Fintech lender SoFi Technologies (SOFI) has reopened crypto trading for retail customers, nearly two years after pausing the service to obtain its national banking license. The update makes SoFi the first U.S. bank to bring crypto access back to everyday users under new federal rules, a move that could prompt other banks to follow.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SoFi Reconnects Banking and Crypto

Starting this week, select SoFi customers can buy and sell cryptocurrencies including Bitcoin (BTC-USD) and Ether (ETH-USD) directly through the SoFi app. Access will expand to all 12.6 million SoFi members before the end of 2025.

“Today marks a pivotal moment when banking meets crypto in one app,” said CEO Anthony Noto in a statement. “It’s critical to give our members a secure and regulated way to step into the future of money.”

The company’s relaunch follows a broader shift in Washington’s stance toward crypto integration within traditional finance. After years of hesitation under the Biden administration, federal regulators under President Trump have clarified that banks can custody and execute crypto transactions. The Office of the Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC) both issued guidance earlier this year giving banks a clear regulatory pathway to engage in digital assets.

Major Lenders Prepare to Follow SoFi’s Lead

SoFi’s move could soon be echoed by several major institutions. Charles Schwab (SCHW), Morgan Stanley (MS), and PNC Financial (PNC) are reportedly preparing similar crypto offerings. Analysts expect that the rollout of digital trading services will be followed by stablecoin-based payment tools and tokenized deposit products as banks test new ways to compete with fintech and blockchain-native rivals.

This regulatory thaw follows President Trump’s signing of a federal framework for stablecoins in July, paving the way for banks to use dollar-pegged tokens as collateral for loans and settlement. Top banking executives, including Jamie Dimon of JPMorgan (JPM), Jane Fraser of Citigroup (C), and Brian Moynihan of Bank of America (BAC), have all signaled their intention to participate in the stablecoin and tokenized deposit space.

SoFi Expands Crypto Ambitions

The relaunch of crypto trading is just one part of SoFi’s broader digital finance strategy. During the company’s third-quarter earnings call, Noto described the 2026 crypto roadmap as “ambitious,” outlining plans to issue a SoFi-branded stablecoin and enable customers to borrow against crypto holdings.

The company already allows cross-border payments between the U.S. and Mexico using Bitcoin’s Lightning Network, one of the first bank-backed integrations of the protocol. These initiatives aim to position SoFi as both a retail bank and a next-generation fintech hub bridging traditional and blockchain finance.

Meanwhile, several crypto-native firms, including Ripple, BitGo, Circle (CRCL), and Coinbase (COIN), are pursuing national trust bank charters from the OCC, which would place them under similar federal oversight as SoFi.

It’s a Test Case for Banking’s Crypto Future

SoFi’s latest move marks an important inflection point: the return of crypto to the regulated banking system. While investor reaction to Tuesday’s announcement was muted, the decision reinforces the company’s positioning as a first mover in a space Wall Street is once again embracing.

If SoFi’s rollout succeeds, analysts say it could accelerate adoption across the banking sector, bringing crypto access to tens of millions of mainstream customers, and potentially changing the mentality on how Americans hold and move digital assets.

Is SOFI a Good Stock to Buy?

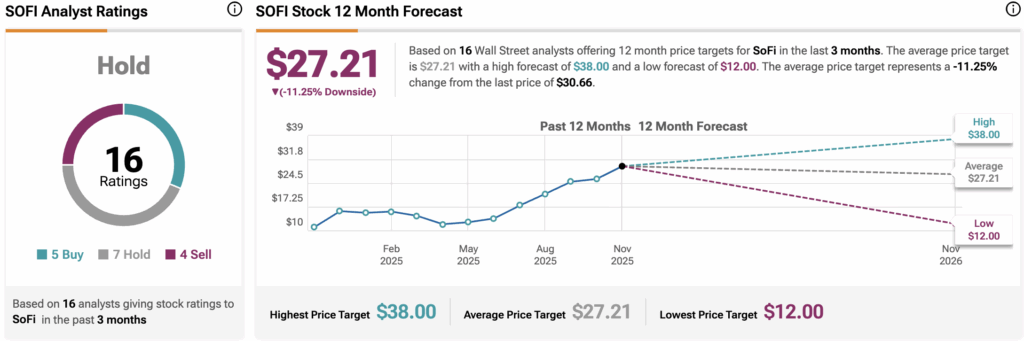

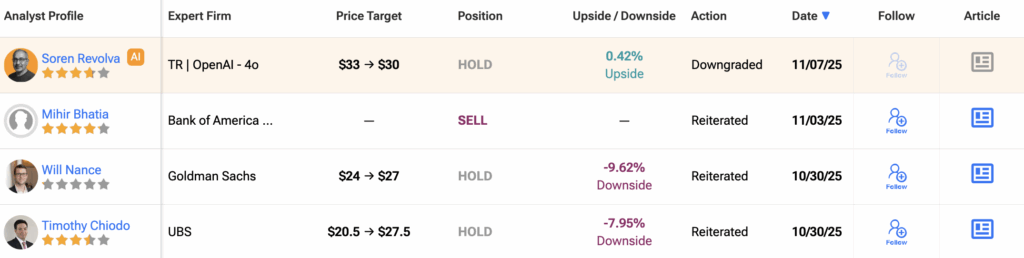

Wall Street remains divided on SoFi Technologies (SOFI) after its return to the crypto market. Of the 16 analysts covering the stock over the past three months, five rate it a Buy, seven call it a Hold, and four recommend a Sell. The consensus 12-month SOFI price target sits at $27.21, implying an 11.25% downside from the latest closing price.