Chinese electric vehicle (EV) maker Nio, Inc. (NIO) has suspended production at its plants due to supply chain issues faced by its parts manufacturer. Nio stock closed down 1.8% at $20 on April 8 and has lost 40.2% year-to-date.

China has been grappling with the resurgence of the latest COVID-19 variant. The government has imposed lockdowns and restrictions in major parts of the nation to curb the multiplication of the virus.

Amid the chaos, Nio’s supplier partners in various locations including, Jilin, Shanghai, and Jiangsu, were forced to shut shops, which has adversely impacted Nio’s production. As a result, Nio has been compelled to stop manufacturing its EVs till the supplier problem is resolved, and has also deferred deliveries of its autos until further notice.

Nio to Hike EV Prices

According to a CnEVPost report, Nio is set to hike its car prices on May 10. The solid increase in input prices for EV makers, especially for battery components, has forced many companies to announce price hikes in March. At the time, Nio had noted that it would not take such a step.

Eventually, Nio bowed down to the inflationary pressure and decided to go on a price hike tour itself. Nio said on its app Saturday, that it would raise the prices of all of its SUVs, including the ES6, ES8, and EC6s, by 10,000 yuan ($1,571).

However, the prices of its sedans, ET7 launched in March, and ET5, which is expected to be launched in September, will remain unchanged.

Moreover, the company stated that customers who pay for the ES8, ES6, EC6, ET7 deposits or reserve the ET5 before May 9, will be immune to the price hikes.

Additionally, Nio is also increasing the monthly fees for its Battery as a Service (BaaS) rental offering for the long-range battery pack effective May 10.

Nio Price Forecast

Wall Street analysts are highly optimistic about the NIO stock with a Strong Buy consensus rating based on 16 Buys and two Holds. The average Nio price forecast of $43.51 implies a whopping 117.6% upside potential to current levels.

Website Traffic Analysis

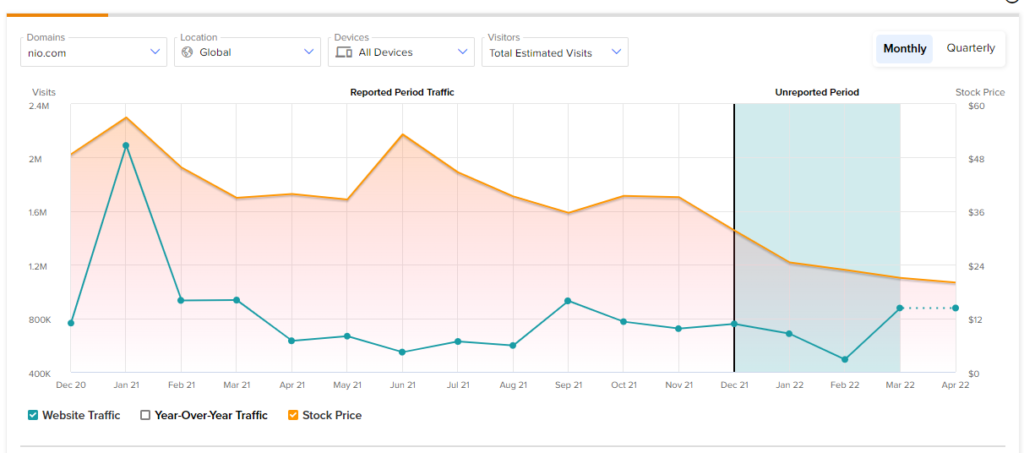

According to the TipRanks Website Traffic tool, Nio reported a 77.97% year-over-year uptick in website visits in March, much in line with its reported robust Q1 deliveries. However, year-to-date its website visits fell 48.11% compared to the same period last year.

Concluding Thoughts

Going ahead, the company’s website visits are expected to continue their steady rise, meaning that Nio is poised to perform well. Overall, it is a good time to be bullish on the EV sector with the rising fuel prices and enhanced awareness of growing carbon ill effects.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Walmart Hikes Truckers’ Pay

Regulatory Warfare Forces JD.com Founder to Exit CEO Role

Alphabet’s Drones Take Flight in Texas