A leading Wall Street brokerage says that Apple’s (AAPL) iPhone 17 sales are losing momentum weeks after the new smartphone models went on sale.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Initial indications were that iPhone 17 orders and sales were strong and outpacing last year’s iPhone 16 model. That news had sent AAPL stock 10% higher in the last month and led the share price to enter positive territory for the year. But new data suggests more of a mixed picture when it comes to sales of the newest iPhone.

Analysts at Jefferies Financial Group (JEF) warn that early strength in iPhone 17 orders could be quickly fading. “While iPhone 17 series’ initial sales momentum was strong, our tracking shows it has been cooling off, as delivery lead time has been generally falling,” wrote Jefferies in a research note. “In particular, the US remains the weakest market among the six we track.”

Weakening Demand

The lead times referred to by Jefferies concern the period between when a customer places an order and receives their iPhone. Analysts use it to gauge demand, with longer lead times indicating a higher number of orders. Jefferies tracks lead times in the U.S., China, Hong Kong, Germany, the U.K., and Japan.

“Our tracking of lead time shows the US as the weakest market among the six we track, across all four model variants. This is consistent with our view that many consumers bought a new iPhone in the June quarter due to tariff concerns,” wrote Jefferies in its research note.

Apple is under pressure to add artificial intelligence (AI) features to its iPhone models to help boost sales. The company has teased new AI features for the 2026 devices, including a possible revamped Siri digital assistant. AAPL stock is up 2% this year.

Is AAPL Stock a Buy?

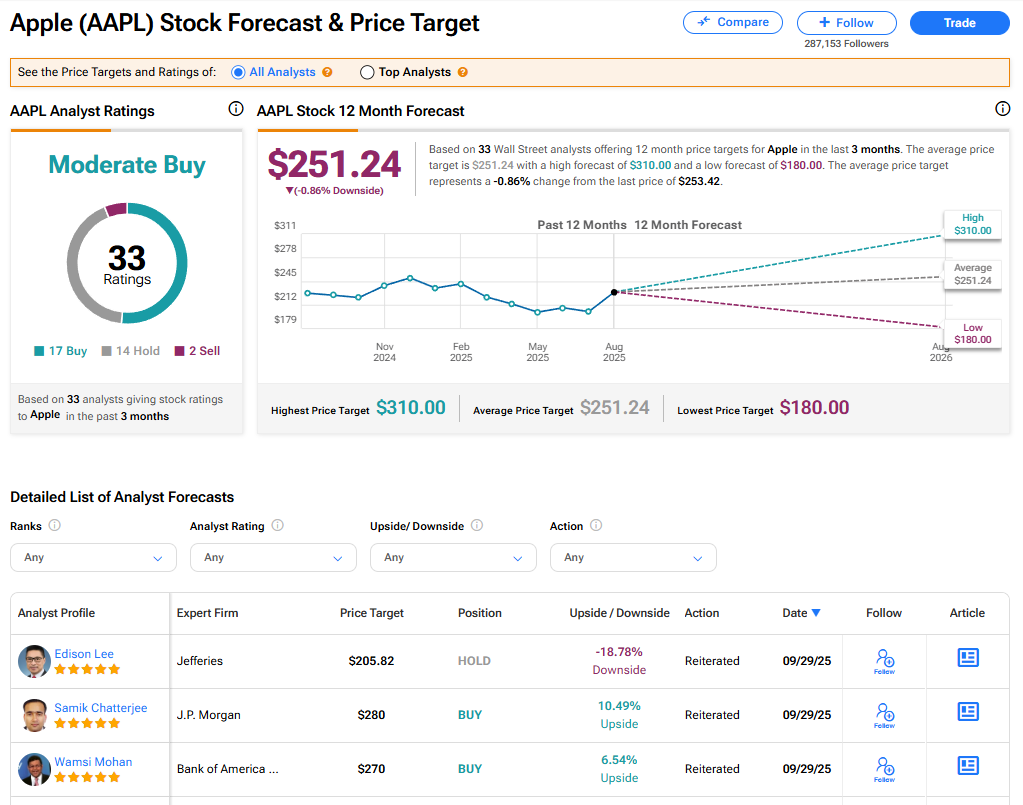

The stock of Apple has a consensus Moderate Buy rating among 33 Wall Street analysts. That rating is based on 17 Buy, 14 Hold, and two Sell recommendations issued in the last three months. The average AAPL price target of $251.24 implies 0.86% downside from current levels.