woos Investors With Stock Split

Nio Bows to Supply Issues & Inflation

JetBlue Stock Expects Gains Despite Trimmed Flight Schedules