Analyst Brendan Sproules is known for his wide coverage of Australian and U.S. banks. Sproules has more than 12 years of experience in the banking and financial sectors and is preferred by institutional investors. Here, we discuss two banking stocks from Australia, Westpac Banking (AU:WBC) and National Australia Bank Limited (AU:NAB), from the list of his rated stocks.

Sproules joined Citigroup in 2014 and is now the Head of Research for Australian Banks. Before joining Citigroup, he was a part of organizations such as J.P. Morgan for five years and the National Australia Bank for more than seven years, among others.

Where Does Brendan Sproules Stand Among Other Analysts?

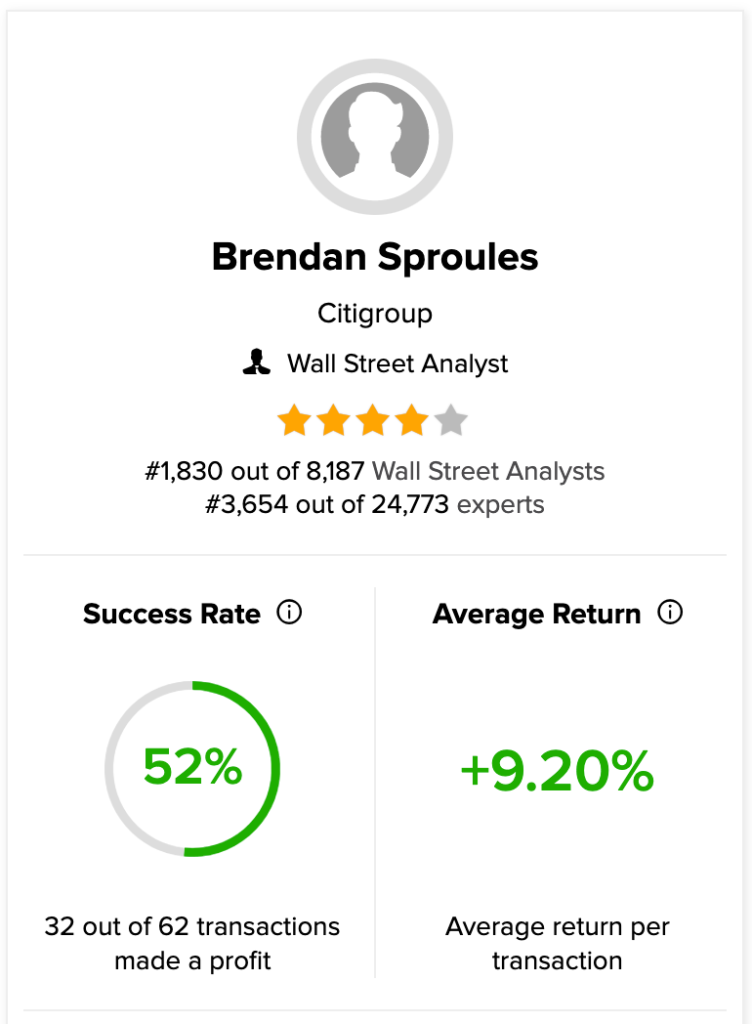

According to the TipRanks Star Ranking system, Sproules is a four-star rated analyst and is ranked 1,830 out of 8,187 analysts. As per this system, the experts are analyzed and ranked based on different factors, such as their success rates, returns, and statistical significance.

Sproules has a success rate of 52%, with 32 out of 62 ratings being successful. He has generated an average return of 9.2% per transaction.

According to TipRanks, Sproules’ most profitable rating so far has been Australia & New Zealand Banking (AU:ANZ), on which he made a return of 125.4% between May 2020 and May 2021.

Let’s discuss the stocks in detail.

Westpac Banking

Headquartered in Australia, Westpac is a leading banking institution in the country. It is also one of the oldest banks in Australia.

Sproules has been covering Westpac since 2018 and has always remained bullish on the stock. The share price is already up by 14% this year, and he sees a further upside of around 28%. He has the highest target price of AU$30 on the stock.

The bank’s cost-cutting measures and focus on improving its core banking services have made it well-positioned to benefit from rising interest rates. In its full-year results, the statutory net profit was up by 4%, while the cash earnings were down by 1% to AU$5.2 billion. In 2022, the net interest margin was at 1.87%, down by 17 bps (basis points) from 2021.

Even though Sproules maintained a Buy rating, he reduced the cash earnings forecast by 2-4% for the next two years, mainly due to challenges in the mortgage business. He also cut NIM to 2.07% from the earlier forecast of 2.15%.

The bank’s expenses were down by 7% in 2022, and it has revised its cost target to AU$8.6 billion for 2024. Some analysts remain worried about this number and expect a reduction in the headcount. Analysts believe that interest margins will continue to expand in 2023.

What is the Forecast for Westpac Shares?

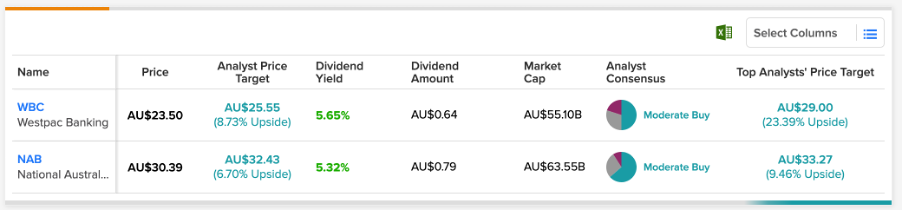

According to TipRanks’ analyst consensus, Westpac stock has a Moderate Buy rating based on five Buy, three Hold, and two Sell recommendations.

The average target price is AU$25.55, which is 9% higher than the current price level.

National Australia Bank Limited

National Australia Bank (NAB) is one of the four largest banks in Australia.

Despite the already soaring share prices of NAB, Sproules is bullish on the stock, mainly due to the expanding lending margins. The stock has gained around 15% in the last six months.

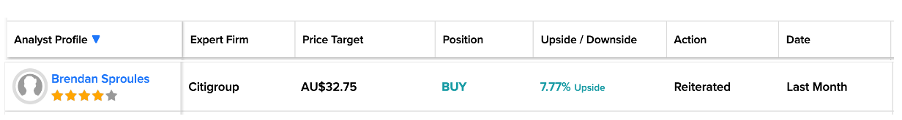

Last month, Sproules maintained his Buy rating on the stock and expects an upside of 7.7%. He added, “The bank was seeing strong business lending momentum.”

In its full-year results for 2022, cash earnings increased by 8.3% to AU$7.1 billion. This was driven by volume growth across all the business segments along with a strict approach to cost-cutting. In 2022, the net interest margin fell by 6 basis points to 1.65%. The higher earnings were mostly offset by the home loan business.

Is National Australia Bank a Good Investment?

According to TipRanks, NAB stock has a Moderate Buy rating, based on recommendations from 11 analysts.

The average target price is AU$32.14, which is 5.7% above the current price level.

Conclusion

After 11 years of lower interest rates, Australian banks are getting the benefit of higher interest rates. This could push the banks’ earnings higher in the near future.

Considering Sproules’ experience and expertise in the sector, investors can choose these stocks for a safer bet in the inflationary environment.