Among the major news for UK stocks, shares of FTSE 100-listed Lloyds Banking Group PLC (GB:LLOY) rose more than 6% after the bank reported a 57% jump in its statutory pre-tax profits to £7.5 billion in 2023. However, the bank recorded a £450 million provision for the potential expenses stemming from an inquiry into its historical car finance sales practices.

Lloyds Banking Group is one of the UK’s oldest and largest banks, providing a diverse range of services.

Strong Performance Marred by Regulatory Inquiry

Lloyds met its 2023 guidance numbers in its full-year results, driven by revenue expansion, prudent cost management, and high asset standards. The bank’s net interest income reached £13.8 billion, marking a 5% increase. Lloyds maintained a net interest margin of 3.11%, as anticipated.

On the flip side, the bank’s Q4 numbers were impacted by intensified competition in mortgage and deposit pricing. Net income for the fourth quarter declined about 10% year-on-year to £4.2 billion, falling short of the projected £4.4 billion. The banking net interest margin stood at 2.98% in the fourth quarter, decreasing by 10 basis points during the period.

Meanwhile, the bank announced plans to repurchase up to £2 billion of its shares and distribute a final ordinary dividend of 1.84p per share.

Speaking of the risks ahead, Lloyds faces a major challenge in an ongoing regulatory investigation related to its car finance subsidiary, Black Horse. This probe is focused on the potential historical overcharging of car financing deals. Analysts express concern that the investigation could result in industry-wide costs reaching billions of pounds.

Is Lloyds a Good Share to Buy?

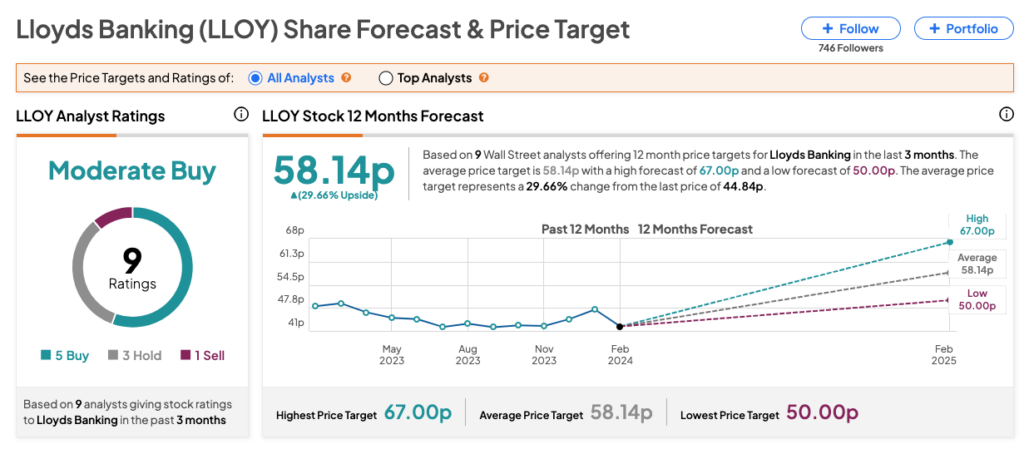

According to TipRanks’ analyst consensus, LLOY stock has a Moderate Buy rating based on a total of nine recommendations, of which five are Buy. It also includes three Holds and one Sell recommendation. The Lloyds share price prediction is 58.14p, which shows a positive change of 30% in the share price.