Warner Bros. Discovery (WBD) recently rejected Paramount Skydance’s (PSKY) initial takeover offer of $20 per share, according to Bloomberg. Sources familiar with the matter said WBD considers the offer “too low” and believes it undervalues the company’s potential. Paramount Skydance aims to acquire Warner Bros. in its entirety before WBD’s proposed split takes place next year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The David Ellison-led Paramount Skydance now faces few options, including increasing its bid, appealing directly to WBD’s shareholders, or seeking additional support from a financial partner. As of today, PSKY has a market capitalization of about $18.6 billion, while Warner Bros. is significantly larger, valued around $42 billion. Although this would be one of Hollywood’s biggest mergers, Warner Bros. is much larger than Paramount, which gives it more leverage in the negotiations.

Paramount Aims to Boost its Content Offerings

Paramount Skydance intends to strengthen its content library with new movies and shows and enhance its competitive position in streaming. At the recent Bloomberg Screentime conference, Ellison stated that there are many acquisition opportunities available, and that companies need “more content to yield more engagement.”

Paramount faces a difficult path in acquiring Warner Bros., especially because Warner Bros. carries a debt load nearing $36 billion, and Paramount’s offer may not account for this debt assumption. Ellison has lately been in discussions with private equity company Apollo Global Management (APO) about joining in the takeover bid.

Warner Bros. is splitting its company in a bid to boost shareholder value for the more profitable streaming business. In June, Warner Bros. confirmed plans to split into two independent companies, with one focusing on its legacy TV networks and the other on streaming and studios.

If the deal succeeds, it will unite two of Hollywood’s major studios and streaming platforms, including HBO Max and Paramount+. Warner Bros. Discovery owns blockbuster franchises like Barbie, DC Comics, and Harry Potter, as well as leading news channels such as CNN, TBS, and TNT. Meanwhile, PSKY faces potential competition from streaming giants like Amazon (AMZN) and Netflix (NFLX) in its bid to acquire Warner Bros. Discovery.

Is PSKY Stock a Buy, Hold, or Sell?

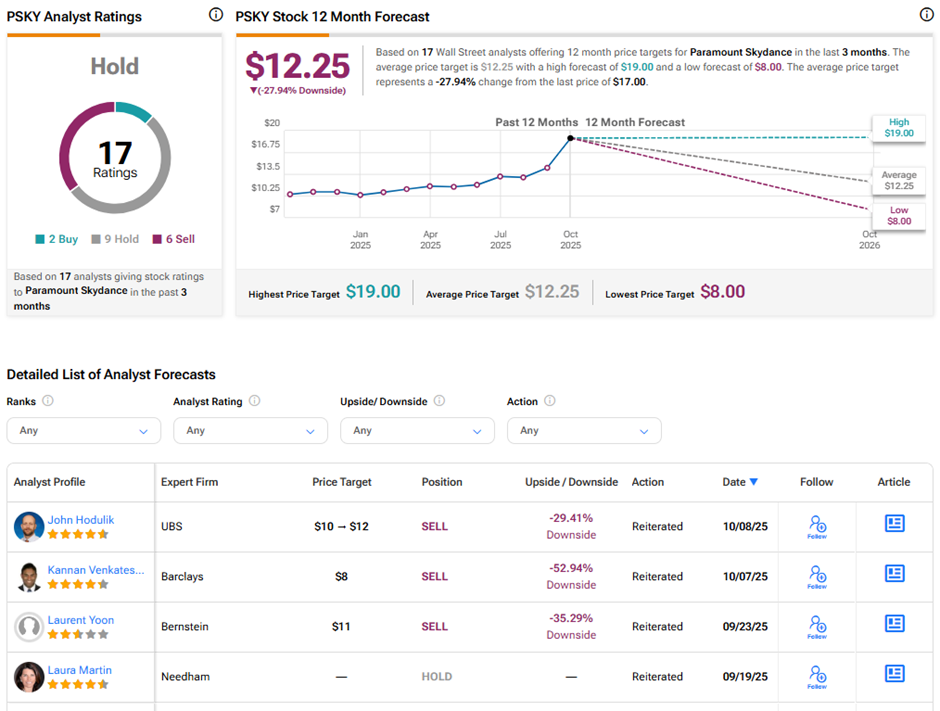

Analysts remain cautious about Paramount Skydance’s long-term outlook amid the challenges of integration and effectively executing new content strategies in intense competition.

On TipRanks, PSKY stock has a Hold consensus rating based on two Buys, nine Holds, and six Sell ratings. The average Paramount Skydance price target of $12.25 implies 27.9% downside potential from current levels. Year-to-date, PSKY stock has surged 64.4%.