Chinese stocks including major e-commerce players like Alibaba (BABA) and JD.com (JD) dipped in pre-market trading at the time of writing on Friday after the world’s second-biggest economy, China seemed to be showing signs of prolonged weakness.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The latest round of economic data from China indicated that the country’s manufacturing sector continued to contract in June for the third straight month while its non-manufacturing sector showed signs of weakness as new orders fell for both these sectors. Employment is also on a decline across both sectors indicating a jobs shortage, particularly, for young people.

Moreover, the Chinese government’s efforts to boost the economy have left investors underwhelmed. Recently, the People’s Bank of China slashed its loan prime rate by 10 basis points to 3.55% for one year and lowered its five-year rate to 4.2%.

There are also signs that the trade war between the U.S. and China is worsening after news that the U.S. could be mulling new restrictions on exports of chips to China.

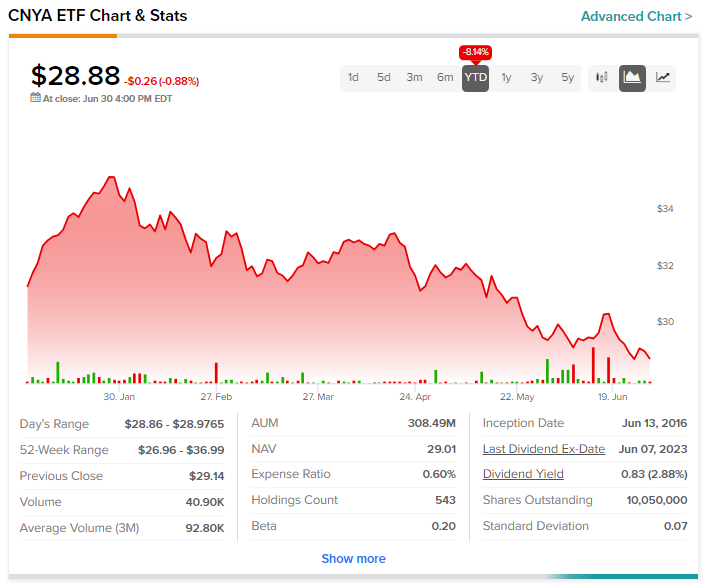

The worries over the Chinese economy have meant that year-to-date, iShares MSCI China A ETF (CNYA) has also dropped by more than 7%.