Shares of Palantir Technologies Inc. (NYSE: PLTR) plunged almost 16% to close at $11.77 on Thursday after the company reported disappointing earnings for the fourth quarter of 2021.

Meanwhile, the American software company specialized in big data analytics recorded upbeat revenues and provided better-than-expected revenue guidance.

Results in Detail

Total revenues of $433 million grew 34% year-over-year and surpassed analysts’ expectations of $413.99 million. Remarkably, U.S. commercial revenue surged 132%, while Government revenue jumped 26%.

Palantir registered fourth-quarter adjusted earnings per share of $0.02, below the consensus estimate of $0.04 per share. The company had reported adjusted earnings of $0.03 per share in the same quarter last year. Adjusted income from operations margin stood at 29%.

The company added 34 net new customers during the quarter. Further, it closed 64 deals of $1 million or more, including 27 deals of $5 million or more, and 19 deals of $10 million or more.

For 2021, Palantir reported adjusted earnings of $0.13 per share, compared to $0.09 per share a year ago. Total revenues stood at $1.54 billion, up 41% year-over-year. Markedly, commercial customer count tripled to 147 customers in the year.

Outlook

For the first quarter of 2022, the company projects total revenues of $443 million against the consensus estimate of $439 million. Adjusted operating margin is expected to be 23%.

For 2022, the company expects an adjusted operating margin of 27%

As per the long-term guidance policy provided by the CEO of Palantir, Alex Karp, revenue growth of 30% or greater is anticipated annually through 2025.

Wall Street’s Take

Following the fourth-quarter results, RBC Capital analyst Rishi Jaluria maintained a Sell rating on the stock and reduced the price target to $9 (23.53% downside potential) from $15.

Jaluria said, “PLTR reported mixed 4Q21 results, leading shares down 11% intraday (vs. Nasdaq down ~1%). The company continues to see a broad- based deceleration, led by a slowdown in Total Deal Value and Government revenue. Commercial growth excluding investment agreements continues to be lackluster in our view, especially given an easier compare. We maintain our Underperform rating as we continue to struggle to underwrite sustainable 30% growth.”

Overall, the Street is bearish on the stock and has a Moderate Sell consensus rating based on 1 Buy, 2 Holds and 3 Sells. The average Palantir price target of $18.40 implies 56.33% upside potential to current levels. Shares have lost 55.8% over the past year.

Risk Analysis

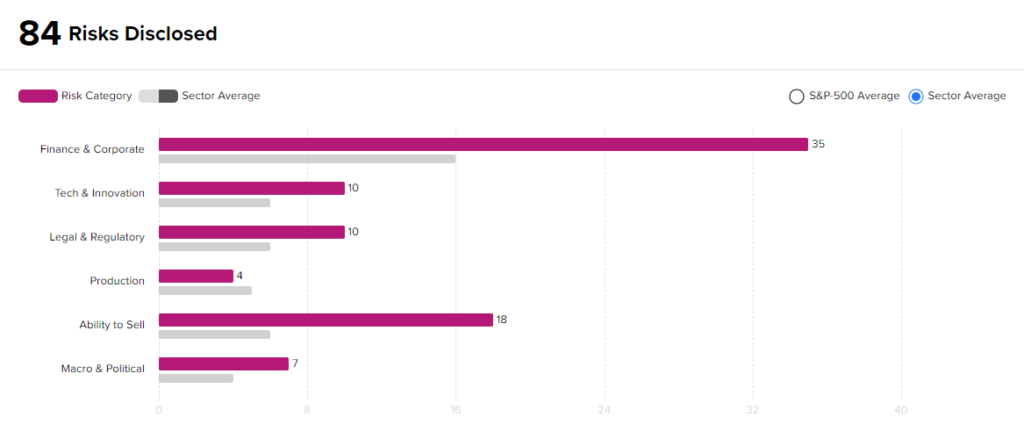

According to the TipRanks Risk Factors tool, the Palantir stock is at risk mainly from two factors: Finance and Corporate and Ability to Sell, which contribute 35 and 18 risks, respectively, to the total 84 risks identified for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Cisco Posts Upbeat Q2 Results; Shares Rise After-Hours

Spotify Buys Podsights and Chartable

Matterport Books Wider-than-Expected Q4 Loss; Shares Drop Pre-Market