At the initial onset of the COVID-19 crisis, streaming stocks would turn out to represent a viable arena to park one’s money. With very little to do, the underlying platforms provided much-needed entertainment. However, the normalization of society eventually soured this framework. Still, two major tickers in this segment – Netflix (NASDAQ:NFLX) and Disney (NYSE:DIS) – stand poised to benefit from a pivot in consumer behaviors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First, some background information will be helpful for investors. When the COVID-19 pandemic first disrupted American society, one of the sectors to suffer conspicuous damage was the entertainment industry. Devoid of live sporting events, many households and businesses – particularly those in the food-and-beverage sector – cut the cord. However, not all segments of the entertainment space suffered equally. Some, like streaming stocks, benefitted handsomely.

Leveraging vast portfolios of previously filmed content, streaming service providers enjoyed a hostage audience. Stuck at home due to shelter-in-place mandates, people binged hours of online entertainment. While this dynamic provided a valuation spike for streaming stocks, the pendulum would soon swing in a different direction.

Predictably, after roughly two years of activity restrictions, the loosening of COVID-related restrictions fueled the revenge travel phenomenon. Essentially, people were tired of sitting at home all day, instead desiring real experiences over digital ones. As a result, streaming stocks lost their luster, leading to some ugly earnings performances of previously powerful companies.

However, a pivot back to the living room appears to have materialized. In August, TipRanks reporter Chandrima Sanyal noted that cable TV viewership stats lost out to streaming alternatives. Moreover, macroeconomic pressures – most prominently historically high inflation – likely contributed to consumers returning to at-home entertainment.

That’s music to the ears of streaming stocks to buy. Below are two major ones to consider.

Netflix

One of the most devastated streaming stocks in part because of revenge travel, Netflix has a long way to go to restore investor confidence. On a year-to-date basis through the conclusion of the October 21 session, NFLX stock hemorrhaged over 51% of equity value. However, in the trailing five days that ended October 21, NFLX gained over 23% in value.

As TipRanks reporter Vince Condarcuri stated, Netflix delivered earnings per share of $3.10, beating analysts’ consensus estimate of $2.14. Further, revenue increased 6% on a year-over-year basis to hit $7.93 billion. This beat out the consensus target of $7.843 billion.

“Turning to subscriber growth, Netflix’s subscriber base increased by 2.4 million, which was more than double its goal of 1 million. Looking forward, the company expects to add 4.5 million net new subscribers in the fourth quarter.”

As Condarcuri acknowledged, sentiment for NFLX remains negative, but here’s the point. Based on TipRanks’ website traffic chart, engagement at Netflix.com has increased conspicuously since June 2022. This may indicate the early innings of a consumer pivot to home entertainment.

Compared to other forms of entertainment, a subscription service to Netflix represents a very cheap pathway to escapism. Again, with economic pressures mounting, NFLX is worth a look among streaming stocks.

Is NFLX Stock a Buy?

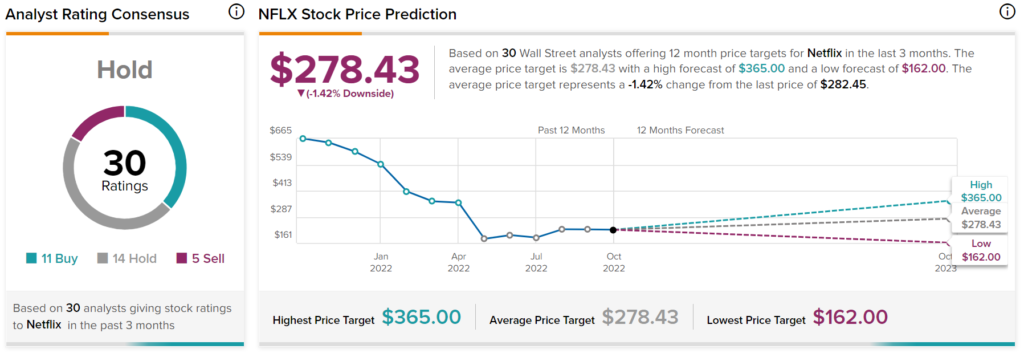

Turning to Wall Street, NFLX stock has a Hold consensus rating based on 11 Buys, 14 Holds, and five Sell sells assigned in the past three months. The average NFLX price target is $278.43, implying 1.42% downside potential.

Disney

A massive entertainment stalwart, Disney entered the streaming fray in November 2019, mere months before the COVID-19 pandemic struck. Management likely patted itself on the back for pivoting to the digitalization of entertainment. Following a shock loss of valuation, DIS stock quickly rebounded from the March doldrums of 2020. By early 2021, shares hit a record high.

Unfortunately, since late 2021, circumstances have not been so auspicious for the Magic Kingdom. Since the beginning of this year, DIS has dropped nearly 35% in equity value. While Disney has yet to enjoy the meteoric comeback that NFLX printed recently, over the trailing month, DIS gained 2.6%.

Given that Netflix released strong results for its Q3 report, market observers hope that Disney can do the same. The company will release its fiscal Q4 results on November 8. Fundamentally, with entertainment trends appearing to move back to the living room, the Disney+ segment could see significant gains.

Primarily, the company enjoys significant relevance thanks to its popular franchises, especially Star Wars. Allowing Disney to build offshoot content series such as “The Mandalorian” and “The Book of Boba Fett,” it essentially owns the right to print cash.

Is DIS Stock a Sell or Buy?

Turning to Wall Street, DIS stock has a Strong Buy consensus rating based on 15 Buys, three Holds, and zero Sell ratings. The average DIS price target is $142.88, implying 40.53% upside potential.

Streaming Stocks Poised to Take Over

When the pandemic initially capsized the country (and the world), streaming stocks enjoyed unparalleled growth due to intense demand. Investors are unlikely to see such relevance of magnitude again. However, in its place is the normalization of consumer behaviors. Having enjoyed their vacations, people are now ready to consume streamed entertainment. As well, macroeconomic pressures ensure more butts will stay glued to the living room sofa.