Analysts at TD Cowen and Benchmark Co. believe Paramount Skydance (PSKY) could emerge as the leading bidder for Warner Bros. Discovery (WBD). The comments followed WBD’s announcement that it is open to selling part or all of its business to qualified buyers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TD Cowen’s Doug Creutz has a “Hold” rating and $14 price target on PSKY stock, implying 15.2% downside potential. Meanwhile, Benchmark’s Matthew Harrigan kept his “Buy” rating on WBD stock and raised the price target from $18 to $25, implying 23% upside potential from current levels. Harrigan noted that despite WBD’s 11% gain yesterday, the stock could maintain a high single-digit free cash flow yield after 2025, with the $25 target reflecting expectations for 2026.

Warner Bros. Rejects Paramount’s Offers

Reports indicate that David Ellison-led Paramount made several offers to acquire Warner Bros., all of which were rejected. The bids reportedly ranged between $23 and $24 per share, with the highest offer nearing $30 per share.

WBD also confirmed receiving multiple bids with various conditions, including options to proceed with its planned split and spin, sell the entire company or specific units such as Warner Bros. or Discovery Global, or merge Warner Bros. and spin off Discovery Global to shareholders.

Analysts Back Paramount’s Takeover

Following the news, Creutz highlighted that WBD’s announcement was just a formality since several reports were already talking about the takeover bids. He believes “a transaction with Paramount Skydance is reasonably likely,” and remains skeptical that a more attractive offer will emerge.

Harrigan also believes that Ellison’s Paramount Skydance is best positioned to acquire WBD, offering strong strategic value and likely regulatory approval. He added that a pre-separation deal would be cheaper, avoiding higher future costs tied to Warner Bros.’ and HBO Max’s growth, as well as potential tax delays after the split.

The two analysts noted that other potential buyers like Apple (AAPL), Amazon (AMZN), and Comcast (CMCSA) could face greater regulatory hurdles, while Netflix’s (NFLX) Greg Peters has already expressed a lack of interest.

Overall, analysts view Paramount Skydance as the frontrunner amid complex deal negotiations, pointing to its strategic alignment with WBD’s content portfolio and a higher likelihood of regulatory approval compared to tech-sector rivals.

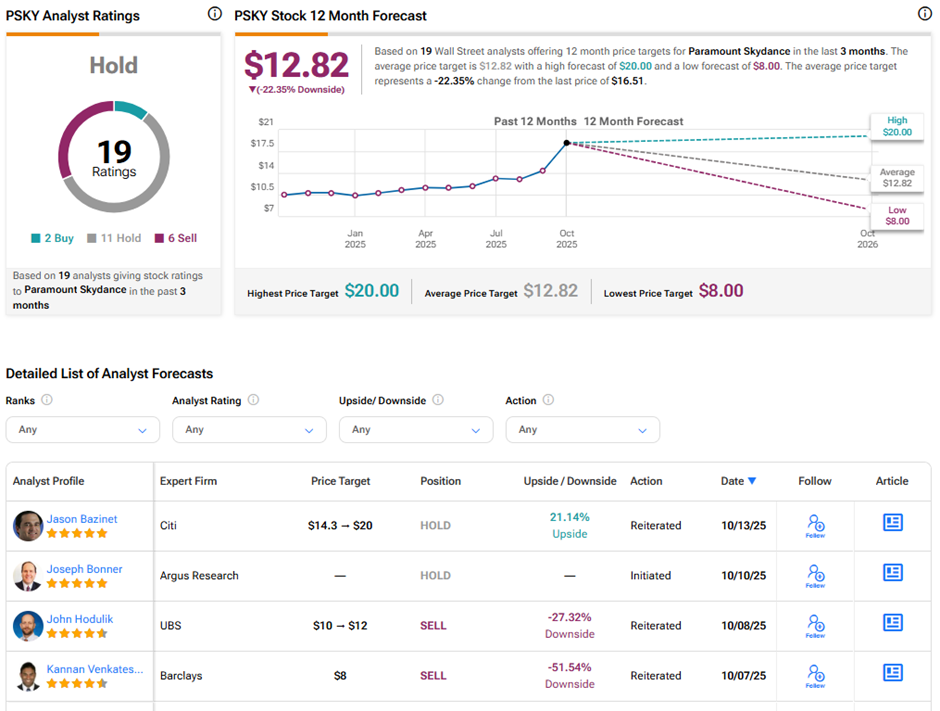

Is PSKY Stock a Buy, Hold, or Sell?

Following Paramount’s recent merger with Skydance and pending full takeover and synergies, analysts prefer to remain on the sidelines. On TipRanks, PSKY stock has a Hold consensus rating based on two Buys, 11 Holds, and six Sell ratings. The average Paramount Skydance price target of $12.82 implies 22.3% downside potential from current levels. Year-to-date, PSKY stock has surged nearly 60%.