Today was huge for entertainment giant Warner Bros. Discovery (WBD), as two key factors emerged to drive its share prices through the roof. The first probably should not have had the kind of impact it did, namely, a price hike across all of its plans for HBO Max service. But Warner also said the quiet part out loud, and made it official: it was indeed taking offers to buy the whole company. The result was a huge uptick, as Warner shares were up nearly 12% in the closing minutes of Tuesday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New customers will pay more today for HBO Max streaming service than they did yesterday. For existing customers, you will have nearly a month until your prices increase, when the rate hike kicks in on November 20.

Ad-supported Basic service will now run $10.99 per month. Standard service will go to $18.49 per month, and Premium service will top out at $22.99 per month. With around 125.7 million paying subscribers across all its services, it is clear what kind of money is at stake here. And with CEO David Zaslav still believing that HBO Max is “…way underpriced,” it explains why Warner went ahead with a price hike just before it sells itself off.

The Quiet Part Out Loud

And then, in a move that is really only obvious in retrospect, Warner also announced that it was for sale, formally. Warner rejected an opening bid from Paramount Skydance (PSKY) not even two weeks ago, and now, it is prepared to accept other offers.

Based on what we have already heard, there are several other companies either actively or cautiously interested in picking up Warner, with varying degrees of potential success. It is a safe bet Paramount Skydance will come back to the table with a better bid later, but it may not be alone when it does. Though whether anyone will buy Warner in its current state, or come back with offers after the split into Discovery Global happens, is unclear.

Is WBD Stock a Good Buy?

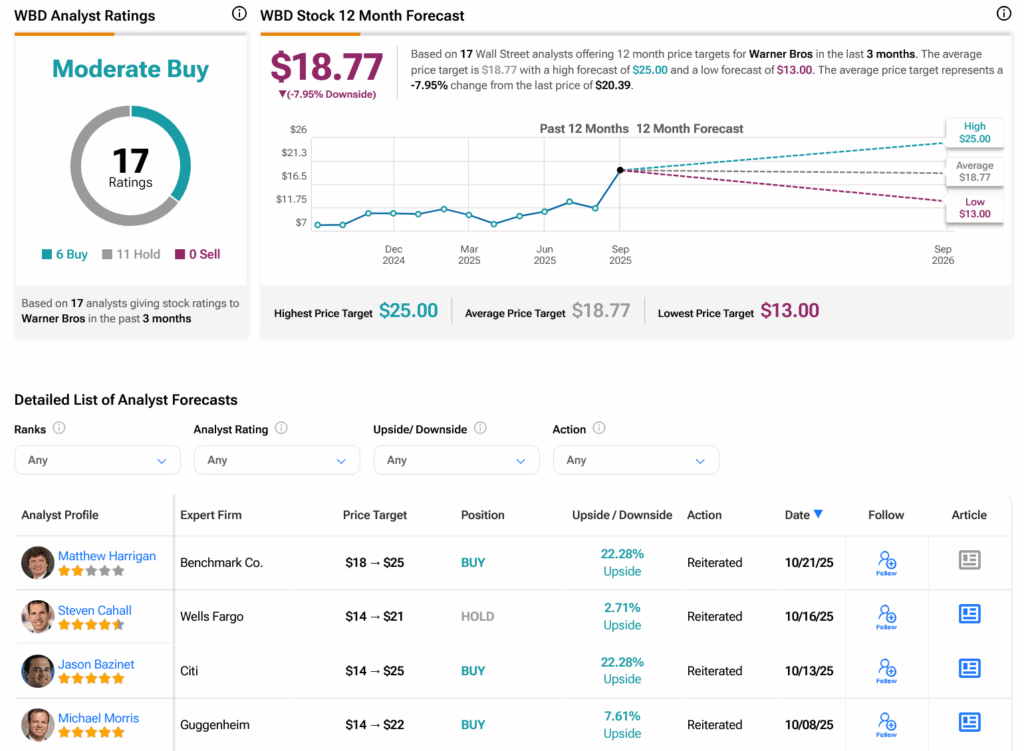

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on six Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. After a 143.29% rally in its share price over the past year, the average WBD price target of $18.77 per share implies 7.95% downside risk.