Healthcare technology company Medtronic plc (NYSE: MDT) recently revealed that it has received approval from the Food and Drug Administration (FDA) for its Freezor and Freezor Xtra Cardiac Cryoablation Catheters for the treatment of pediatric Atrioventricular Nodal Reentrant Tachycardia (AVNRT).

Following the news, shares of the company almost remained static by declining 1.1% on Friday and gaining 1.11% to close at $101.70 in the extended trading session.

Details of the Approval

AVNRT is a life-threatening abnormal heart rhythm and afflicts 89,000 people each year with almost 35% of the cases among children. AVNRT causes a very rapid heart rhythm that if left untreated, can affect the heart’s ability to pump normally, leading to palpitations, lightheadedness, and syncope.

Notably, the Freezor and Freezor Xtra Catheters are flexible, single-use devices used to freeze cardiac tissue and block unnecessary electrical signals within the heart. The Freezor family enables safe and effective focal cryoablation therapy which can reduce the risk of permanent AV block, a complication of AVNRT.

The catheters have been approved after multiple pediatric randomized, multi-center studies that demonstrated the safety and effectiveness of the treatment of AVNRT using the Freezor and Freezor Xtra cardiac cryoablation catheters.

Management Commentary

The President of the Cardiac Ablation Solutions business at Medtronic, Rebecca Seidel, said, “We’re proud of our work with PACES and FDA in this first-of-its-kind, multi-stakeholder initiative to address a critical patient population. The shared commitment to collaborate and grow this therapy’s unique position to treat AVNRT patients demonstrates our confidence in the proven safety and efficacy of our cryoablation technology.”

Stock Rating

Recently, Raymond James analyst Jayson Bedford reiterated a Buy rating on the stock with a price target of $116, which implies upside potential of 15.3% from current levels.

Consensus among analysts is a Moderate Buy based on 12 Buys and 7 Holds. The average Medtronic stock prediction of $127.44 implies upside potential of 26.7% from current levels. Shares have declined 13.1% over the past year.

Positive Sentiment

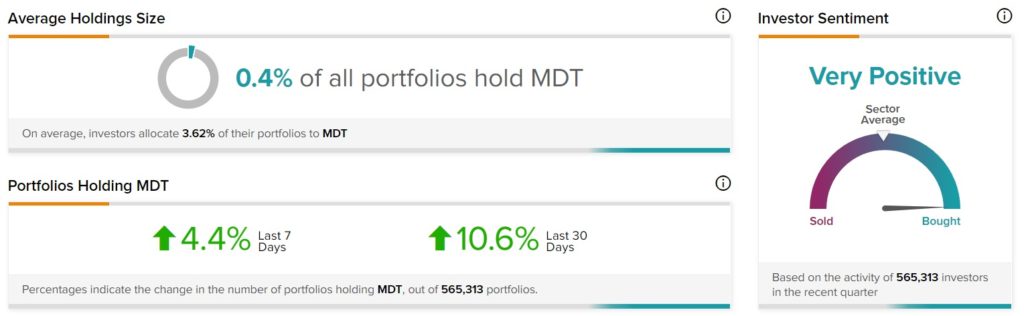

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on MDT, as 10.6% of portfolios tracked by TipRanks increased their exposure to MDT stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Foot Locker Partners with Authentic Brands to Offer Reebok Products in the U.S.

Universal Music Signs Deal to Develop NFT Collections

Palantir Tanks 16% on Q4 Earnings Miss; Revenues Outperform