The Big Tech earnings season began on October 29, with Microsoft (MSFT), Alphabet (GOOGL), and Meta Platforms (META) all exceeding analysts’ expectations on earnings and revenue. However, their shares saw mixed reactions as investors focused more on the companies’ surging capital expenditures (capex). These increases are primarily driven by investments in artificial intelligence (AI) and cloud infrastructure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MSFT stock dropped nearly 4% in after-hours trading after stating that the company took a $3.1 billion hit to earnings due to its investment in OpenAI. Similarly, META stock plunged 7.5% after incurring a one-time tax charge of $15.93 billion. Conversely, GOOGL shares rose 6.7% after reporting a 16% year-over-year jump in sales, crossing $100 billion for the first time. Let’s learn about their massive capital plans.

Here’s How Big Tech Is Expanding Capex

Alphabet plans to spend about $91 billion to $93 billion on capital investments in 2025, which is an increase of around $10 billion to $12 billion from earlier estimates of about $75 billion to $85 billion. The increase reflects robust demand for Alphabet’s AI and cloud services, including its Gemini models and Google Cloud growth. CFO Anat Ashkenazi also noted that the company would see a “significant increase” in capex for 2026.

Meta raised the low end of its 2025 capex forecast to between $70 billion and $72 billion, up from an earlier estimate of about $66 billion to $72 billion. The additional spending will fund new AI data centers, infrastructure upgrades, and continued development of its Llama AI models and Reality Labs platforms. CEO Mark Zuckerberg emphasized that these investments are necessary to maintain long-term AI competitiveness.

Microsoft saw its Azure cloud business grow 40% in Q3FY25, underscoring strong enterprise demand for AI services and integration with OpenAI models such as GPT-4. Although the company did not provide any exact figure for increased capital spending, CFO Amy Hood stated that capex for Q1FY26 was higher-than-expected at $34.9 billion, and the growth rate for fiscal year 2026 will also exceed that of 2025.

AI and the Market Outlook

Despite growing fears of an “AI Bubble,” companies are significantly ramping up spending to build advanced AI data centers, high-performance chips, enhance cloud services, and maintain leadership in the rapidly evolving tech landscape. The increased capital expenditures by Alphabet, Microsoft, and Meta reflect the broader technology industry’s strong focus on AI and cloud infrastructure investments in 2025.

MSFT, META, or GOOGL: Which Is the Better Tech Stock, According to Analysts?

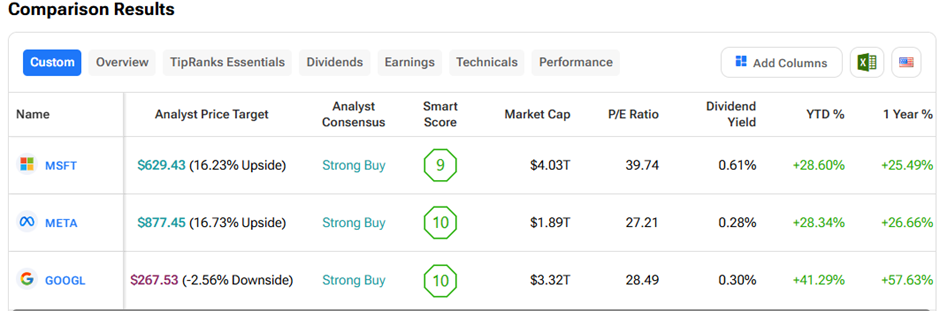

We used the TipRanks Stock Comparison Tool to determine which Big Tech stock is currently favored by analysts.

Wall Street has assigned a “Strong Buy” rating to all three stocks, with META offering the highest upside potential over the next twelve months.