Shares of Chinese tech major Baidu (NASDAQ:BIDU) are on the rise today after its fourth-quarter numbers came in better than estimates. With a year-over-year increase of 6%, revenue of $4.92 billion surpassed expectations by $40 million. Further, earnings per American Depository Share (EPADS) of $3.08 outpaced consensus by a wide margin of $0.64.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While its core business remains healthy, Baidu is focusing on driving gains with its AI offerings and operational efficiency. During the quarter, its Core revenue increased by 7% to $3.87 billion. The online marketing portion ticked up by 6% to $2.7 billion. Meanwhile, robust momentum in its AI Cloud business helped Baidu increase its non-online marketing revenue by 9% to $1.17 billion. Further, revenue from iQIYI inched up by 2% to $1.09 billion.

At the same time, higher costs associated with its AI Cloud business resulted in Baidu’s cost of revenues rising by 3% to $2.45 billion. In comparison, the company’s selling, general, and administrative expenses remained largely unchanged at $825 million. The tech major had $28.93 billion in cash at the end of December 2023.

What Is the Target Price for BIDU?

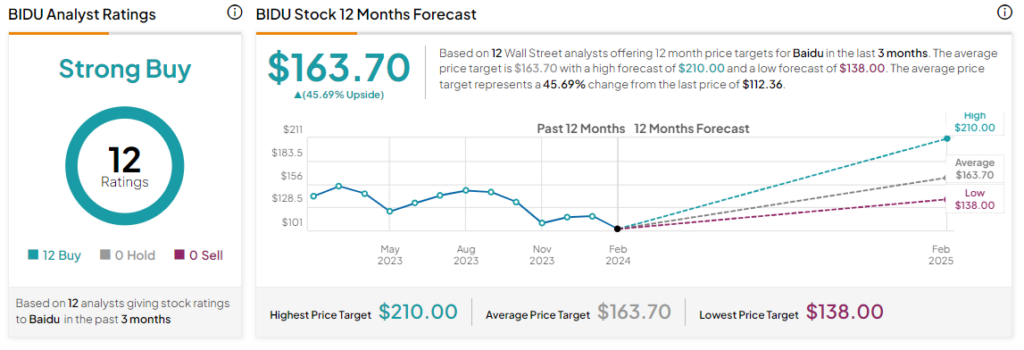

Baidu’s share price has corrected by nearly 19% over the past year amid broader weakness in China’s financial markets. Overall, the Street has a Strong Buy consensus rating on Baidu, and the average BIDU price target of $163.70 implies a substantial 45.7% potential upside in the stock. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure