China’s search engine giant and artificial intelligence (AI) company Baidu (NASDAQ:BIDU) feels that the recently announced U.S. export controls on advanced chips will have “quite limited” impact in the near future. During the Q3 conference call, Dou Shen, head of Baidu’s AI cloud group, stated that a major portion of the company’s AI and cloud computing business is not significantly dependent on the highly advanced chips.

Shen added that for its businesses that need advanced chips, the company has already stocked enough to cater to near-term requirements. The executive also noted that there are alternatives to the restricted chips and the company has the required technologies to use these alternatives to achieve nearly “the same effectiveness and efficiency” in its AI and cloud computing businesses.

Furthermore, Shen highlighted that the company has its own AI chip, Kunlun, which is already used in some large-scale AI computing tasks. Moreover, Baidu’s in-vehicle computing will not be impacted as automotive chips are not on the restricted chips list. Shen concluded that America’s new chip controls create market opportunities for the Chinese chip makers.

On Tuesday, Baidu announced upbeat Q3 results backed by continued strength in its AI cloud business and gradual improvement in the company’s ad revenue.

What is the Target Price for Baidu Stock?

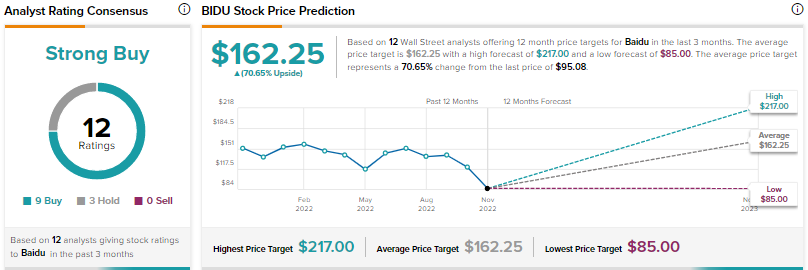

Wall Street’s Strong Buy consensus rating for Baidu stock is based on nine Buys and three Holds. The average BIDU stock price target implies nearly 71% upside potential. The U.S.-listed shares of Baidu have declined 36% so far this year.