Digital Turbine (NASDAQ:APPS) is a small-cap stock with a big vision, but the CEO’s optimism won’t be enough to rescue the company in 2024. It’s fine to be a dip buyer, but Digital Turbine’s recent financial figures are dismal. In light of this, I’m bearish on APPS stock.

Based in Texas, Digital Turbine “empowers superior mobile consumer experiences and results,” which is a fancy way of saying that the company helps businesses reach people through smartphone apps. For example, Digital Turbine recently struck a deal with Korea’s ONE Store to “elevate the mobile experience in the Korean App Market.”

That’s all fine and well, but stock traders weren’t particularly pleased with Digital Turbine today. So, let’s take a closer look at Digital Turbine’s latest round of financial figures and see if there’s a good buying opportunity or just another toxic stock here.

Digital Turbine Stock Drops, but the CEO Is Optimistic Anyway

It’s fine for a company’s CEO to be a pitchman, to a certain extent. In the case of Digital Turbine today, however, the market just isn’t buying what Digital Turbine CEO Bill Stone is selling.

Let’s start with the facts. In the third quarter of Fiscal Year 2023, Digital Turbine generated $142.6 million in revenue, down 12% year-over-year. Furthermore, this result fell short of the consensus estimate of $146.2 million.

That’s not even the worst part, though. Turning to the bottom line, Digital Turbine flipped from GAAP-measured earnings per share (EPS) of $0.04 in the year-earlier quarter to a net loss of $0.14 per share in Fiscal Q3 2023. Also, using non-GAAP measurements, the company reported quarterly adjusted net income of $0.15 per share, which is below the year-earlier quarter’s result of $0.29 per share and Wall Street’s consensus forecast of $0.17 per share.

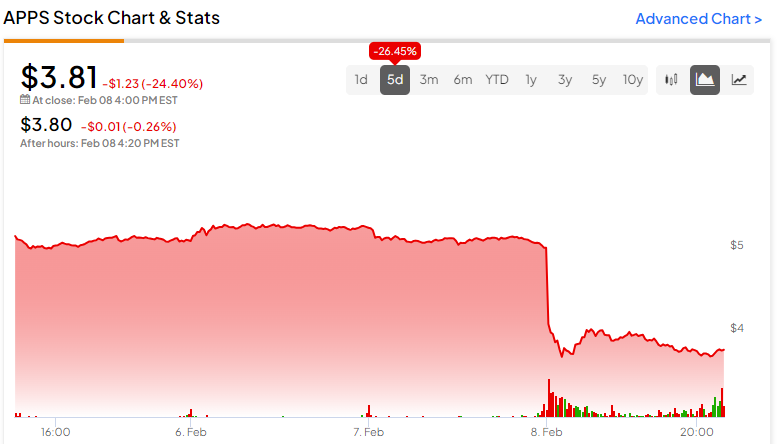

Despite these dreary results, Stone cited recent but unspecified “regulatory and legislative news,” as well as the “soon-to-be-effective Digital Markets Act in the European Union,” as factors that will supposedly draw “global operators, OEMs [original equipment manufacturers], and app publishers to our advantageously positioned direct distribution platform offerings.” Yet, all of this remains to be seen, and the market sold off APPS stock, sending it 24% lower today.

Is APPS Stock a Buy, According to Analysts?

On TipRanks, APPS comes in as a Hold based on one Buy and four Hold ratings assigned by analysts in the past three months. The average Digital Turbine stock price target is $6.13, implying 60.9% upside potential.

Conclusion: Should You Consider APPS Stock?

Will “global operators, OEMs, and app publishers” come flocking to Digital Turbine in 2024? There’s no assurance that this will actually happen, and the market is focusing on Digital Turbine’s current data, not the CEO’s hopes and wishes. Therefore, I’m preparing for further declines in APPS stock and am certainly not considering it now.