To be clear up front, few investors should participate in the cineplex operator industry. With streaming services representing massive competition, companies like Marcus (NYSE:MCS) – a smaller player in the embattled segment – face a tough uphill challenge. Nevertheless, if you had to pick a possibly compelling name in the space, MCS stock might entice gamblers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For one thing, streaming companies themselves provide a bit of an ironic upside catalyst. During the worst of the COVID-19 crisis, platforms such as Netflix (NASDAQ:NFLX) benefited handsomely due to a hostage audience. With nothing else to do and live sports being canceled for a time, streaming subscriptions increased. However, as pandemic-related restrictions eased, many consumers rushed out the door, eager for real experiences.

Still, as Netflix’s surprisingly robust third-quarter earnings performance implied, entertainment sentiment may finally be pivoting back to the living room. Part of this could stem from economic challenges, particularly as monetary policy fluctuations force consumers to tighten their wallets. Such a backdrop may also help MCS stock.

While streaming will likely impose heavy competition for cineplex operators, it’s also fair to point out that the concept of revenge travel generally proves that humans are social creatures. Therefore, the box office provides a social experience with an entertainment platform, all at a (relatively) low price. Theoretically, this should help MCS stock.

Another factor to consider is Marcus’ direct competition. While AMC Entertainment (NYSE:AMC) admittedly makes for a more exciting trade, it’s also much more troubled. Deeply embattled – more so than Marcus – those who see the broader contrarian opportunities in the movie theater business will likely elect MCS stock over AMC, moving forward.

Interestingly, on TipRanks, MCS has a 7 out of 10 Smart Score rating. This indicates moderate potential for the stock to outperform the broader market.

MCS Stock Enjoys Numerous Fundamental Catalysts

From the get-go, one of the factors that distinguish MCS stock from its larger rivals is geographical coverage. While you can find an AMC theatre in most states (44, to be exact), Marcus Theatre doesn’t have anywhere close to that level of coverage. At present, the company only features 90 locations in total. Primarily, they’re located in the middle of America, along with some eastern states.

From one perspective, the lack of coverage translates to a lower total addressable market. However, in the era of streaming, this total addressable market will be limited anyways. Therefore, it’s better for a company to have a smaller footprint and closer relationships with core customers. In a way, the deflationary environment for the box office benefits MCS stock.

Further, Marcus enjoys the advantage of demographic trends. As many analysts pointed out, millennials have been branching out to cheaper areas. In September of this year, I stated the following. “Back before the COVID-19 pandemic, multiple research papers and surveys revealed that young professionals were already migrating away from traditional economic hubs like New York City and Chicago. In their stead, millennials began moving to cities in states like Texas, Colorado, Washington, and Arizona.”

Put another way, the underlying movie theater locations of MCS stock are positioned where many millennials are moving. Since this demographic should provide years of spending power, Marcus enjoys being the big fish in a small pond.

Is MCS a Good Stock to Buy, According to Analysts?

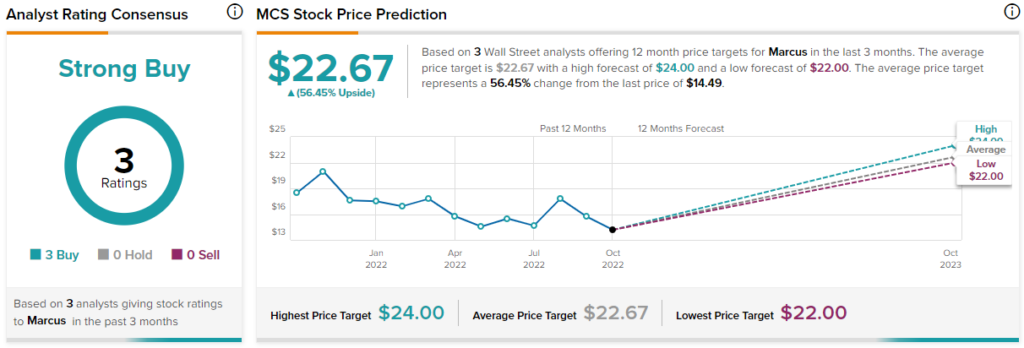

Turning to Wall Street, MCS stock has a Strong Buy consensus rating based on three Buys, zero Holds, and zero Sell ratings. The average MCS price target is $22.67, implying 56.45% upside potential.

Conclusion: Quantitative Analysis Favors Marcus Over AMC

If the above fundamentals weren’t enough to convince investors to consider MCS stock over AMC, market participants should realize that the quantitative data also favors Marcus.

To be fair, both Marcus and AMC present a rather shoddy picture of financial stability. Still, if we’re comparing just the two enterprises, one clearly stands above the other. When you consider the weaknesses of MCS stock, critics will point to income statement issues (declining gross margins and revenues), along with poor stability in the balance sheet (an Altman Z-Score in the distressed zone). For reference, the Altman Z-Score is a “formula used to predict the probability that a firm will go into bankruptcy within two years,” according to Finbox.

Regarding AMC, critics will note that the embattled cineplex operator also has the same issues as Marcus. In addition, however, AMC keeps issuing new debt – $1.3 billion over the past three years, to keep score. That debt issuance results in the company having poor financial stability. For example, AMC’s Altman Z-Score slipped into negative territory, indicating deeper magnitudes of fiscal distress.

Unfortunately, it gets worse for AMC. On its balance sheet, its debt-to-equity ratio sits 449% below parity, indicating that AMC has a negative net worth.

That’s not to say that MCS stock represents the bastion of stability. However, Marcus’ debt-to-equity ratio is 110.8% – worse than 81% of its peers but cynically 19% better than other poor souls. One of them happens to be AMC.

Ultimately, then, whether you value outside fundamentals or internal financial metrics, the point is the same. If you only had to pick between MCS stock and AMC, one does stand out better amid the flames of fiscal perdition.