Apple (AAPL) delivered robust fourth-quarter results after the markets closed on October 30, pushing its shares up 2.3%. Earnings per share rose 13% year over year to $1.85, while revenue climbed 8% to $102.5 billion. Notably, Apple has exceeded Wall Street’s expectations in each of the past eight quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Commenting on the solid results, CNBC’s Mad Money host Jim Cramer criticized Apple bears for their persistent pessimism despite the company’s strong showing. In a post on X, he wrote that “Apple bears owe us an explanation,” for punishing the stock. He added that bears were wrong about Apple’s lead times, store demand, and estimates.

iPhone and Services Power Q4 Strength

Apple attributed its stellar results to strong demand for the iPhone 17 lineup and continued growth in its high-margin Services business. iPhone sales grew 6.1% year-over-year to $49 billion, while Services revenue surged 15.1%. The quarter included only two weeks of iPhone 17 sales, but early demand was strong, with reports showing it outsold the iPhone 16 by more than 14% in the first 10 days.

Additionally, CEO Tim Cook said that Apple expects strong holiday period sales, forecasting double-digit growth in iPhone sales and a return to growth in China.

Cramer Dismisses Tech Sector Downturn

Cramer also weighed in on the broader tech sector’s recent decline following Meta Platforms’ (META) announcement of higher capital expenditures on artificial intelligence (AI). Despite Meta’s strong earnings and revenue, its stock fell 11.3%, triggering a broader tech sell-off.

Nonetheless, Cramer believes this weakness may be temporary. He highlighted the solid quarterly performances of Apple, Meta, and Amazon (AMZN), predicting investor confidence will soon return and money will flow back into leading tech stocks.

Is Apple a Good Stock to Buy?

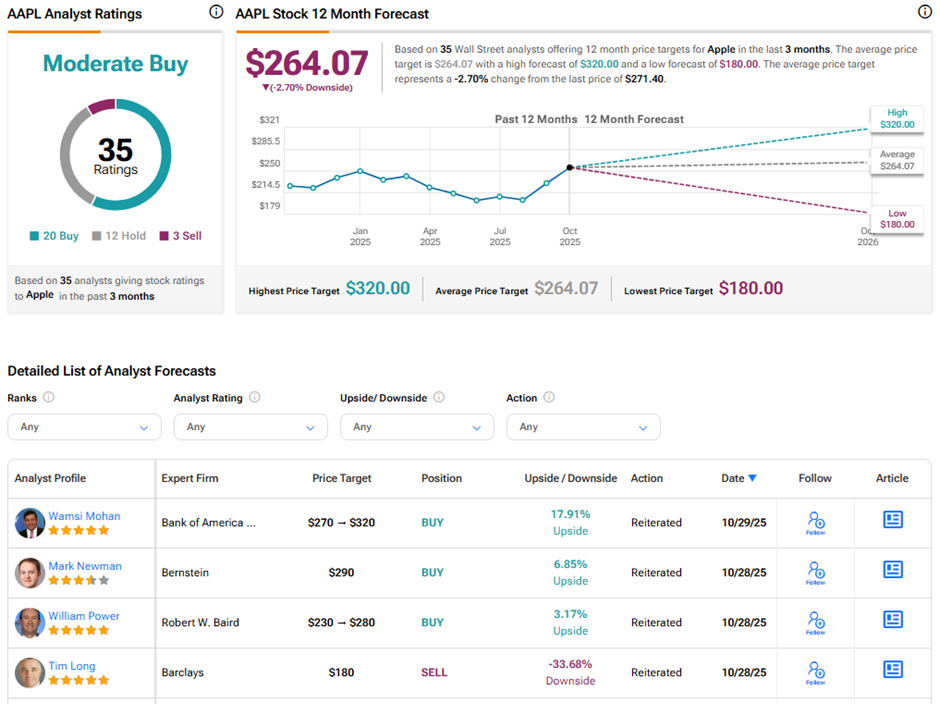

Analysts remain divided on Apple’s long-term outlook. On TipRanks, AAPL stock has a Moderate Buy consensus rating based on 20 Buys, 12 Holds, and three Sell ratings. The average Apple price target of $264.07 implies 2.7% downside potential from current levels. Year-to-date, AAPL stock has gained 8.8%.

Please note that these ratings were issued before the results and may change once analysts review the earnings.