In the current business environment, it’s practically impossible not to hear about artificial intelligence (AI). Theoretically, this framework should benefit Baidu (NASDAQ:BIDU), which is essentially China’s answer to Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG). Despite dominating the Chinese search engine market and forwarding compelling AI services, various headwinds cloud Baidu. However, BIDU stock seems incredibly undervalued now, making me bullish, as investors could potentially rotate into this opportunity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BIDU Stock Gets No Love Despite Good Results

Arguably, BIDU stock should get love, not skepticism, from Wall Street. However, the red ink on its chart suggests that the underlying company suffers from a huge credibility problem. Since the start of the year, BIDU has lost 15% of its market value. Over the past 52 weeks, it’s off the pace by more than 32%.

Fundamentally, and without any other context, the red ink in BIDU stock seems nonsensical. Last week, Baidu released its fourth-quarter earnings report, with numbers that came in better than expected. According to TipRanks reporter Kailas Salunkhe, the Chinese internet technology giant posted revenue of $4.92 billion. This figure represented a 6% year-over-year lift and beat expectations by $40 million.

On the bottom line, earnings per American Depository Share clocked in at $3.08. This figure easily outpaced the consensus target of $0.64. Even better (from a narrative standpoint), management has been focusing on driving gains with its AI offerings and operational efficiency.

Per Salunkhe, in Q4, the company’s “Core revenue increased by 7% to $3.87 billion. The online marketing portion ticked up by 6% to $2.7 billion. Meanwhile, robust momentum in its AI Cloud business helped Baidu increase its non-online marketing revenue by 9% to $1.17 billion. Further, revenue from iQIYI inched up by 2% to $1.09 billion.”

In other words, Baidu isn’t just talking the talk about AI. It’s walking the walk. Nevertheless, BIDU stock slipped 6% last week. Lingering concerns about the weaker-than-expected Chinese economy have hampered the nation’s publicly-traded companies. Politically, concerns exist about Baidu’s chatbots being tested by scientists tied to the Chinese military. Further, the U.S. has banned advanced semiconductor sales to China, thus negatively affecting its tech space.

Still, for those willing to speculate, BIDU stock remains an enticing proposition.

Give Baidu a Chance

Although the outside circumstances surrounding BIDU stock are unappealing, they also have key rebuttals. First, while the economic narrative is not particularly encouraging, an argument can be made that Chinese policymakers have the tools to kickstart the machinery.

Second, the geopolitical backdrop seems like a dealbreaker for Chinese tech companies. However, several of the nation’s agencies – including AI research institutes, universities, and even military entities – managed to get their hands on advanced U.S. semiconductors despite the export ban.

Further, even if the ban worked 100% effectively, it’s not going to stop China from making its own advanced chips. Granted, many obstacles exist with this approach. However, evidence points to the country’s biggest chipmaker manufacturing innovative semiconductors. Combined with China’s heavy investments in tech education, it’s not inconceivable that it could catch up.

Even more critically, the first-generation AI systems have produced enough poor results that a trust problem has materialized against the industry. Of course, this development impugns BIDU stock as well. However, where Baidu may be able to distinguish itself is that, like Alphabet, it dominates its regional search engine market.

If in the future Baidu can combine its internet ecosystem with its AI platform – that is, to enable its digital intelligence products to self-validate answers before providing them to users – the innovation could dramatically alter the industry paradigm.

What’s more, as other AI-related enterprises become more and more richly priced, an intra-sector rotation may materialize. In other words, at some point, heavily touted AI companies will disappoint against earnings expectations. When that happens, the undervalued players may finally receive the love that they’ve been looking for.

An Attractive Valuation

Right now, BIDU stock trades at only 13.4x trailing-year earnings. That’s well undervalued compared to the internet content and information sector’s average multiple of 23.71x. While it’s difficult to classify Baidu, its multiple sits well underneath other related tech subsectors. For example, the IT services space stands at 32.37x. Also, the internet retail space runs an earnings multiple of 25.43x.

No matter how you slice and dice it, BIDU stock is undervalued. And despite the geopolitical noise, Baidu is expected to grow at a steady clip this year and the next. So, it’s quite possible that this discount won’t last indefinitely.

Is BIDU Stock a Buy, According to Analysts?

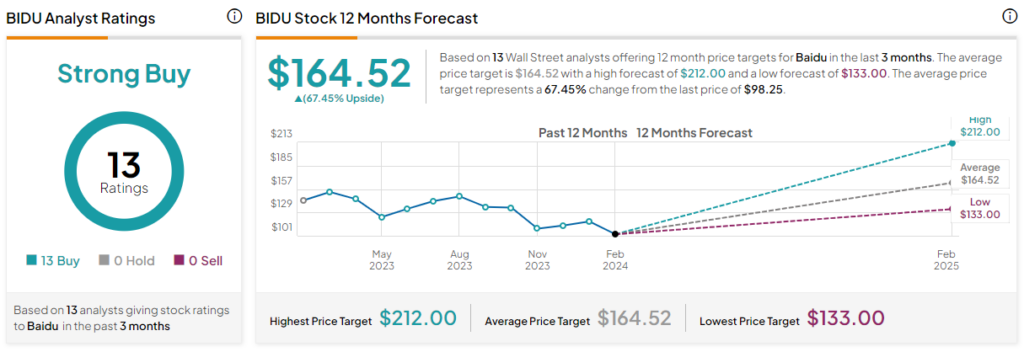

Turning to Wall Street, BIDU stock has a Strong Buy consensus rating based on 13 Buys, zero Holds, and zero Sell ratings. The average BIDU stock price target is $164.52, implying 67.45% upside potential.

The Takeaway: BIDU Stock Deserves Another Look

At first glance, the China-related headwinds impacting the nation’s tech space seem big enough to dissuade investments in Baidu. However, beneath the hood lies a surprisingly compelling narrative. In particular, the company is making AI work, and it has the potential to improve upon digital intelligence through its vast internet ecosystem. Subsequently, the current discount in BIDU stock might not last long, as an intra-sector rotation may occur.