Apple Inc. (AAPL) is seeing its strongest smartphone growth since the pandemic. The new iPhone 17 is driving that comeback after the company’s biggest redesign in years. Early signs from Apple’s supply chain and mobile partners show stronger sales than expected before launch.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

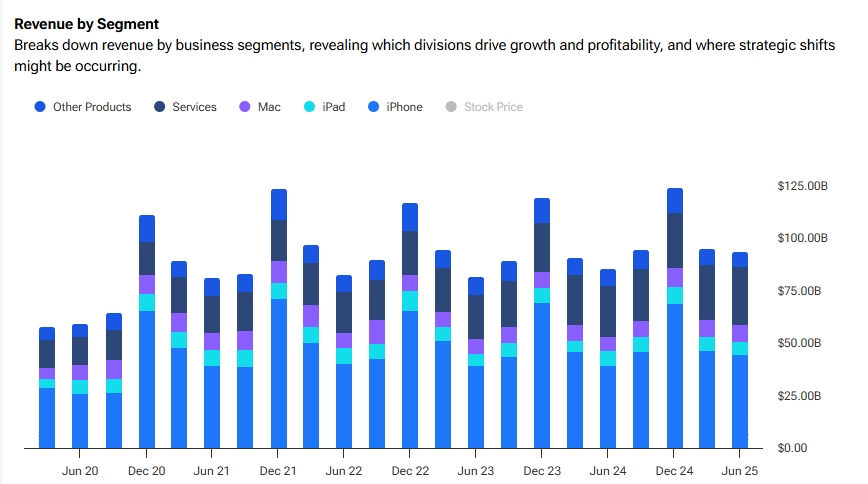

According to Visible Alpha, Apple’s iPhone revenue is forecast to reach $209.3 billion in fiscal 2025, up 4% from last year. In fiscal 2026, it could climb to $218.9 billion, a gain of almost 5%. By comparison, iPhone sales fell 2% in 2023 and were flat in 2024. Analysts expect unit sales to rise to between 235 million through 2026 and then rise toward 240 million to 260 million by the end of the decade.

Demand Signals Growth

Across the board, early demand looks firm. Bank of America (BAC) reported that shipping times for the iPhone 17 are about 13% longer than those for last year’s iPhone 16. Longer wait times often mean stronger interest. In addition, Apple Store data and carrier checks point to higher order activity. Queues outside stores have also returned, which suggests rising upgrade momentum.

Trade-in programs have helped make the new models easier to afford, while subsidy policies in China have supported sales of the base version. Moreover, key camera, display, and battery upgrades have pushed more customers to replace older devices.

Apple kept prices steady even as tariff risks rose. The company decided not to pass possible cost increases to buyers after Donald Trump renewed threats of 100% tariffs on imports from China. That choice helped maintain demand at a crucial moment.

However, delays in rolling out Apple’s new AI features have held back some investor enthusiasm. Even so, hardware-driven growth is supporting market confidence as Apple enters the holiday quarter. The iPhone still accounts for more than half of Apple’s roughly $390 billion in yearly revenue, making its success vital to overall results.

Analyst Views and Outlook

Gene Munster of Deepwater Asset Management said the iPhone 17 launch was stronger than Wall Street expected. Francisco Jeronimo of IDC called the quarter very strong and noted that Apple stores have seen crowds not witnessed in years.

Still, Jefferies recently downgraded Apple to underperform, saying investor expectations may be too high after the stock’s rally. Apple will report its fiscal fourth-quarter results on October 30, which will include the first few weeks of iPhone 17 sales. Strong results could signal that the company’s latest iPhone cycle is not just a short-term boost but a steady return to growth in 2025.

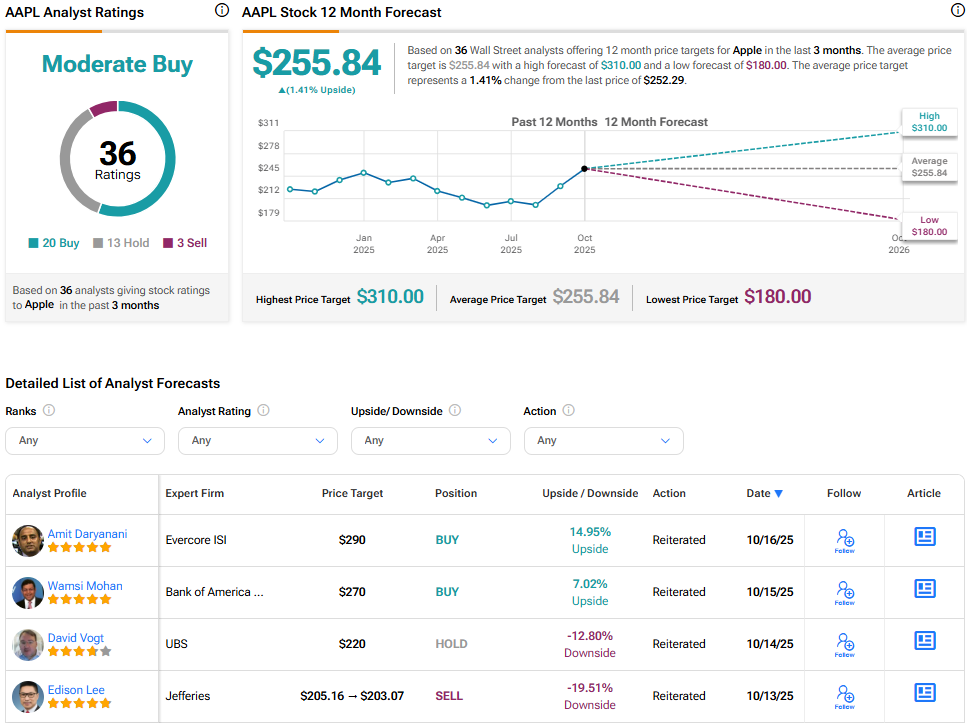

Is Apple a Buy, Hold, or Sell?

On the Street, Apple boasts a fairly positive outlook with a Moderate Buy consensus rating. The average AAPL stock price target stands at $255.84, implying a 1.14% upside from the current price.