Shares of e-commerce giant Amazon (AMZN) jumped in after-hours trading after the firm reported solid Q3 results. Earnings per share came in at $1.95, which beat analysts’ consensus estimate of $1.57 per share. Sales increased by 13.4% year-over-year, with revenue hitting $180.2 billion. This also beat analysts’ expectations of $177.9 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, the company’s various segments witnessed notable growth over the past year. Indeed, North America’s sales climbed to $106.3 billion, which was a 11% increase from the previous year. In the International segment, sales reached $40.9 billion, a year-over-year growth of 14%. Additionally, the AWS segment experienced a 20% increase in sales, which equaled a total of $33 billion.

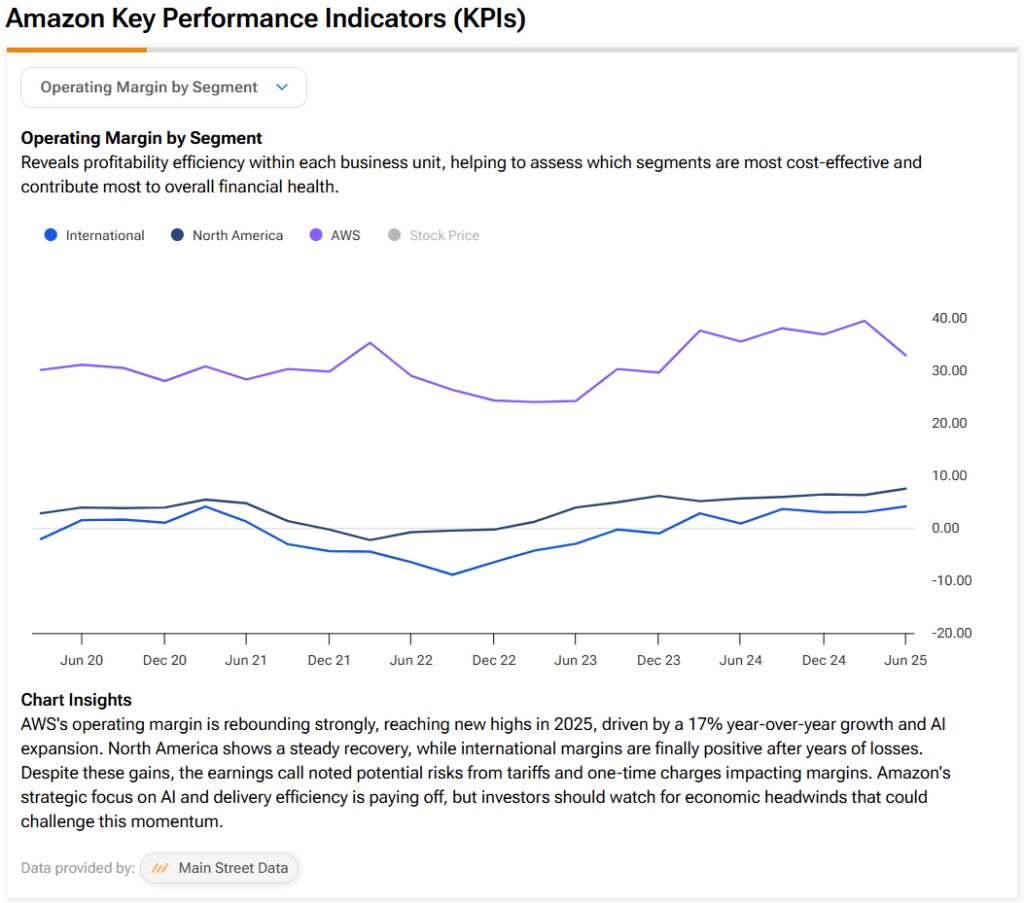

AWS is particularly important to the company because it is Amazon’s highest-margin segment, as illustrated below, thereby accounting for the bulk of its operating income.

Guidance for Q4 2025:

Looking forward, management released the following guidance for Q4 2025:

- Revenue in the range of $206 billion to $213 billion compared to analysts’ forecast of $207.9 billion

- Operating income between $21 billion to $26 billion versus expectations of $23.41 billion

As we can see, guidance came in better than expected, which helped push shares higher in after hours trading.

Is Amazon a Buy, Sell, or Hold?

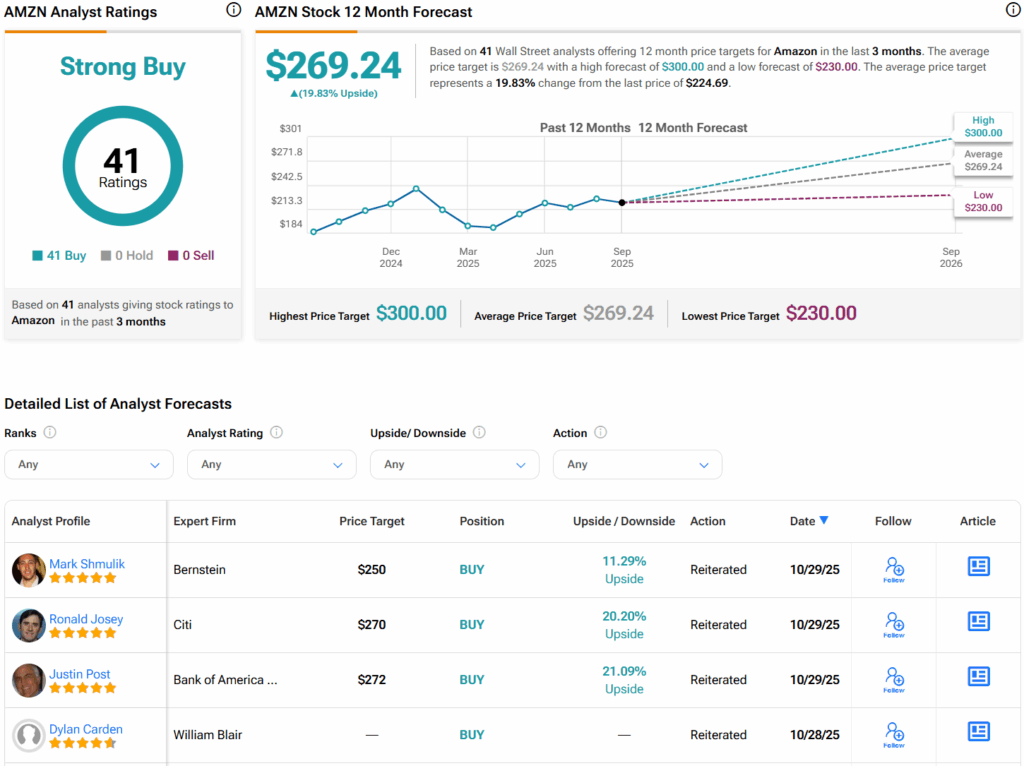

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 41 Buys assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $269.24 per share implies 19.8% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.