Among the popular UK stocks, FTSE 100-listed Lloyds Banking Group PLC (GB:LLOY) boasts a dividend yield of 5.19%. The yield exceeds the sector average of 2.1%, making it an attractive investment choice for passive-income investors. Lloyds is among the largest banks in the UK, serving around 27 million customers.

TipRanks offers a variety of tools designed to help users select dividend stocks that match their criteria. In this instance, we have used the TipRanks Top Dividend Shares tool for the UK market. This tool aggregates the list of high-dividend-paying companies, alongside a range of other parameters for users to evaluate.

Let’s take a look at more details.

Lloyds’ Dividends in 2023

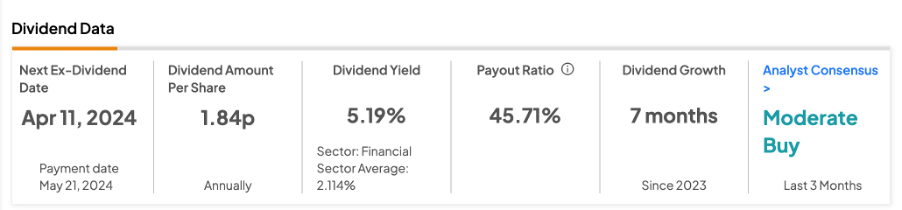

Last month, in its annual results for 2023, Lloyds proposed a final ordinary dividend of 1.84p per share, leading to a total dividend of 2.76p per share. This marked a 15% increase from the previous year and is consistent with the bank’s progressive dividend policy. Additionally, Lloyds declared a share buyback program of £2.0 billion.

Earnings Delight

Lloyds achieved its 2023 guidance targets, propelled by revenue growth and cost control measures. The bank revealed a 57% surge in full-year pre-tax profit to £7.5 billion in 2023. Net interest income climbed to £13.8 billion, reflecting a 5% uptick. Moreover, the net interest margin was 3.11%, aligning with the provided guidance.

On the flip side, the bank has raised concerns about the impending risk of an ongoing regulatory investigation into its car finance subsidiary, Black Horse. In its results, the bank allocated a £450 million provision to cover potential expenses arising from this inquiry.

Is Lloyds a Good Stock to Buy?

Lloyds shares have exhibited significant volatility in recent years. In the last 12 months, the stock has gained 3.13%.

According to TipRanks’ analyst consensus, LLOY stock has a Moderate Buy rating based on a total of 11 recommendations, of which seven are Buy. It also includes three Holds and one Sell recommendation. The Lloyds share price prediction is 55.44p, which indicates an upside potential of 14% in the share price.