Baidu (NASDAQ: BIDU) announced its Q3 results with revenues of $4.57 billion, up 2% year-over-year and beating Street estimates by $100 million. The Chinese technology giant reported adjusted earnings of $2.37 per ADS, a growth of 15% year-over-year and exceeding Street estimates of $2.17.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Baidu also holds an approximately 53% stake in the Chinese video-streaming platform iQIYI. This platform saw an average daily number of total subscribing members of 101 million at the end of Q3 versus 104.7 million in the same period last year.

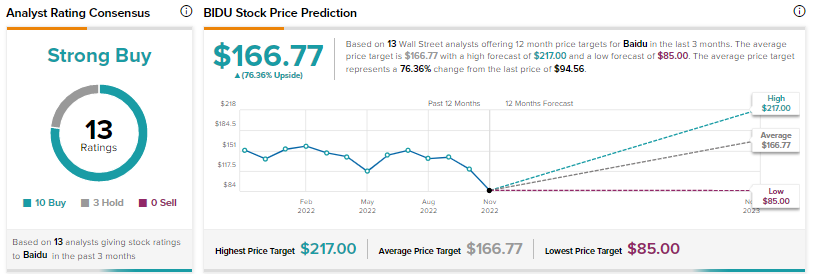

The above graphic represents the analysts’ forecast for BIDU stock.

Rong Luo, CFO of Baidu commented, “In the third quarter of 2022, Baidu Core’s non-GAAP operating profit increased by 14% year over year to RMB6.7 billion despite that the resurgence of COVID-19 pressured revenue performance. Going forward, we will continue to focus on quality revenue growth. At the same time, we will keep investing in technology and talents to propel our future development.”