Shares of Monday.com Ltd. (MNDY) tanked 27.6% on Wednesday after the cloud-based project management software company reported a loss for the fourth quarter of 2021. Nevertheless, both earnings and revenue exceeded expectations by a considerable margin.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company reported an adjusted quarterly loss of $0.26 per share, much lower than analysts’ estimated loss of $0.52 per share. MNDY had posted an adjusted loss of $0.64 per share in the same quarter last year.

Meanwhile, revenue grew 91% year-over-year to $95.5 million, outpacing estimates of $87.8 million.

The company’s net dollar retention rate for customers with more than 10 users exceeded 135% in the fourth quarter, and the number of customers with $50,000 in annual recurring revenue (ARR) grew 200% year-over-year. Also, the total paid customers were 152,048, up 34% from December 31, 2020.

Eran Zinman, Founder and Co-CEO of Monday.com, said, “During the past quarter we took our product innovation to new heights, introducing several new capabilities to give customers more robust ways of creating software to run the core of their business.”

Guidance

Monday.com forecasts first-quarter revenue to be between $100 million and $102 million. Further, it expects to report an adjusted operating loss of $47 million to $45 million.

Additionally, the 2022 revenue is expected to be in the range of $470 million to $475 million. Operating loss on an adjusted basis is anticipated to be in the range of $147 million to $142 million.

Analysts’ View

Following the fourth-quarter results, JPMorgan analyst Mark Murphy reiterated a Hold rating on Monday.com and lowered the price target to $200 from $335. The new price target implies 55.7% upside potential from current levels.

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 3 Holds. The Monday.com stock price prediction of $300.83 implies 134.2% upside potential to current levels. Shares have gained 28.2% over the past year.

News Sentiment

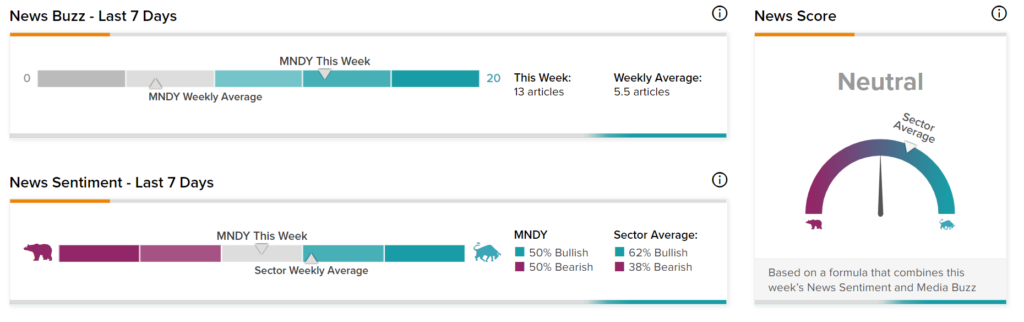

News Sentiment for Monday.com is Neutral based on 13 articles over the past seven days. 50% of the articles have Bullish sentiment, compared to a sector average of 62%, and the remaining half has Bearish Sentiment, compared to a sector average of 38%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

CoStar Dips 21.5% Despite Q4 Results Beat

Krispy Kreme Gains 8.4% as Revenue Exceeds Expectations

Mosaic’s Q4 Results Miss Expectations; Shares Fall